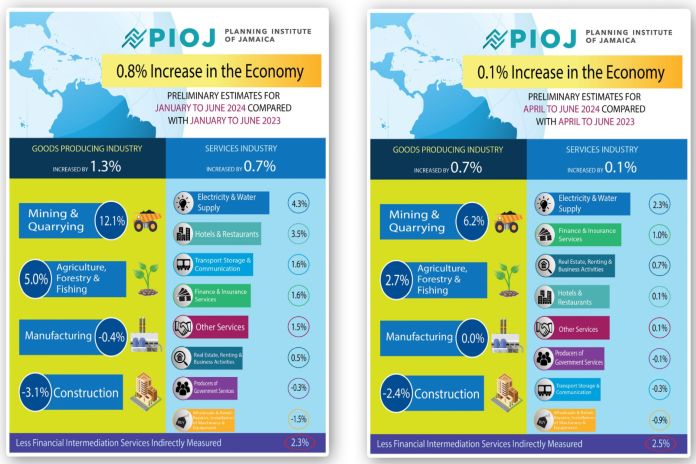

Jamaican economy remained relatively flat at 0.1 percent compared with the corresponding quarter, April to June 2023

By Caribbean News Global contributor

KINGSTON, Jamaica, (PIOJ News) – The Planning Institute of Jamaica (PIOJ) presents preliminary estimates on economic performance for each quarter. This is based on early information provided by major data providers, reports director general of PIOJ, Dr Wayne Henry.

“The provision of preliminary estimates is consistent with trends in modern economies globally, where it is the common practice to release a 1st, 2nd and even a 3rd preliminary estimate, before the final figures are provided.”

The PIOJ releases the preliminary growth estimate approximately six weeks following the end of the quarter being reviewed, while STATIN releases the official figures at the end of the 3rd month following the end of the quarter.

“Various stakeholders, including our International development partners, the private sector, as well as the government, use the preliminary data to inform critical planning and policy-related decisions. Today, we are reporting that the Jamaican economy remained relatively flat, recording an estimated growth of 0.1% compared with the corresponding quarter, April to June 2023,” said PIOJ, Dr Henry, overview of the current economic context.

“The outturn for the review quarter largely reflected the normalization of performances of most industries following the return to pre-COVID-19 levels of output in 2023. Specifically, the performance mainly reflected the estimated downturns in the Wholesale & Retail Trade, Repair and Installation of Machinery; and Construction industries, as well as a slowing in the pace of growth in most other industries.

The main factors influencing the performance during the review quarter included:

- Strengthening of consumer confidence as well as relatively high levels of employment which supported increased levels of domestic demand for goods and services

- Growth in the economies of Jamaica’s major trading partners, which supported external demand, and

- Challenges associated with:

– A fire at Petrojam refinery in March 2024, which negatively impacted production during the review quarter; and a fall in business confidence, as less firms believe that the climate is good for investment.

Conclusion

Note however, that for the full fiscal year 2024/25, the projection is more uncertain ranging from -1.0 to 1.0 percent and is largely dependent of the pace of recovery from the fallout from hurricane Beryl.

At the negative side of the range the uncertainties are driven by:

- The extensive damage in some of the main agriculture-producing areas. In light of this, a return to positive performance in this industry may not be recorded until FY 2025/26. Additionally, there will be an associated fallout in the WRTRIM industry (the largest single industry) given the decline in Agriculture.

- The potential negative impact of the Electricity & Water Supply industry on other productive activities in the most affected parishes of St Elizabeth, Clarendon Manchester and Westmoreland. This impact is still unknown as the data and information collection process is ongoing; and,

- The negative impact of an extended fallout in Mining & Quarrying and the associated downturn on Transport and Storage activities.

Towards the positive side of the range, the projection is predicated on the expectation that the contraction will be short-lived and there will be a return to positive performance by the October-December 2024 quarter. There is the potential for all industries, with the exception of Agriculture, to return to positive performance, based on:

- The return to full/normal operating capacities by utility providers (electricity, water and telecommunications), consequent on the completion of restoration works in the July–September quarter.

- The return to higher levels of operations in the Mining & Quarrying Industry with the full resumption of operations at a major shipping Port, following repairs of damages caused by hurricane Beryl. This is anticipated to result in higher capacity utilisation rates; and,

- A return to growth in the construction industry reflecting increased rebuilding and repair activities associated with recovery from hurricane Beryl, as well as the ramping-up of activities under the Relief Emergency Assistance & Community Help (REACH) road rehabilitation programme during the latter half of the fiscal year.

“Despite the challenges that abound, we remain optimistic as we continue to closely monitor and assess these developments,” PIOJ reports.

Source: caribbeannewsglobal.com