After a difficult year in 2023, food retailers and wholesalers have grown slightly more positive in their outlook for the year ahead, according to this year’s Supermarket News Retailer Expectations Survey.

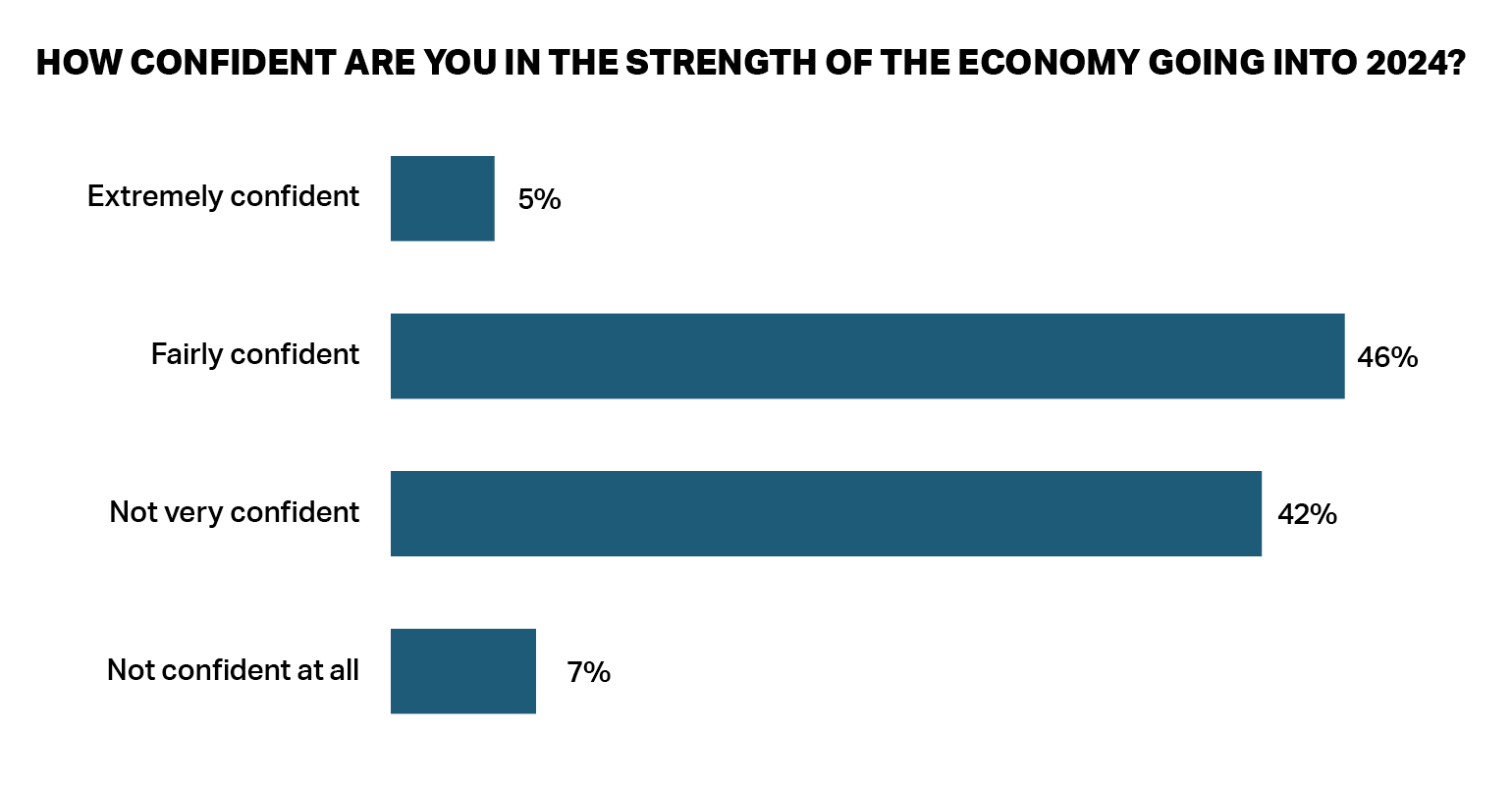

Just over half — 52% — of retailer and wholesaler respondents said they were at least “fairly confident” in the strength of the economy, including 8% who said they were “extremely confident.”

That marks the first year-to-year outlook improvement in the four-year history of the survey. Last year only 44% of respondents cited optimism about the economy in 2023.

Despite the positive economic outlook for 2024, however, 56% of retailers said they still expected a potential recession in the year ahead. And these retailers are not alone: A recent survey of CEOs across a range of businesses by The Conference Board found that the recession was the top external concern for both U.S. and global CEOs in 2024.

