Momentum in the U.S. online grocery market has continued to tail off since the boom triggered by the COVID-19 pandemic, a new study from Coresight Research shows.

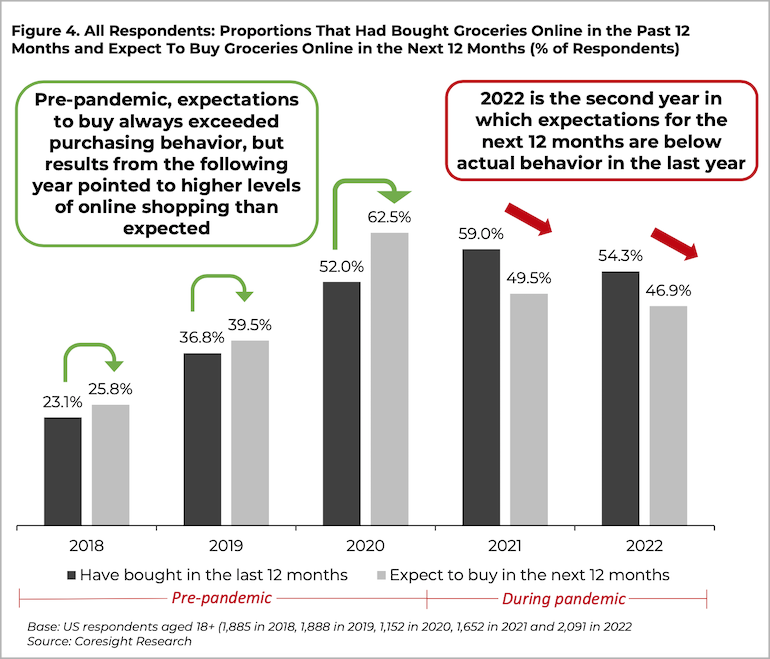

Of nearly 2,100 U.S. adults polled, 54.3% had purchased groceries online in the past 12 months, down from 59% a year ago, according to Coresight’s “U.S. Online Grocery Survey 2022” report, released Monday. What’s more, 46.9% said they plan to buy groceries online in the next 12 months, a decrease from the 49.5% who planned to do so in the 2021 survey. That marked the second straight year in which customer expectations for the upcoming 12 months were below actual behavior in the past year.

“The drop in intent to shop through e-commerce signifies that online grocery shopping has largely stabilized from its pandemic highs, albeit at higher levels than pre-pandemic times,” New York-based retail industry research firm Coresight stated in the study.

The results still contain positives in terms of growth in the e-grocery shopping arena, Coresight noted. For example, the report said, the 54.3% of consumers who bought groceries online in 2022 is 4.8 percentage points higher than the 49.5% of respondents in 2021 who said they expected to purchase groceries online in the next 12 months. The 2022 percentage of online grocery purchasers, too, remained above the percentages for 2020 (52%) and the pre-pandemic period in 2019 (36.8%).

Coresight also found that the share of customers doing the bulk of their grocery shopping online has grown nearly 4 percentage points. In 2022, 28.3% of those polled did most (16.5%) or almost all/all (11.8%) of their grocery shop online, compared with 24.7% (most 14.7%, almost all/all 10%) in 2021 and 14% (most 9.7%, almost all/all 4.3%) in 2020.

“This indicates that the online channel now captures a meaningful share of full-basket grocery shoppers,” Coresight observed. Indeed, on the flip side, 48.9% of e-grocery customers reported doing “almost none” (16.7%) or “a small amount” (32.2%) of their grocery shopping online in 2022, down from 55.3% in 2021 and 63.1% in 2020.

The percentage of online grocery shoppers receiving their orders via pickup came in at 48.2% in 2022, up from 43% in 2021, Coresight found. Delivery usage declined with 49% of respondents receiving orders that way in 2022 versus 55.5% in 2021.

“It’s no secret that the COVID-19 pandemic has rapidly accelerated the shift to e-commerce, leading to a dramatic spike in online grocery shopping,” Coresight explained in its report. “Coresight Research estimates that the market will expand by a healthy 32.4% year over year in 2022, after observing 17.9% growth in 2021 and 94.4% growth in 2020. Growth will be supported by the retention of pandemic-induced behaviors in the online channel. Retailers should look to build on pandemic-driven trends and position themselves for longer-term growth.

In 2022, online grocery shoppers made their purchases from 2.4 retailers on average, about the same as 2.5 in 2021 and 2.3 in 2020, but well above the 1.8 ion 2019.

Among retailers, Amazon and Walmart were by far the most-shopped retailers for online grocery customers, cited by 51.6% and 50.5% of 2022 survey respondents, respectively, who made a purchase with those operators in the pat 12 months. Rounding out the top 10 most-shopped online grocery retailers, Coresight said, were Target (25.5%), Sam’s Club (16.1%), Costco Wholesale (15.7%), The Kroger Co. (13.6%), Whole Foods Market (13.1%), Aldi (8.4%), Publix (7.1%) and Albertsons/Safeway (7%).

“Our 2022 survey found that the major retailers saw lower proportions of respondents buy groceries from them in the past 12 months, compared to in 2021,” Coresight said in the study. “Compared to 2020, Amazon saw the largest decline in online grocery shoppers, of 11 percentage points. The share of Walmart — the second-most-shopped retailer — also declined, albeit to a lesser extent. Other omnichannel retailers such as Albertsons, Costco and Target saw an increase in online grocery shoppers compared to 2020, at the expense of Amazon and Walmart.”