Ontario fertilizer prices at mercy of outside forces

Fertilizer pricing analysts are in a wait-and-see mode.

Read Also

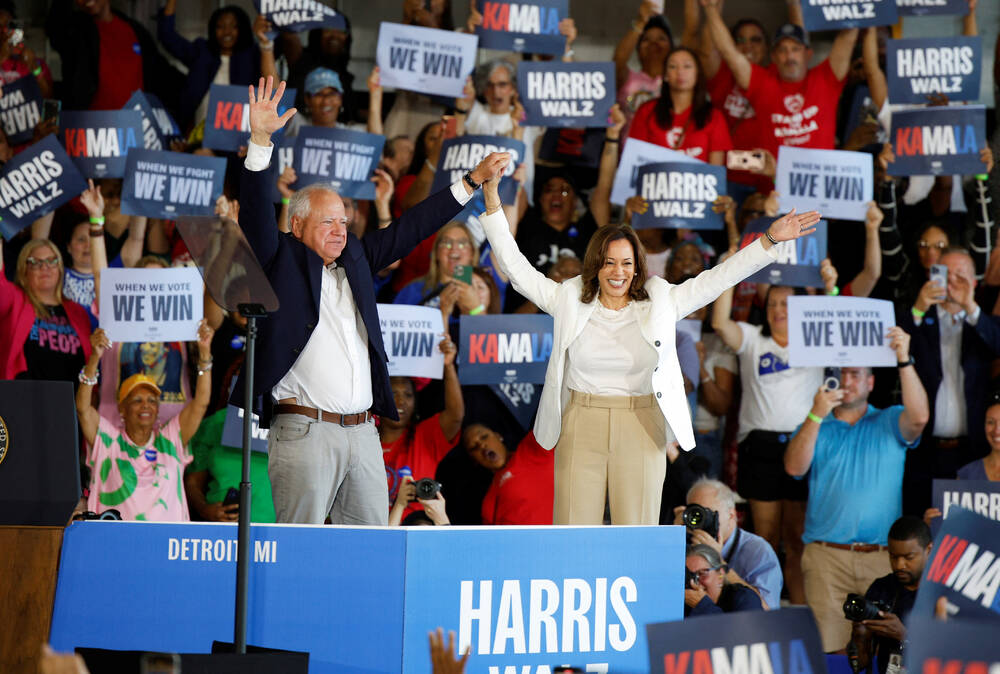

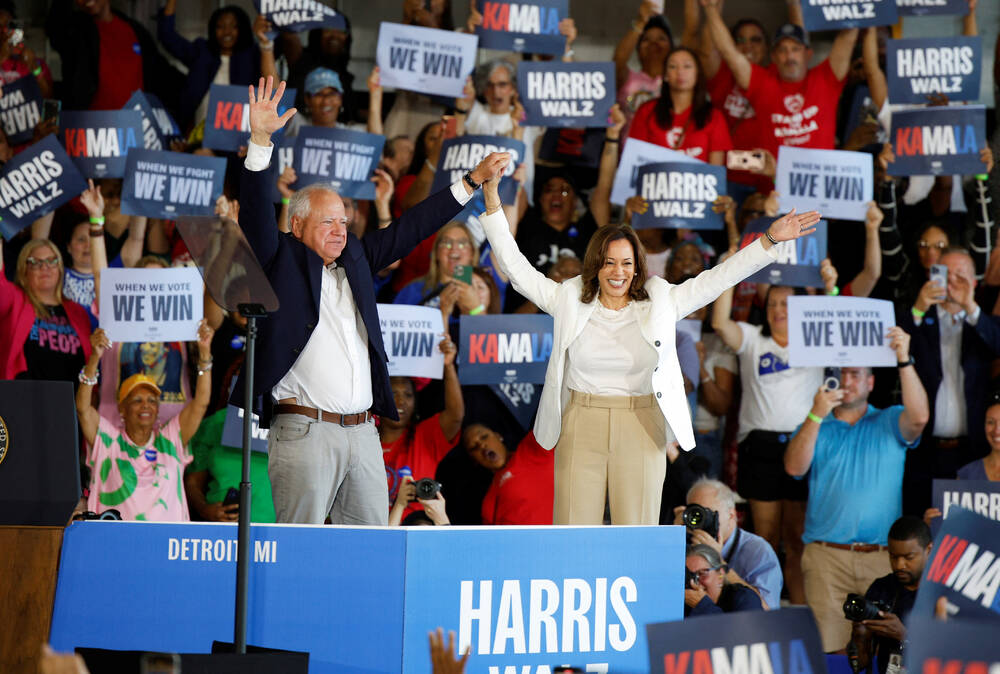

U.S. vice-presidential hopeful called pro-ag, pro-trade

Canada might have a noted supporter of international trade as a vice-president should Kamala Harris win the U.S. presidential election in November. Tim Walz, the Minnesota governor who Harris named as her vice-presidential pick.

A railway labour disruption in Canada and the prospect of a massive crop in the U.S. Midwest leave too many questions for clear pronouncements on fertilizer or commodity market directions in Ontario.

Why it matters: An expected U.S. bumper crop and the prospect of higher input prices because of a railway labour dispute have Ontario farmers watching the bottom line.

The combined effects of these uncertainties make Russel Hurst, executive director of the Ontario Agri Business Association (OABA), suspect that farmers will sharpen their pencils in the coming production cycle.

“Managing costs is going to be, I think, very much on the mind of Ontario growers going into 2025,” he said.

