Consumers prefer to buy groceries at Walmart’s stores and websites versus Amazon, even as the latter holds the overall lead in retail e-commerce, according to an analysis by Jungle Scout.

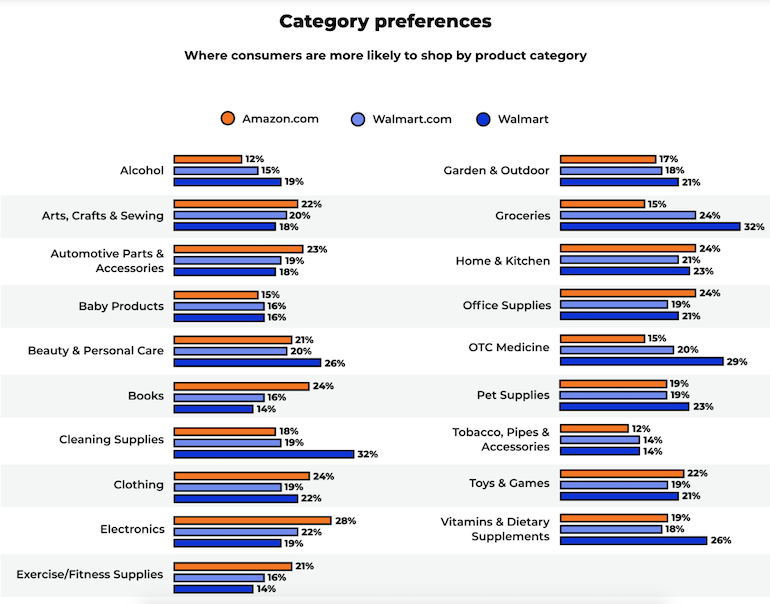

Of more than 1,000 U.S. adults surveyed, 57% said they’re more likely to shop Walmart for groceries, compared with 15% for Amazon.com, Jungle Scout said in its “2022 Amazon vs. Walmart Report.” The Walmart figure includes 32% of customers who prefer to shop for groceries at its stores and 24% at Walmart.com.

Walmart also gets the nod from consumers as their main destination for purchases in a range of other categories found at the supermarket, said the study from Austin, Texas-based Jungle Scout, which provides an e-commerce platform for selling on Amazon.

For example, 34% of respondents indicated they like to shop at Walmart for alcohol (15% at Walmart.com) versus 12% at Amazon, and 51% opt for Walmart (19% for Walmart.com) in cleaning supplies, compared with 18% for Amazon.

Walmart also held the edge in the following grocery store-related categories: 32% favor shopping at Walmart (16% at Walmart.com) for baby care vs. 15% at Amazon, 46% at Walmart (20% at Walmart.com) for beauty/personal care vs. 21% at Amazon, 49% at Walmart (20% at Walmart.com) for over-the-counter medicine vs. 15% at Amazon, 43% at Walmart (19% at Walmart.com) for pet supplies vs. 19% at Amazon, and 44% at Walmart (18% at Walmart.com) for vitamins and supplements vs. 19% at Amazon.

In total, Amazon was the preferred purchase destination in nine of 19 categories in Jungle Scout’s study, including arts, crafts and sewing; automotive care; books; clothing; electronics; exercise/fitness gear; home and kitchen; office supplies; and toys and games.

“The retail environment is constantly changing, due to economic currents and consumer whims. Amazon and Walmart are both leveraging online and offline technologies as a way for brands to create more dynamic solutions that satisfy their customers,” observed Michael Scheschuk, president of small and medium business and chief marketing officer at Jungle Scout. “Investments like Amazon’s Dash Cart in Amazon Fresh stores and Walmart’s Virtual Try-On in their iOS app will raise the bar for all retailers and improve consumer experiences.”

