The Kroger-Albertsons merger deal would combine the first- and second-largest U.S. supermarket operators into one, mammoth grocery retailer. As regulators get under way with the review process, industry observers are sizing up the potential market impact.

Together, The Kroger Co. and Albertsons Cos. would form a national company with 4,996 stores, 66 distribution centers, 52 manufacturing plants, 2,015 fuel centers and more than 710,000 associates across 48 states and the District of Columbia. The merged entity also would be the fifth-largest retail pharmacy operator by locations, with 3,972 pharmacies.

Boise, Idaho-based Albertsons Cos. operates food and drug stores in 34 states and the District of Columbia under such banners as Albertsons, Safeway, Vons, Jewel-Osco, Shaw’s, Acme, Tom Thumb, Randalls, United Supermarkets, Pavilions, Star Market, Haggen, Carrs, Kings Food Markets and Balducci’s Food Lovers Market. Meanwhile, Cincinnati-based Kroger’s brick-and-mortar retail base includes supermarkets and multi-department stores in 35 states under banners such as Kroger, Ralphs, Dillons, Smith’s, King Soopers, Fry’s, QFC, City Market, Owen’s, Jay C, Pay Less, Baker’s, Gerbes, Harris Teeter, Pick N’ Save, Metro Market, Mariano’s, Fred Meyer, Food 4 Less and Foods Co.

Based on fiscal 2021 data, Kroger and Albertsons combined generated about $210 billion in revenue, $3.3 billion in net earnings and $11.6 billion of adjusted EBITDA.

Market share view

Consumer data specialist Numerator said Thursday that, by acquiring Albertsons, Kroger would reach two in three U.S. shoppers. Currently, Kroger captures nearly 65 million shoppers, yet post-acquisition its shopper base would jump by more than 21 million households.

The combination also would give Kroger a more national presence, since Albertsons has a heavy presence in the West (12.5% CPG market share through September), the Mountain region (10.4% share) and New England (7% share), according to Numerator data. Kroger could expect upwards of 10 points of CPG share gains within the West and Mountain regions by merging with Albertsons, Numerator estimated.

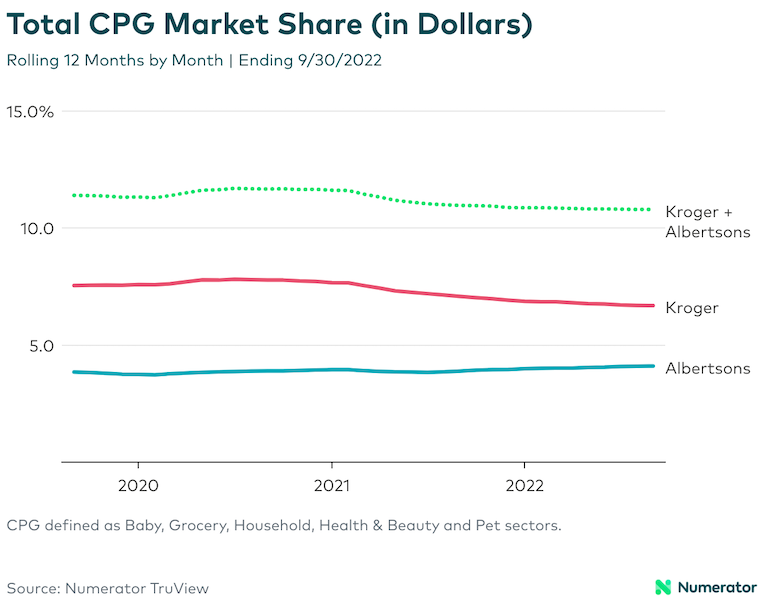

In addition, Numerator reckoned that CPG market share gains between Kroger and Albertsons have diverged since their highs at the onset COVID-19. Kroger’s share has declined to a three-year low of 6.7%, whereas Albertsons’ share has risen to a three-year high of 4.1% — for a combined 10.8% CPG share through September, Numerator reported.

In any event, Kroger-Albertsons would become the second-largest grocery retailer behind Walmart, and only the second to hold double-digit market share (pre-divestitures). BofA Securities analyst Robert Ohmes pegs U.S. grocery market share for Kroger-Albertsons at mid- to high teens (pre-divestitures), compared with roughly 25% for Walmart (30% including Sam’s Club) and 9% for Costco Wholesale at a distant third.

Location proximity

From the middle of the country moving West, Kroger and Albertsons have significant overlap in store locations, R5 Capital CEO Scott Mushkin wrote in a research note on the merger deal.

The proximity of stores between the two retailers jumps when the radius is extended from 1 mile to 3 miles. For example, Mushkin’s report showed in seven markets, the percentage of Albertsons stores in Chicago with at least one Kroger location increases from 2.79% within 1 mile to 14.53% within 3 miles. The trend is similar in other markets: Denver (30.95% 1 mile, 90.48% 3 miles), Las Vegas (28.57% 1 mile, 95.24% 3 miles), Phoenix (22.08% 1 mile, 89.61% 3 miles), Portland (29.69% 1 mile, 81.25% 3 miles), San Diego (19.72% 1 mile, 76.06% 3 miles) and Seattle (40.78% 1 mile, 87.38% 3 miles).

Store visit landscape

Besides getting a big bump up in grocery sales market share, Kroger-Albertsons would command the supermarket arena in store visits.