A large majority of retailers and wholesalers in the SN survey — 87% — said they agreed, at least somewhat, that inflation was a major concern in 2024, despite recent data showing that inflation had slowed considerably from 2023 levels.

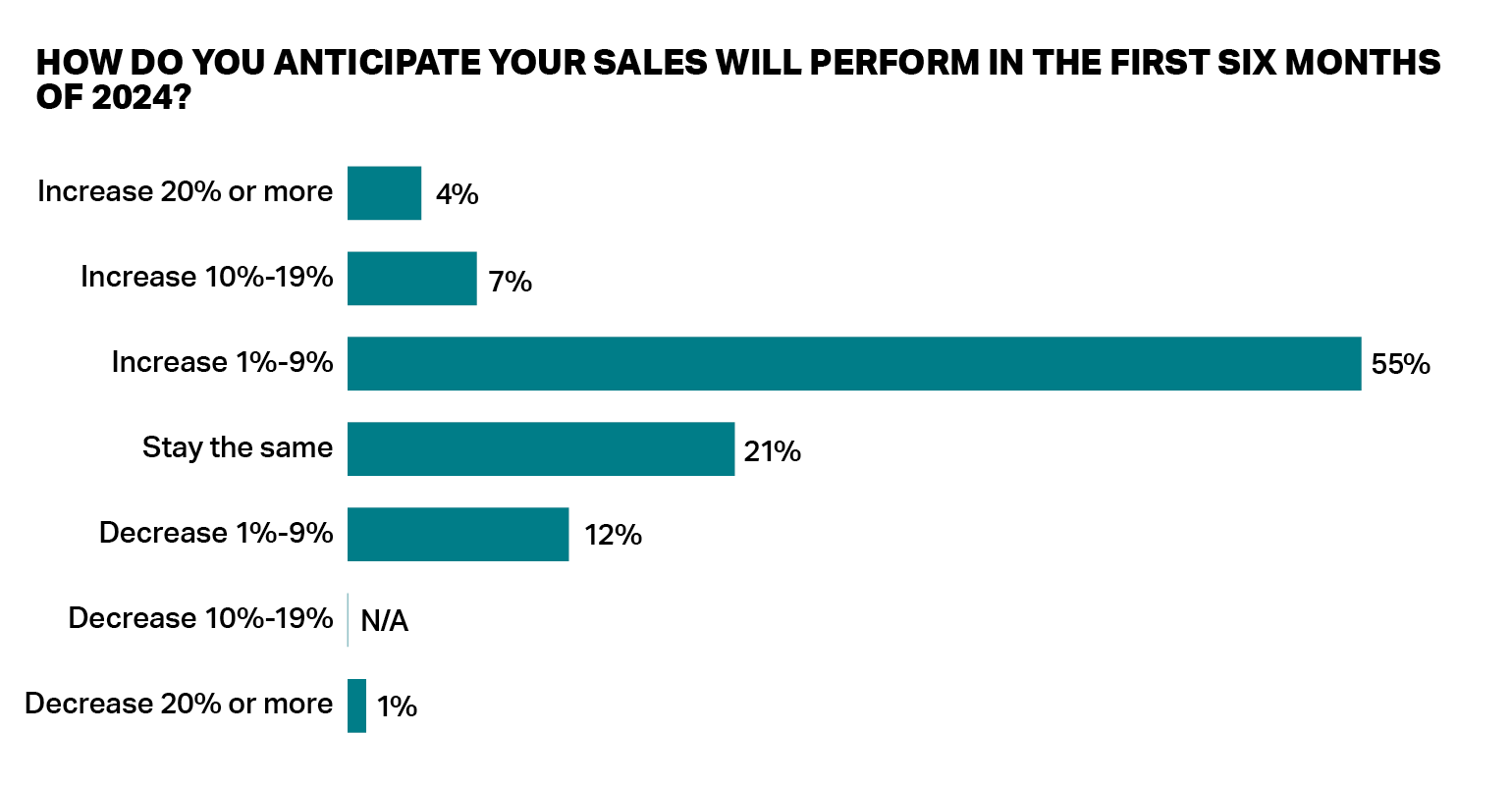

The high inflation rates of last year could pose a challenge for retailers seeking to grow their dollar sales on a year-over-year basis and may be dampening sales expectations for 2024. Only 59% of retailer/wholesaler respondents said they expected sales to improve in the first six months of 2024, compared with 73% who said in last year’s survey that they expected sales gains in the first six months of 2023.

About a quarter — 26% — of this year’s retailer/wholesaler respondents said they expected sales to remain about the same, and 15% said they expected sales to decline.

