Following the news of Mars agreement to acquire Kellanova

Rabia Yasmeen, Industry Manager E-commerce at Euromonitor International:

Probably the biggest acquisition in snacks industry. Acquisition of Kellanova by Mars represents culmination of a sweet brand portfolio and a salty portfolio with regards to snacks industry. As Mars strategic move to diversify from a coco-dependent brand portfolio, the acquisition marks a hedge against rising cocoa prices and decline in consumption of sugary products as health and wellness trends define new consumer preferences.

Overall snacks industry is expected to see a growth of over 8% during 2024. Latin America and Middle East & Africa are the fastest growing regions, each having over 14% growth this year. Growth rates in North America for overall snacks have steadily been declining, while have remained stable in Asia Pacific.

Future growth opportunities for companies is highly dependent on product diversification, new product development, expansion in emerging markets and channels.

Globally, nearly 7% of the snacks sales is channelled via e-commerce and is expected to grow by 8% in 2024.

As significance of e-commerce channel grows, we see what the impact of this acquisition for Snacks e-commerce landscape is.

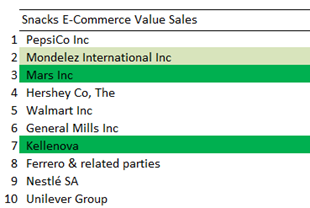

Snacks E-Commerce Company Ranks:

Mars ranks 3rd globally* for snacks E-Commerce in 2023 and in 2024 (year till date, data until June 2024). Kellanova ranks 7th in 2024 (Year till date), though the brand overtook Ferrero which ranked 7th in 2023.

As Mars acquires Kellanova, Mars increases its snacks e-commerce value share to a sizeable difference. Based on E-Commerce sales of more than 300 retailers across 15 top markets globally, the collective snacks e-commerce value sales for Mars and Kellanova in 2023 is 55% higher than Mars alone. Though, the new snack powerhouse ownership still sees strong competition from Mondelez International, ranking second, the results of this acquisition can impact the top three ranks in 2025, with likelihood of Mars reaching for the second rank.

The biggest win for Mars through this acquisition is the brand positioning and snacks e-commerce at brand level.

While Mars’ top 3 ranks are M&M’s, Galaxy and KIND in the snacks e-commerce space, acquiring Kellanova gives the company ownership of Pringle’s, Cheez It and Kellogg’s – with each having higher sales than Mars’ second best performing brand.

On a market level, the acquisition will help Kellanova extend the growth of its brands in emerging markets, where Mars has greater influence. For example, Mars has notable presence in China in snacks e-commerce, with the country ranking second biggest market after the US. However, this penetration is missing for Kellanova, and achieving that in savoury segment can unlock new e-commerce growth for the new powerhouse.

Carl Quash III, Head of Snacks and Nutrition at Euromonitor International:

Snacks remain a high growth area to invest in. But with ongoing industry volatilities, from post-inflationary recovery to industry specific challenges like the cocoa crisis, players are looking at ways to stabilize the success of their future business.

Mars and Kellanova megamerger announcements happened quite swiftly. This megamerger will truly accelerate Mars’ goal to double its snacking business by 2034 while also intensifying competition for global snack leaders PepsiCo and Mondelez due to its anticipated near 2pp gain of global snacks. And it will now hold a stronger play in the largest and one of the most resilient snack categories, savoury snacks, where its presence is very low today.

Mars, like the rest of the chocolate and confectionery industry, is having a tough time with pricing and demand shifts due to the cocoa crisis and health conscious moves away from too many sweets. With the promise of this acquisition, Mars will hold a wider range of assets and build a stronger savoury presence to complement its dominance in sweets/confectionery. This will also benefit Mars’ future demand with several of Kellanova’s savoury brands already repositioning to deliver on increased health demands such as the launch of Pringle’s Harvest Blends and Cheez-its made with whole grains and real cheese. Mars will also be able to better buffer the challenges faced in any one part of its business – like offsetting chocolate pressures with a push in its future savoury offerings.

Mars will also become a leader in savoury snacks – moving from a negligible presence to rank as the second leading player behind PepsiCo in 2025, globally. The combined assets of Mars and Kellanova will also make it the top player in global snack bars, dethroning General Mills.

We expect an increase in merger and acquisition activity within the snack industry as competition heats up among the leading players.

Source: westerngrocer.com