Despite these pressure points, the projected cost of crop nutrients over the next year is “starting to settle into this post-2022 scenario, moving away from those massive price swings over a six-week period that we saw (in 2022 and 2023). It’s more of a slow burn now.”

OABA members include crop input retailers, grain elevators and feed mills, and Hurst notes it’s near the time when retailers set prices for pre-paid crop nutrients for the 2025 growing season. The railway labour disruption has thrown a wrench into things.

Members received notifications in mid-August that the freight companies would, in anticipation of a work stoppage, limit the amount of hazardous materials on the rails. Retailers must thus consider the need to store more phosphorus on site to ensure continued supply, which will affect prices.

Supply threats

Fertilizer Canada, which represents manufacturers and distributors of crop nutrient products, advised Aug. 12 that “75 per cent of all fertilizer produced and used in Canada is moved by rail.”

On Aug. 20, it said “the railways move an average of 69,000 metric tonnes of fertilizer product per day, which is equivalent to four to five trains.”

This includes potash extracted from the Canadian Prairies and shipped east and south for use in Canada and the U.S., as well as to ports for export worldwide. It also includes imported nutrients arriving at eastern Canadian ports and shipped west to the Prairies and the U.S. Midwest.

For Fertilizer Canada, the biggest threat of an extended rail stoppage is failure of prairie-mined potash to reach the global potassium marketplace.

“In the last seven years, Canadian supply chain labour disruptions have cost the fertilizer industry nearly $1 billion,” Fertilizer Canada president and CEO Karen Proud said in the Aug. 20 news release, referencing not only railway stoppages but also labour troubles at Canadian ports.

“These stoppages are doing immense damage to our reputation as a reliable trading partner. Our customers, who rely on Canadian fertilizer products, are being forced to turn to our competitors in Russia, Belarus and China. We can’t afford for our railways to shut down.”

The situation and expected disruption of crop inputs delivered to U.S. growers was flagged by the U.S.-based National Corn Growers Association. In an Aug. 20 news release, it called on “Prime Minister Trudeau, the Teamsters and Canadian rail workers to do everything possible to avoid such a strike.”

“Of great concern to corn growers, a strike could interrupt shipments of fertilizer imports and exports of ethanol, corn and byproducts used as animal feed,” the association said.

For Ontario growers, the biggest threat is losing reliable and relatively affordable access to western Canadian potash.

“We’ve still got lots of time,” Hurst said of the potash supply situation. He said he’s confident that enough pressure will be exerted on the federal government to limit the stoppage to two weeks.

But even if it does last two weeks — or longer — the increased costs borne by Ontario’s crop input retailers will be passed on, to some degree, to growers.

Ongoing issues

A year ago, the big concern for fertilizer retailers and customers was the tariff initiated by the federal government on crop nutrient products from Russia, in response to the war in Ukraine. Hurst says that has faded, though the tariff remains in place.

Fertilizer is a global commodity, he said, and operators within the supply chain adjust to such trade barriers. He likened it to U.S. tariffs on imports of phosphorus from Morocco. After an initial impact on prices across North America, ports in Canada’s Atlantic provinces began offloading shipments from Morocco and loading trains destined for the U.S. Midwest.

“Eastern Canadian growers haven’t increased their phosphorus use anywhere near that much compared to how much more is coming in through those ports,” Hurst said. “It just ends up in the Midwest in a circumvented manner.”

Russia and Belarus still produce fertilizer and supply other markets. A lot of it goes to South America, Hurst said, so the effects of this shift in destination rippled through the hemisphere. He said this is proof that tariffs are ineffective in a truly global marketplace like fertilizer, and the biggest losers due to Canadian tariffs on Russian imports have been eastern Canadian growers.

So far, that argument has fallen on deaf ears in Ottawa.

“We’re in contact with the prime minister’s office on a regular basis,” Hurst told Farmtario. “We’re in contact with the finance minister’s office. Every three to four months, we contact them and say, ‘hey, don’t forget about this.’ But unless there’s a resolution to the war in Ukraine, (finance minister Chrystia) Freeland isn’t going to give up (the fertilizer tariffs).”

Hurst said OABA members will soon set their 2025 pre-pay rates, and trends so far on nutrient prices are “flat to up slightly” for nitrogen and “a rising market” for phosphorus due to low stockpiles in Canada and continued fallout from countervailing duties on imports from Morocco into the U.S.

“That’s one where growers really need to be dialed in with their retailer to identify their needs,” he said of phosphorus fertilizers. An assessment on potassium awaits a resolution to the rail stoppage, he added.

Like many others in the industry, Hurst is watching the impact of a massive crop in the U.S. Midwest. Most estimates show a steep drop in crop prices in the wake of projected bumper yields. That could make cost of production and margins the biggest factors in Ontario growers’ fertilizer buying decisions.

Most growers watch the USDA’s pricing and yield reports.

“If it turns out we’ve got massive crop numbers from the Midwest, and it’s looking like that’s going to be the case, that’s going to impact what your corn and soybean pricing is going to be for the foreseeable future,” Hurst said.

Fertilizer manufacturers “can play the supply and demand game as good as anyone.”

Actions by China, as always, are a wild card. The big China purchases typically happen in late fall, but domestic fertilizer availability and exports are tightly controlled by the government to ensure an affordable supply. Things can change quickly.

“If you’re John or Jane Farmer, it’s not something that you probably lay awake at night thinking about,” Hurst said, adding it may be wise to ask crop input retailers if they’ve got their eye on this, in case there are opportunities or risks related to China’s activity.

Source: Farmtario.com