Strategies for sales growth

As far as strategies for growing sales in the year ahead, adjusting pricing or adopting a discounting strategy was the top response, cited by 62% of retailers and wholesalers. Other popular strategies included offering more in-store promotions (59%) and increasing digital marketing offers (51%). Not far behind those strategies was expanding fresh offerings, cited by 36% of retailers and wholesalers.

One retailer detailed specific steps they planned around improving customers’ in-store experience in the year ahead, including:

- “Comparative price reviews available to customers at least quarterly and posted in stores”

- “Upgrading customer service by training and retraining staff to be more attentive and watchful when customers need or look like they need help”

- “Not expecting customers to do store employee jobs”

- “Reorganize what staff does for each task”

- “Absolutely no cell phone use when staff on duty”

- “Smile and make every customer welcome”

Several retailers reported plans to focus on sharper pricing.

“I’m thinking hotter ads and more in-store specials with deals we get from suppliers,” said one, adding that they also planned to offer “coupons on the app for high-use items.”

Another said, “more aggressive promotions and more frequency.”

Pricing plans by category

This year’s survey also provided granular data about retailer expectations around pricing in each product category. Most retailer/wholesaler respondents said they expected to maintain price levels in 2024 across categories, although some indicated that price increases were on the way.

Meat prices appeared to have the most volatility. One third of respondents — 33% — said they expected to increase prices on fresh meat, the highest percentage of any product category. That compares with 44% who said they planned to keep their fresh meat prices the same and 22% who said they expected to discount meat prices in 2024, which was also the highest percentage of any product category.

Other categories in which retailers said they were more likely to increase prices than to decrease prices included deli/foodservice, fresh bakery, and frozen foods. Center store was the only category in which more retailers said they expected to discount pricing (20%) than increase pricing (17%).

Prepared foods remain key

Prepared foods remain vital to retailers’ growth strategies in the year ahead, as 64% said they plan to increase their prepared foods assortments, vs. 11% who said they plan to cut back in this area of the store. Forty-three percent said they plan to change their assortments of prepared foods, such as by adding more grab-and-go options.

One retailer summed it up by describing prepared foods as “a key department in our plans.”

Several other retailers said they planned to expand their prepared foods offerings, and in some instances grow the physical footprint of the department:

- “Increase linear footage and production planning”

- “Push and add new varieties of prepared foods. Expand area in cases to get plan in place”

- “Continuing to grow deli sales through marketing, ready meals, promotions such as Cheep Chicken Monday and the fried fish plate; expanding on the Boar’s Head offering; and growing specialty cheese”

- “Pre-packaged items like hoagies and sandwiches and deli salads in the cold case for customers to pick up and check out”

- “Add more snacking items”

Deli/foodservice was also the top category that all respondents said they expected to have success with in 2024. It was cited by 50% of respondents, tied with fresh produce. Those categories were just slightly ahead of fresh meat and center store, both cited by 47% of retailers and wholesalers.

Private label growth

The optimism about center store, relative to several other categories, marks a shift from recent years in which retailers were more pessimistic about this area of the store. Last year, for example, only 32% of retailer/wholesaler respondents listed center store as category they expected to enjoy success with in 2023.

Among the possible explanations for this shift are the fact that retailers have continued to expand their private label offerings, which are helping them compete against price-focused retailers and have in many cases streamlined and optimized their assortments.

Consumers gravitated to private label in 2023, and retailers seem to feel this trend will continue. More than half — 57% — of retailers and wholesalers said they expect to add more private label products in 2024, and the rest said they expect to maintain current levels.

The categories that retailers said will pose the biggest challenges include general merchandise, which 43% of retailers/wholesalers cited as a challenge. Close behind was health and wellness, which 40% of retailers/wholesalers said was likely to pose challenges in 2024.

The categories least likely to be a challenge? Only 17% of retailers/wholesalers said they expect non-alcoholic beverages — a booming category in 2023 — to be a challenge. Even fewer (6%) said dairy would be a challenge.

