Viewing your farm debt differently

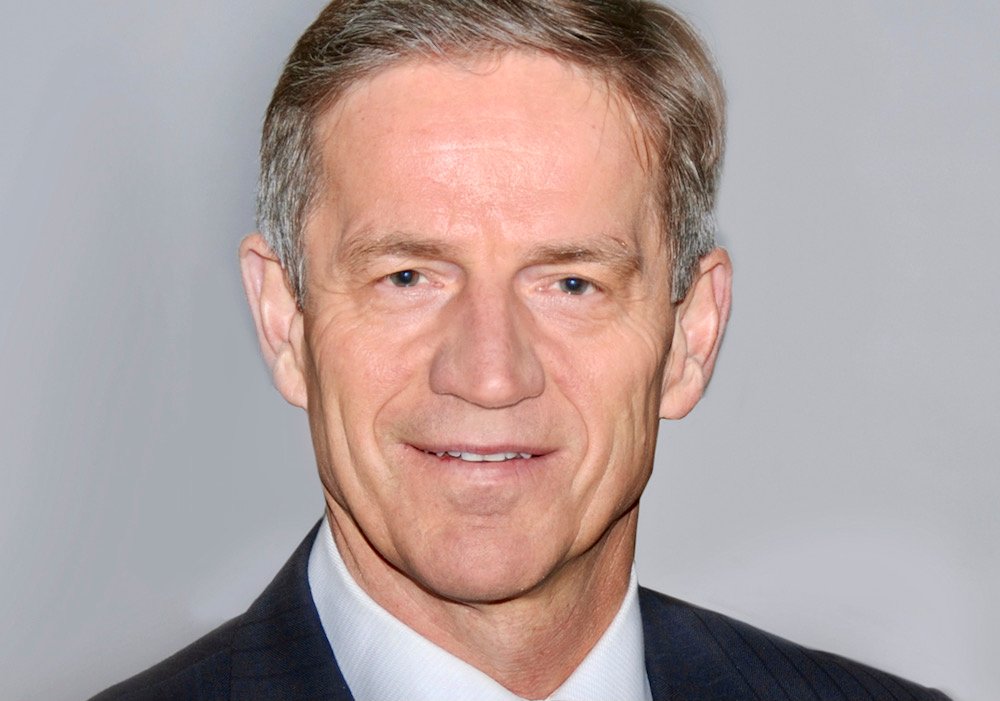

Decades of experience with Farm Credit Canada (FCC) showed John Geurtjens, former vice-president of operations in Ontario, how adaptable the province’s agriculture sector really is. And while issues may change, opportunities remain.

In modern times, where debt levels and prices diverge from interest rates, those opportunities start with a general reconsideration of how farms look and how they can be structured.

Why it matters: Revolving and leveraging loans, rather than debt repayment, are the new norms in farm country. For younger entrepreneurs, smaller scale and niche markets offer opportunities.

“The flow of capital has changed. In the 1980s capital was tight and risk premiums were tight. Today, there’s an active and strong competition by all lending institutions for ag lending,” says Geurtjens, who retired early this year. “There’s a low-risk premium on agriculture. You can get a loan [and] if you run into trouble, there’s another institution willing to step in.”

Different debt structure

Overall, the diversity of financial institutions, low interest, good commodity prices and other factors have promoted a different debt mindset, specifically, a willingness to take on debt. He believes the concept of amortization has shifted from paying down debt to “revolving principal term loans.”

Such borrowing freedom brings opportunities that many farmers have realized by leveraging assets to achieve business goals. In the face of good commodity prices and all-around high costs (such as land, input and construction materials and housing), a revolving credit strategy has been particularly useful for some.

Interest, and a new farm perspective

But debt and perpetual high business costs still bring risks. Geurtjens believes young farmers trying to get established will have to “rethink the farm paradigm” to overcome difficulties.

“Difficult and impossible are different things. Maybe I don’t need to own 1,000 acres, and just need a base,” he says.

Interest rates, running comparatively low for years, are key in the changed debt perspective. Even those who would otherwise hold cash in the bank for retirement or some other longer-term plan are more likely to employ their capital in ways that bring better returns.

As long as interest rates remain low, Geurtjens believes the double-edged sword of current debt and expense trends will continue.

“Interest will determine where we go with assets. It’s going to change. I don’t know which way we’re going to go, but it will change.”

Technology and niche markets

Behavioural changes in finance relate to another theme that Geurtjens says has changed the farm landscape, that of technology, and what he refers to as a continual “technology gap” stemming from the expense of new tools.

“Large, well-run operations can spread out those costs. Smaller ones have difficulty. That is on top of rural internet, which agriculture, in general, suffers from, as does the rest of rural Canada… The longer that persists, the bigger the gaps continue to be.”

For many, finding innovative ways around technological problems are a saving grace. The same applies in the societal realm, as more people show an interest in farming but encounter barriers in upfront investment costs.

Geurtjens says the opportunity for many lies in the local food and food security movements. Through smaller scale and more local markets, those trying to make their agricultural business mark can do so in a more non-traditional way.

This requires a mindset change, however. In practice, that means recognizing that the so-called standard farm doesn’t need to remain the standard. The traditional monoculture farm, by extension, may not be the future.

“The reality of it is there’s going to be lots of food required. The model of the very large farms in itself says there’s going to be fewer and fewer opportunities. Young people looking into it will be disappointed.”

Perry Wilson has taken over as vice-president of operations for Ontario for Farm Credit Canada.

Source: Farmtario.com