Western Canadian feeder market continues upward trend

For the week ending April 12, Western Canadian feeder cattle markets traded $5-8 higher on average. Quality genetic packages made fresh historical highs. It’s that time of year when calf numbers decline and many backgrounding operators liquidated inventory prior to April. Feedlot operators shrugged off the lower futures market early in the week. Once U.S. President Trump announced a 90-day pause on tariffs for most nations, the stronger feeder futures provided the cash market with another shot of adrenaline.

Alberta packers were buying fed cattle on a dressed basis in the range of $470-475 per hundredweight. Using a 60 per cent grading, this equates to a live price of $282-285 per cwt. Fed cattle prices have made fresh highs, which has been supportive for the feeder complex. Current break-even pen closeouts in southern Alberta are in the range of $255-265. Feedlot operators will often base their purchase price for replacements on the current live cattle market, rather than the deferred live cattle futures. Therefore, the weakness in the futures market hasn’t influenced feeder cattle prices. Using the current Alberta cash price for fed cattle, the feeder cattle market has been bid up high enough so that margins barely cover feed costs (silage and barley).

In Ontario, packer bids were surfacing on a dressed basis $480-485 per cwt., which equates to a live range of $288-291 per cwt. Ontario break-even fed cattle prices on current pen closeouts are around $253. Ontario feedlot margins are $420 per head. Ontario feedlot demand for replacements has been stretching as far west as central Alberta. The Ontario cattle feeder has been somewhat isolated from the on-and-off again tariff drama because Eastern Canada is net importer for beef. When feeder cattle prices have softened, it’s the Ontario demand in many cases limiting the downside. It’s important to know that feedlot margins in Canada and the U.S. will move into negative territory during the summer months. This will weigh on the feeder market.

Read Also

Alberta feeder co-op still in limbo over loan program

As negotiations continue to reinstate the Feeders Association Loan Guarantee program to the Picture Butte Feeder Co-operative, the provincial cattle feeders association is making its feelings known.

South of Edmonton, larger-frame Simmental-cross steers weighing just below 1,000 pounds on silage and light grain ration with full processing data traded for $365. At the Lloydminster sale, Black Angus blends with a mean weight of 810 lb. dropped the gavel at $406. In southern Alberta, Charolais-based steers with a mean weight of 725 lb. on light grain and silage diet fully preconditioned were valued at $445 FOB farm. In the Calgary region, red heifers averaging 730 lb. traded for $410.

In central Saskatchewan, red mixed steers on the card at 620 lb. supposedly sold for $511. South of Edmonton, a smaller package of long-term weaned Limousin-based heifers on light barley and silage diet with full processing data averaging 605 lb. traded for $450. In central Saskatchewan, red steers weighing 500 lb. traded for $576 and a handful of black heifers weighing 490 lb. were valued at $529.

In Western Canada, feeder cattle supplies outside finishing feedlots as of April 1, 2025 were estimated at 2.502 million head, down 112,000 head from the April 1, 2024 number of 2.614 million head. This doesn’t include calves born from January 1 through March 30. Cow-calf producers that wanted to sell prior to the tariff announcements have done so by this time. The feeder cattle on farms or ranches are only coming on the market starting in August.

Many feedlot and backgrounding operators held off on feeder cattle purchases prior to April 2. Ideas were that prices would be lower after the U.S. announced tariffs. When there were no tariffs placed on Canadian beef or cattle, the feeder market had to a adjust for a surge in buying interest under normal market conditions. There was a significant amount of pent-up demand.