Operational challenges and opportunities

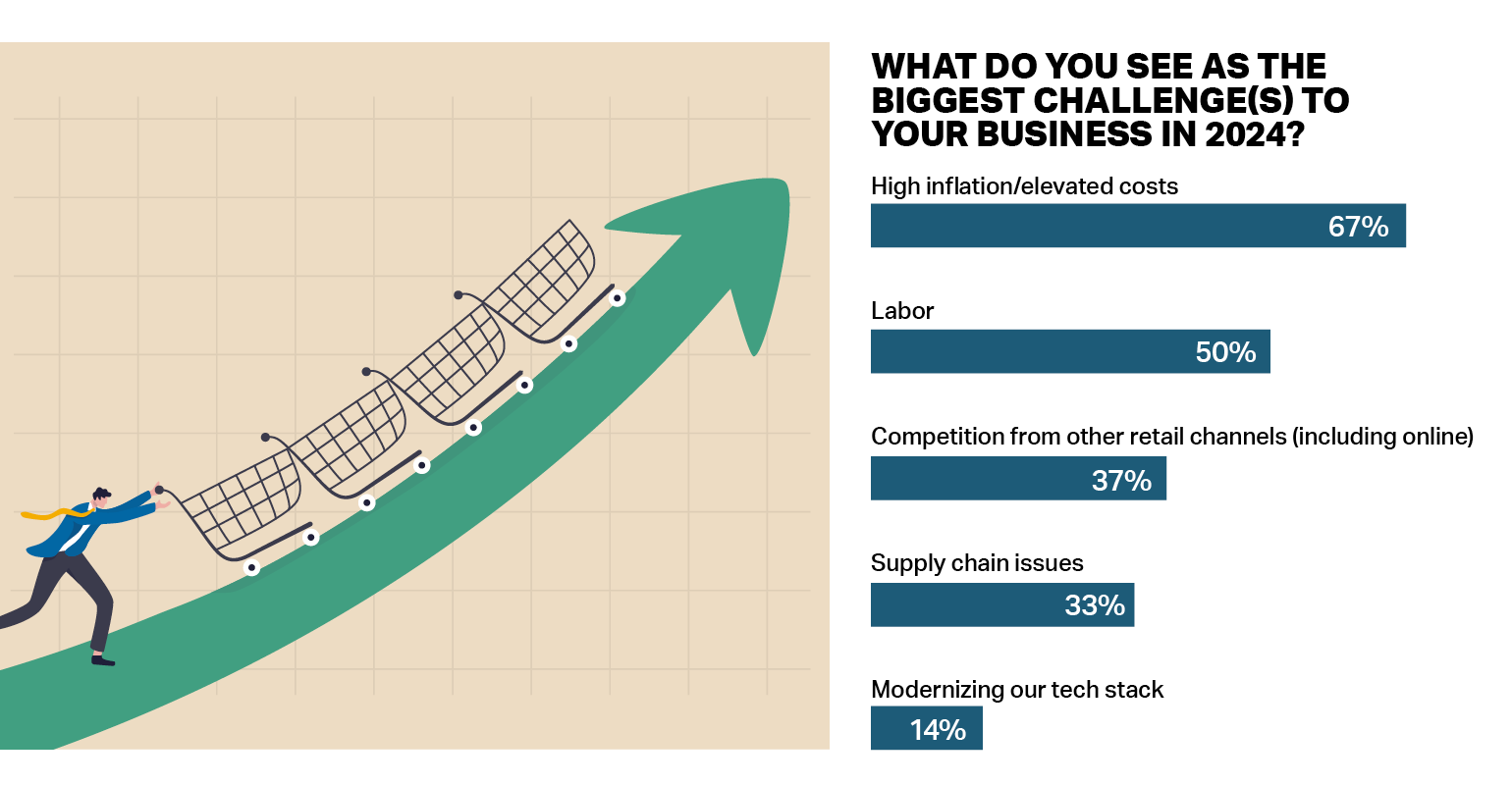

Although labor remains a significant challenge for retailers and wholesalers in 2024, two other factors emerged as the most pressing concerns: competition from other retail channels, which was cited by 57% of retailers/wholesalers, and high inflation/elevated costs, also cited by 57%. Those figures compare with 51% of retailers and wholesalers who cited labor as a significant challenge.

Supply chain issues appear to be fading as a concern, cited by only 35% of retailers/wholesalers. Respondents also seem to be confident in their technology tools, as only 19% said modernizing their tech stack posed a significant challenge.

When asked to elaborate on the biggest challenges in 2024, survey respondents cited a range of issues, including new restrictions on SNAP benefits, and ongoing pressures on unit sales volumes:

- “Cycling out of incremental SNAP dollars and unit growth softening”

- “Deflation will flatten and destroy projections”

- “Government regulations, especially in blue states (California min. wage increase, Colorado polystyrene foam ban, etc.)”

