Supermarkets that are high performers in the brick-and-mortar realm also tend to be sales catalysts in the online grocery arena, new research from strategic advisory firm Brick Meets Click shows.

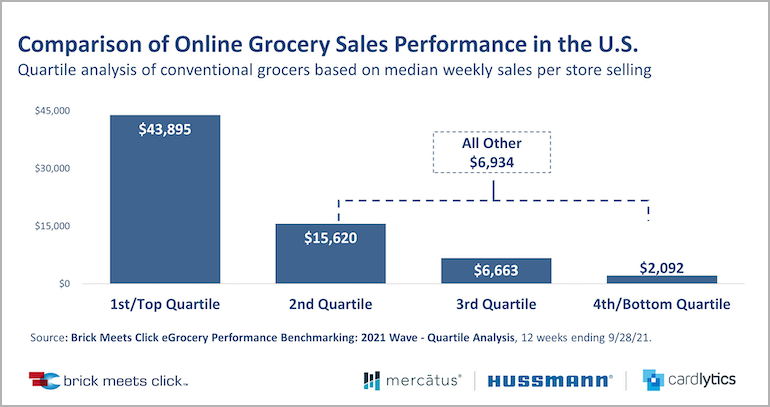

Among nearly 950 stores from 45 U.S. retail banners, conventional supermarkets in the top-performing quartile generated average weekly online grocery sales of $43,895, 6.3 times higher than the median sales of $6,934 for stores in the other quartiles, according to the latest findings of the Brick Meets Click eGrocery Performance Benchmarking 2021 Wave, released Wednesday.

Weekly e-grocery sales of stores in the second quartile averaged $15,620, compared with $6,663 in the third quartile and $2,092 in the fourth quartile, reported Barrington, Ill.-based Brick Meets Click, which focuses on how digital technology impacts food sales and marketing. The findings reflect online transactional data linked to nonpersonal identified households across the examined stores for the 12 weeks ended Sept. 28, 2021.

A much higher average order value (AOV) spurred the strong online grocery sales performance of the top-quartile stores, Brick Meets Click noted. High-performing stores tallied a 46% larger AOV, with customers spending about $126 per order versus $86 at lower-quartile stores. That higher AOV among the top performers likely reflected the online availability of alcohol — beer only; beer and wine; or beer, wine and spirits — as the research indicated that 90% of top-quartile stores sold alcohol online versus 60% of the other stores.

Range of online service also played a pivotal role in driving e-grocery sales. Brick Meets Click said top-quartile stores were 1.5 times more likely to offer pickup and delivery, with 67% of the high-performing stores group offering both services compared with 44% of the other stores. Top-quartile stores offering both pickup and delivery generated 39% higher weekly sales than stores in that group providing just one of those services. For stores in the other quartiles, data showed that having both services available didn’t generate higher sales.

“Grocers are well aware that many variables affect performance across their base of stores, but they need to occasionally challenge or retest assumptions about growth drivers as selling online evolves and matures,” explained David Bishop, partner at Brick Meets Click. “This quartile analysis reinforced that excelling at selling online — like operating a physical store — requires both a sound strategy and effective execution.”

Age of service and store location played less of a role in terms of the performance gap between the top-quartile grocery stores and the others, according to the eGrocery Performance Benchmarking research.

For example, the assumption that the most-populous markets are best locations to operate wasn’t true for the top-performing stores, Brick Meets Click said. In fact, the online grocery sales per-store performance based on trade-area population in the top quartile generally showed an inverse relationship between population size and sales performance. Top-quartile stores operating in ZIP codes with a population less than 10,000 reported 31% higher weekly online sales than stores in areas with a population exceeding 40,000. On the other hand, sales at stores in the lower quartiles rose along with the size of the population.

Meanwhile, online grocery service at top-quartile stores has matured much better than at other stores. Brick Meets Click said top-quartile stores have operated online longer, with 50% offering e-grocery service for four or more years versus 34% of stores in the other quartiles providing that length of service. Conversely, just 10% of the top-quartile stores operated for less than one year, compared with 25% of all other stores.

Brick Meets Click’s analysis also revealed that, when grocery stores were clustered by age of online service within each quartile, the highest-performing stores typically generated online sales growth over time, whereas the others generally contracted.

In the top quartile, stores operating online for four years or longer reported more than 50% higher sales than stores online for less than one year. However, Brick Meets Click said, a comparative analysis of the remaining quartiles showed a “choppy” sales trend, with the stores operating online the longest posting weekly sales 23% lower than stores relatively new to the online grocery space.

“It’s helpful for grocery executives to consider what factors may be preventing their online grocery business from performing at the same level as the top quartile,” according to Sylvain Perrier, president and CEO of Toronto-based e-grocery specialist Mercatus, a sponsor of the study. “The same factors that go to making one location successful in terms of online sales will not necessarily translate to all locations. The best performers likely have ironed out their operational wrinkles, resulting in the best possible fulfillment experience for customers. Meanwhile, the level of marketing investment directed to promoting online service options also will have an impact over time.”

Brick Meets Click’s eGrocery Performance Benchmarking research, the largest independently conducted online grocery benchmarking initiative to date, is an annual initiative based on ePOS data provided by participating retailers. It started in 2016 with 17 grocery store banners and expanded to 45 banners for 2021. The 2021 eGrocery Benchmarking wave — sponsored by Mercatus, Cardlytics and Hussmann — is based on an analysis of comparable 12-week periods in 2021 and 2020, examining performance across three four-week periods, through Sept. 28, 2021. The study (Part 1, Part 2 and Part 3) focuses on findings that can help first-party e-commerce shopping service operators improve strategy and execution.