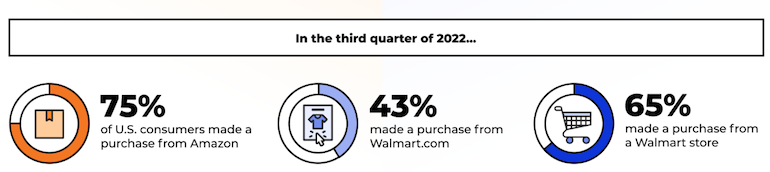

Overall, 75% of U.S. consumers polled by Jungle Scout said they recently made a purchase from Amazon in the third quarter of 2022, compared with 43% from Walmart.com and 65% from a Walmart store. Forty-eight shop on Amazon at least once a week (14% at least once per day) versus 43% at least weekly on Walmart.com (15% at least once per day).

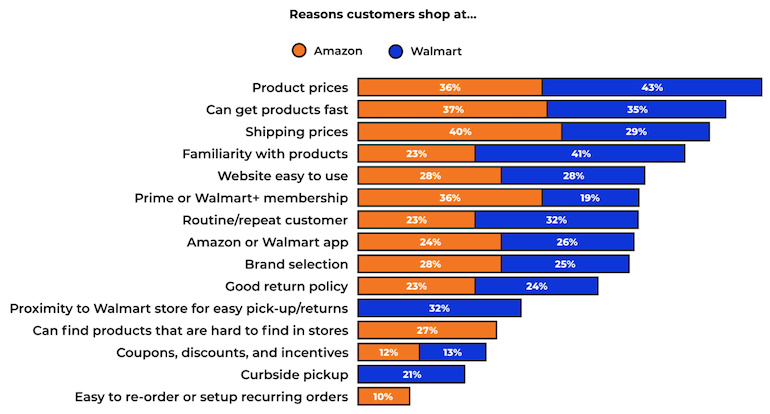

When asked why they shop online at Walmart.com over Amazon, survey respondents cited price (43% to 36%) as the top reason, followed by product familiarity (41% Walmart vs. 23% Amazon), repeat customer (32% Walmart vs. 23% Amazon), app choice (26% Walmart vs. 24% Amazon), return policy (24% Walmart vs. 23% Amazon), ability to return to a store (32% for Walmart) and curbside pickup (21% for Walmart).

Amazon was chosen by online shoppers over Walmart.com in getting products quickly (37% for Amazon vs. 35% for Walmart), shipping prices (40% Amazon vs. 29% Walmart), membership program (36% for Amazon Prime vs. 19% for Walmart+), brand selection (28% Amazon vs. 25% Walmart), products not usually found in stores (27% for Amazon) and easy reorders/recurring orders (10%).

When it comes to consumer spending, Walmart.com leads by far, with 71% of those polled saying they spend up to $99 quarterly versus 45% at Walmart stores and 57% online with Amazon. The percentages largely even off at the next spending level. Thirty-five percent of respondents spend $100 to $499 at Walmart stores versus 20% at Walmart.com and 33% at Amazon. At $1,000 or more, Walmart stores are in front at 6%, compared with 4% at Walmart.com and 3% at Amazon.

Other key findings from Jungle Scout’s analysis:

• 63% of consumers surveyed start their search for a product online on Amazon, compared with 43% at Walmart.com.

• 57% of consumers have an Amazon Prime membership versus 31% who have a Walmart+ account.

• Amazon has 6.3 million third-party sellers versus 150,000 for Walmart.

In its report, Jungle Scout pegged Amazon’s total U.S. e-commerce sales at $50.9 billion (+4.61 year over year) and Walmart’s at $19.2 billion (+11.98% year over year). Amazon’s average monthly site visitors are estimated at 2.5 billion versus 429 million for Walmart. Also, Jungle Scout said Amazon garners subscriptions sales of $8.7 billion, compared with $1.5 billion for Walmart. Walmart has 3,335 physical locations (U.S.), compared with 570 for Amazon (including Whole Foods Markets), the report said.