- “Growing unit sales and adding one more item to the cart. Growing sales by department and increasing staff levels”

- “Inflation [driving] rising costs/sales, but units are down — way down”

- “People don’t want to work”

- “Walmart, Amazon, and new competition”

- “We are focusing on retention. Recruiting has been a bit easier”

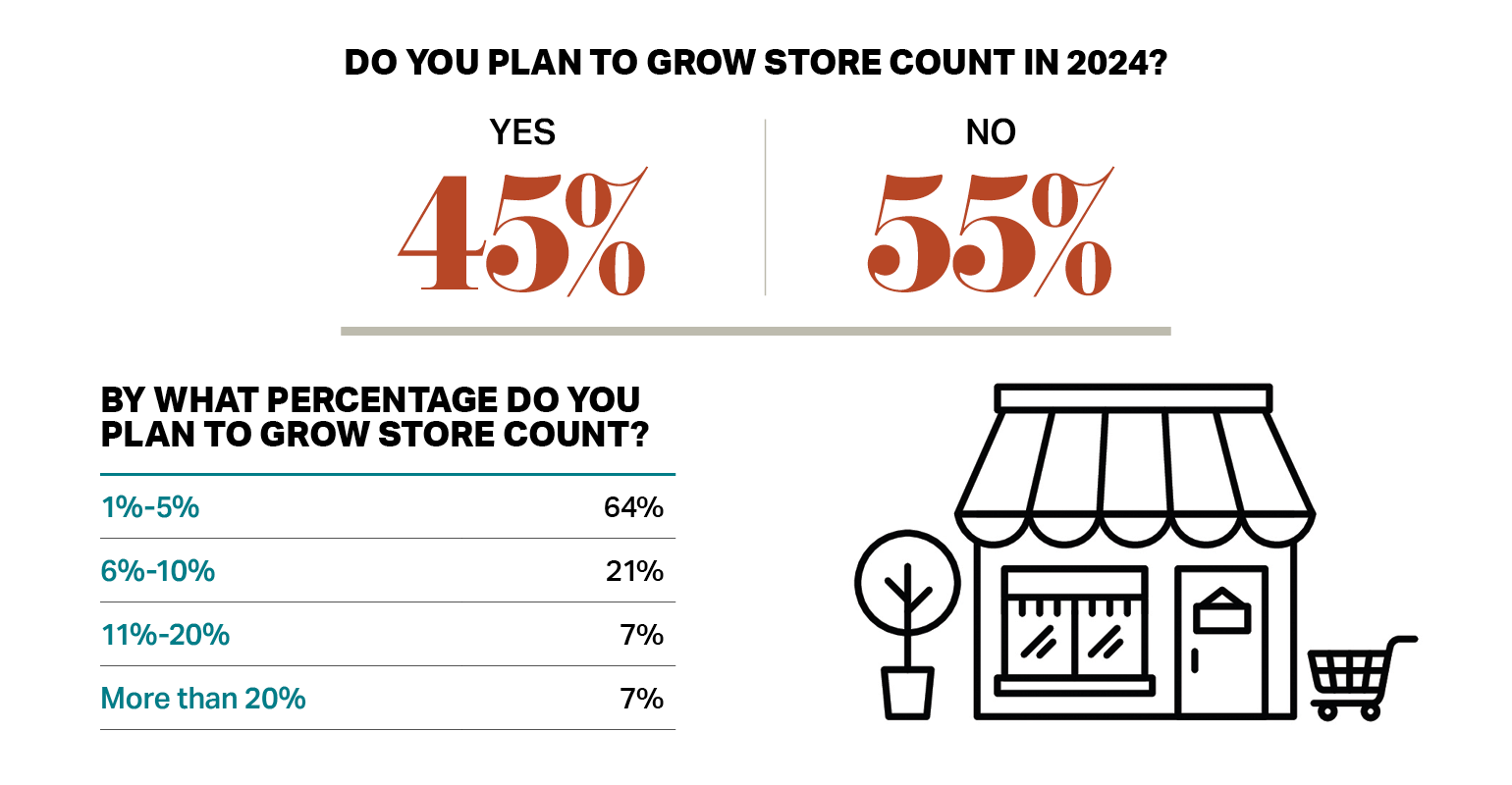

In another sign that retailers are optimistic, despite the difficult comparisons with the inflation-driven sales of 2023, 45% of retailers said they planned to increase their store count in the year ahead, compared with only 27% who had such plans for 2023.

Fewer respondents said they plan to hire more employees in 2023, however, which is perhaps an indication that companies have worked through their staffing challenges of the past several years to some degree. Only 33% of retailer/wholesaler respondents said they planned to increase hiring in 2024, down from 55% who had said last year that they planned to add staff in 2023.

Retailers showed some hints of optimism in their outlook for online grocery sales as well. While 35% of retailer/wholesaler respondents said their online grocery sales were 6% or more of total sales in 2023, 50% said they expect online grocery sales to be 6% or more of total sales in 2024.