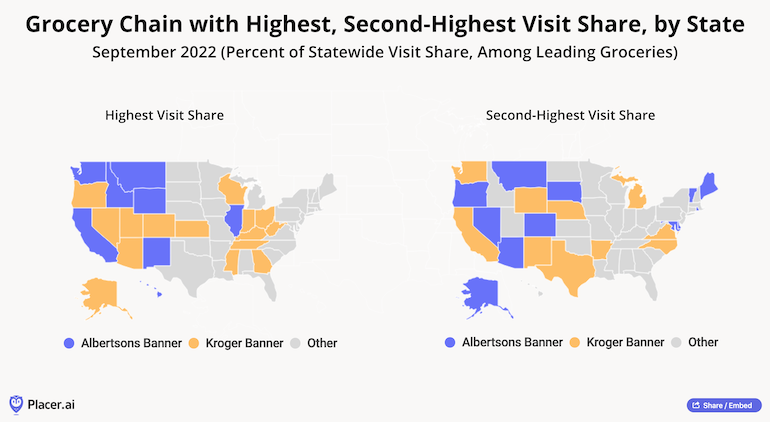

According to a report yesterday by location analytics firm Placer.ai, Kroger had the highest share of visits among top grocery chains in 15 states (Alaska, Oregon, Arizona, Nevada, Utah, Colorado, Kansas, Wisconsin, Indiana, Ohio, Kentucky, West Virginia, Tennessee, Mississippi and Georgia) and ranked second in nine other states.

Placer.ai had Albertsons Cos. chains leading in store visits in eight states (Hawaii, California, Washington, Idaho, Montana, Wyoming, New Mexico and Illinois) and coming in at No. 2 in 11 states.

In the Western U.S., a Kroger Co. or Albertsons Cos. banner ranked first and second for monthly foot traffic in 10 states, Placer.ai noted.

E-commerce arena

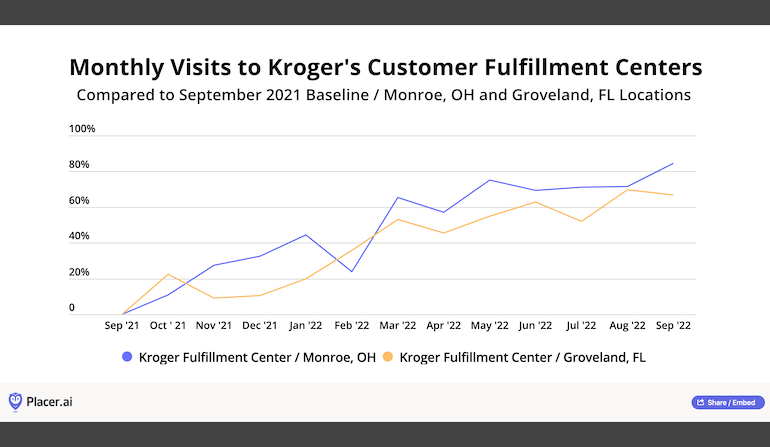

In the digital commerce realm, Kroger has concentrated on building out its infrastructure under its partnership with Ocado Group to roll out 20-some automated customer fulfillment centers (CFS) and supporting spoke facilities nationwide. Albertsons, meanwhile, has focused on expanding its relationships with third-party grocery delivery providers like Instacart, DoorDash and Uber Eats.

A couple of the initial Ocado CFCs opened by Kroger are gaining traction. Placer.ai said that since September 2021, the CFC in Monroe, Ohio (launched in April 2021), has seen an 84.6% surge in traffic (including employees), and the Groveland, Fla., CFC (going into operation two months later) has experienced an increase of 66.7%.

Numerator reported that Albertsons’ e-commerce share has almost tripled year over year for the 12 months ended Sept. 30, driven by more net new households shopping online, current customers shopping online more frequently and expanded curbside pickup service. Projected households and purchase frequency have nearly doubled, up 92% and 84%, respectively, versus last year.

Digital advertising opportunity

Kroger-Albertsons, too, would create a stronger retail media business, melding Kroger Precision Marketing and the Albertsons Media Collective. The combined company would serve over 85 million households, providing a long reach, vast trove of consumer and transactional data, and more impactful advertising opportunity for CPG brands.

According to Placer.ai, average monthly visits to Kroger Co. banners Kroger, Fred Meyer, Ralphs, Harris Teeter, Fry’s, Smith’s through the end of the third quarter totaled 160.1 million. For the Albertsons Cos. banners Safeway, Albertsons, Jewel-Osco, Vons, Acme Markets and Shaw’s, average monthly visits came in at 109.3 million for the quarter.

Shopper profiles

With the addition of Albertsons, Kroger’s customer base would become more diverse, according to Numerator. The new consumers Kroger would gain include 14% Hispanic shoppers (3 million) and 13% Asian consumers (2.6 million). Currently, Kroger’s customer base breaks down as 12% Hispanic and 7% Asian.

New shoppers in Kroger’s portfolio also would be 25% more likely to reside in an urban area, where households tend to have smaller baskets per visit because of a greater reliance on public transportation, Numerator said. The new Kroger shoppers, too, would more greatly value sustainability, driven by the addition of West Coast Albertsons customers. More than one in four would be willing to pay a premium for a more sustainable product, almost 20% more than the current Kroger shopper.