Growth in canola processing to pull production forward

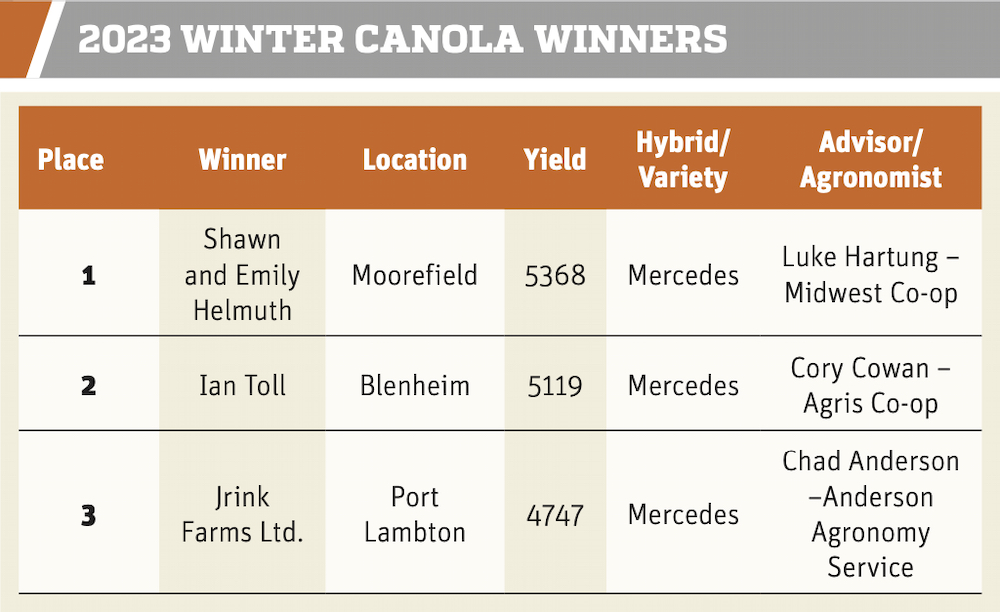

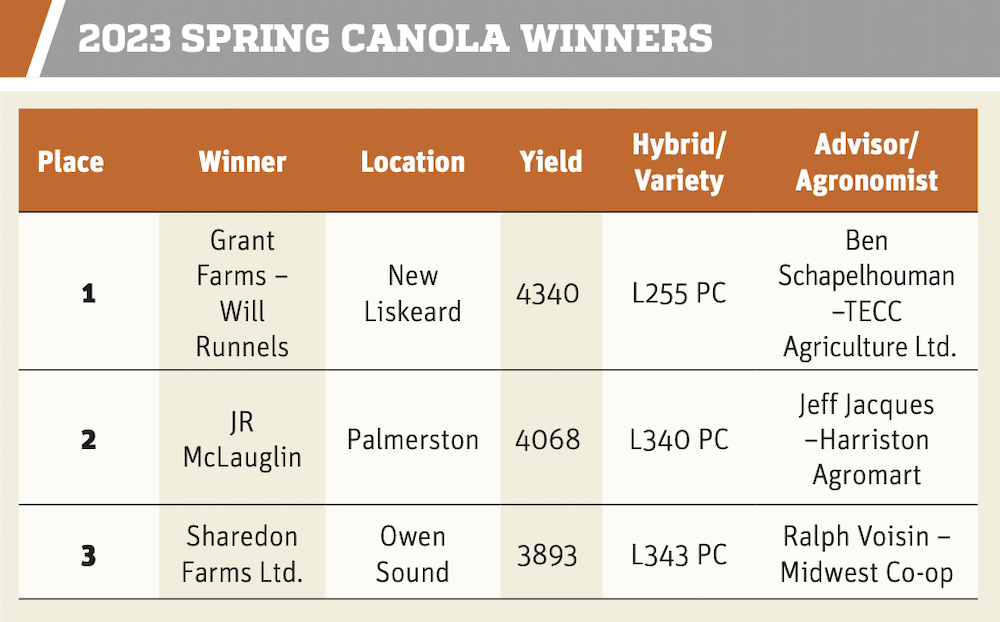

For the third year in a row, winter canola growers had the highest yields in the 2023 Canola Challenge. Winners were announced during the canola industry meeting in late November at a virtual gathering hosted by the Ontario Canola Growers Association.

Read Also

In-egg gender-typing could eradicate male chick culling for poultry sector

Gender-typing technology could provide an ethical and humane solution to the disposal of day-old male chicks, while boosting poultry sector…

The challenge is an annual competition held by the OCGA. In 2021, it separated winter and spring canola into their own categories, and winter canola yields have dominated.

Why it matters: Canola is a high value crop that could help diversify Ontario crop rotations, especially when fall seeded.

The meeting also included presentations on production, growth of winter canola (see page 12) and a summary of the canola oil industry.

All winter canola winners grew the Mercedes variety. Shawn and Emily Helmuth of Moorefield yielded the highest amount at 5,368 bushels. Will Runnels of Grant Farms in New Liskeard was the top spring canola yielder, with 4,240 bushels.

The mood among meeting participants was optimistic. Acreages are up, particularly in winter canola, amid short supplies of Mercedes, the only winter hybrid available.

Chris Vervaet of the Canadian Oilseed Processors Association offered a summary of the demand for canola oil. Production, crush and oil/meal output could reach 23 million tonnes for processing by 2025, with 70 per cent (16.2 million tonnes) of production for crush.

The rest is exported, said Vervaet.

“The benefits of value-added processing come down to market diversification, including value-added opportunities for oil and meal plus value-added jobs,” he said. “And we’re encouraging investment and innovation that supports Canadian biofuel.”

The drive for fuels from renewable sources is key in pushing “industrial usage” into competition with crush for oil and meal. As environmental concerns become a higher priority for governments, regulations mandating lower carbon fuels will drive the market, said Vervaet.

The Canadian Clean Fuel Regulation, implemented last July, and the U.S. Renewable Fuel Standards, are two initiatives that will eventually encourage higher production of renewable fuel sources like canola. There’s also interest in deriving jet fuel from renewable sources and Vervaet referred to that market as “sky’s the limit.”

This could lead to higher demand in Canada and the U.S. for biofuels and renewable diesel. In 2022, renewable fuels accounted for roughly 14 billion litres. By 2025, that number is expected to grow to 16.6 billion, and to 23.3 billion litres by 2030.

In advance of those estimates, five large-scale renewable diesel plants are being built or are in the planning stages across Canada.

“The same story unfolding in the U.S. but at larger levels and at a faster pace,” said Vervaet. “So many operations are in production with more to be built.”

By 2030, it’s estimated food and feed utilization of canola in North America will be 76 per cent of total production, down from 89 per cent in 2022. Within that same time, biofuels are estimated to more than double from 11 per cent in 2022 to 24 per cent by 2030.

“To summarize, increased canola production in in North America is needed to satisfy and balance demands,” said Vervaet. “Productivity improvement is key but increased acreage is also important.”

Source: Farmtario.com