American shopping behavior continues to evolve in tandem with innovation in digital e-commerce and traditional grocery.

Nearly 60% of consumers buying groceries online just started that practice in the past two years, according to Acosta’s Online Grocery Landscape Report, a new study from the CPG sales and marketing firm that examines attitudes and preferences surrounding online grocery shopping. Another telling statistic from the research: Nearly one in five online grocery shoppers intend to do more of their shopping online in the next year.

Popular online grocery delivery services, according to the study, include Amazon Prime (57%), followed by Walmart (40%) and Instacart (32%).

“More than half of American households are buying groceries online at least occasionally, compelling the need for retailers to provide more personalized and enhanced experiences around value, convenience and food discovery in order to increase their share of omnichannel shoppers,” explained John Carroll, chief growth officer at Acosta.

And opportunities abound for retailers to boost their omnichannel performance.

More than half (57%) of online grocery shoppers say they stick with the retailers they shop in-store, providing omnichannel-focused retailers with a big advantage in building consumer loyalty, the study said, adding that other shoppers are still experimenting and determining their preferred delivery options.

And while the balance between online and brick-and-mortar continues to evolve, more online grocery shoppers prefer the in-store experience for discount opportunities and new product discovery, Acosta’s research found. Top online grocery retailers are getting high marks for shopper satisfaction, yet consumers want deals to be easier to find, better product availability and reasonable delivery/pickup fees.

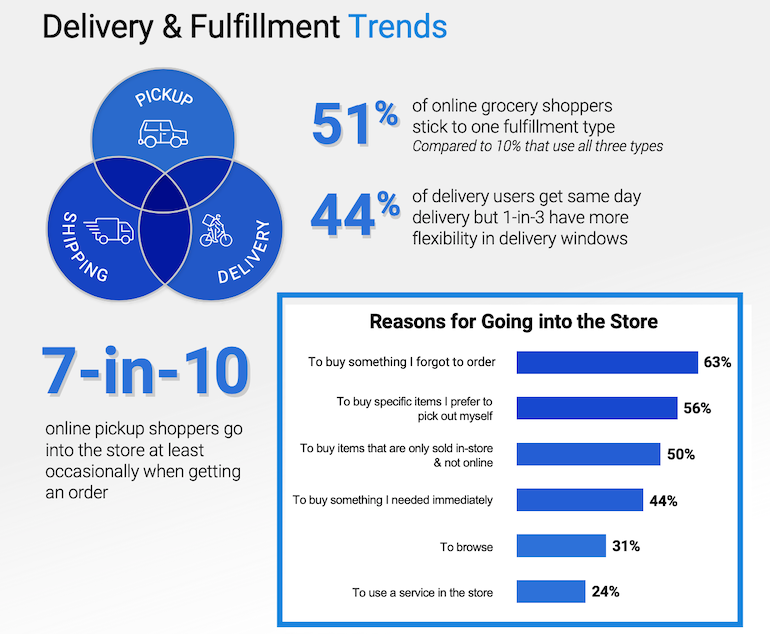

Seventy percent of online pickup users go into the store when picking up an order, mainly to add a forgotten item (63%) or to buy something personally (53%) — presenting an opportunity to re-engage the shopper in-store, Acosta noted.

“Since most online grocery consumers shop the same retailers online and in-store, the brands and retailers that offer strong online and in-store shopping solutions are best positioned to win by nurturing even deeper consumer loyalty,” according to Carroll. “And as wallets tighten due to inflation and shoppers do more pre-shop planning online, an omnichannel focus becomes even more critical.”

Other key findings from the report included the following:

• While 46% of shoppers place orders on retailer websites, they are slow to adopt retailer apps. More than a quarter of respondents say they do not use them.

• Since they started buying groceries online, 38% of shoppers are purchasing heavier items for delivery more often, 33% use a smartphone to plan and/or shop, and 25% use saved shopping lists more often to order in one click.

• Nearly one-third of online grocery shoppers use subscriptions, with pet needs and coffee/tea the most popular product categories.

• Digital coupons are used by 80% of online shoppers, with younger shoppers more likely to look for them while they shop.

• Millennials are utilizing at-home delivery at nearly twice the rate of Baby Boomers.

Jacksonville, Fla.-based Acosta conducted the inaugural Online Grocery Landscape study in June through its proprietary Shopper Community, with input from more than 750 U.S. online grocery shoppers across a range of age groups, behaviors and preferences.