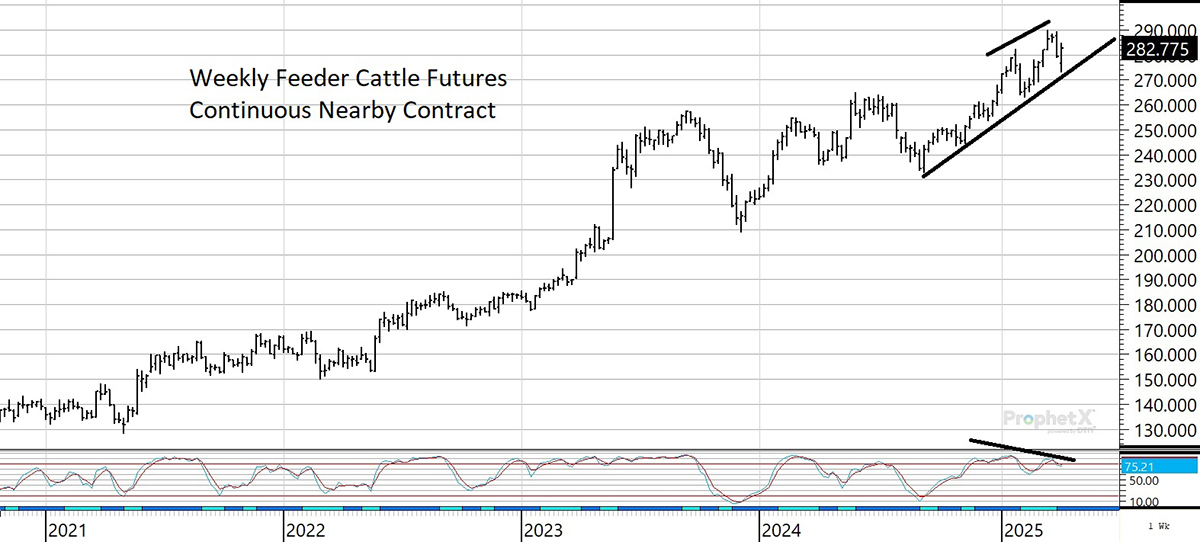

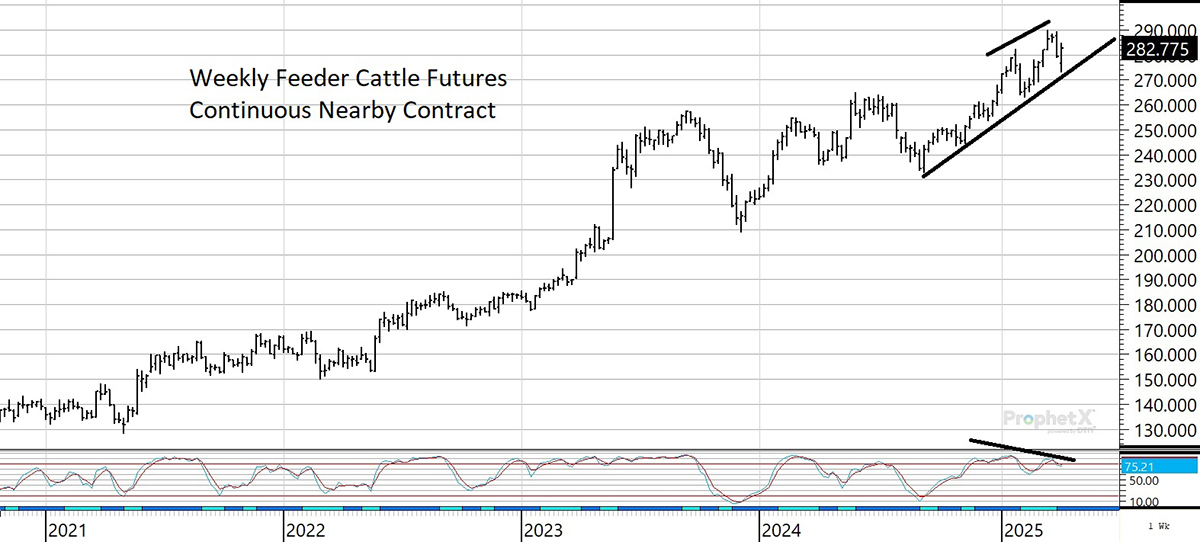

The feeder cattle futures have moved in tandem with the equity markets since April 3. The proposed tariffs will result in higher unemployment levels and increase inflationary pressures. A company like Walmart buys about half of their merchandise from China. Major retailers and restaurants are bracing for a decrease in consumer spending. Keep in mind a one per cent increase in consumer spending equates to a one per cent increase in beef demand. The two are highly correlated when the U.S. economy is expanding. However, when the economy is contracting or shrinking, a one per cent decrease in consumer spending causes beef demand to decrease by one to one and half per cent. The change in beef demand is more severe in a recession. When consumers are worried about their jobs, they don’t buy steak or go out for steak dinner.

China has imposed 56 per cent tariff on U.S. beef. On the April 10, the USDA WASDE Report (World Agriculture Supply and Demand Estimates,) lowered U.S. beef exports by 130 million lb. The USDA only lowered U.S. beef imports by 15 million lb. The net result was that the U.S. domestic market will need to absorb an additional 115 million lb. Supplies are increasing while demand is decreasing. This change in the market structure comes at at time when cattle and beef prices are at historical highs.

The Commitments of Traders Report had the commercial trader short a record 8,872 contacts as of April 1. On the flip side, the managed money or speculative funds were long a record 31,912 contracts. Fund liquidation has been a key feature of the live and feeder cattle futures since April 3. This has caused the feeder cattle futures to divorce from the feeder cash trade.

The CME composite price is the official cash settlement price for the CME feeder cattle futures at contract final settlement. Figures have been calculated by the CME Group from prices reported by the USDA. Above is the seven-day average price for 700-899-lb. feeder steers.

At the time writing this article, the May feeder cattle futures were trading around $275. The futures are $15 discount to the CME composite price. During the May delivery period, the futures and the CME composite price have to be equal.

We have a bullish outlook for corn and feed barley moving forward. Canadian barley stocks are expected to drop to historical low levels at the end of the 2024-25 crop year. The market needs to encourage barley acreage in Western Canada through higher prices. The U.S. corn carryout will also drop below the five-year average and so the upcoming crop cannot afford to experience adverse weather. We expect the corn and barley markets to incorporate a risk premium due to the uncertainty in production. The U.S. will be the main corn exporter on the world market until July.

Jerry Klassen is the president and founder of Resilient Capital, specializing in proprietary commodity futures trading and market analysis. He can be reached at 204-504-8339 or via his website at resilcapital.com.

Source: producer.com