Wheat markets rebound but headwinds persist

Spring wheat futures markets have managed to bounce off contract lows over the past two weeks and are trading close to a two-month high.

Cash prices in the Prairies have also been moving higher with nearby offers mostly in the mid-$8 to lower-$9 per bushel range.

Cash prices are currently at their highest point of the crop year.

Read Also

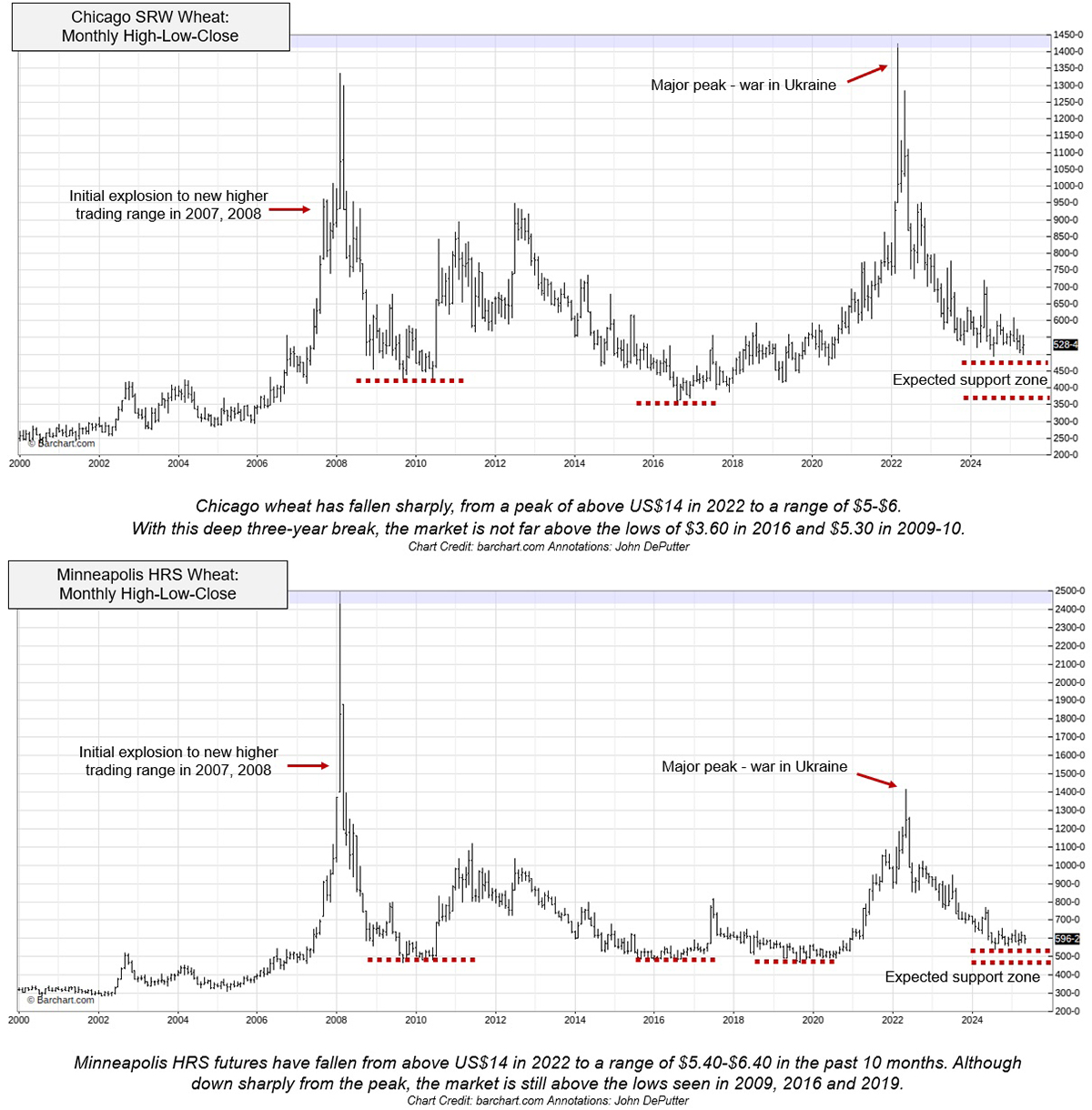

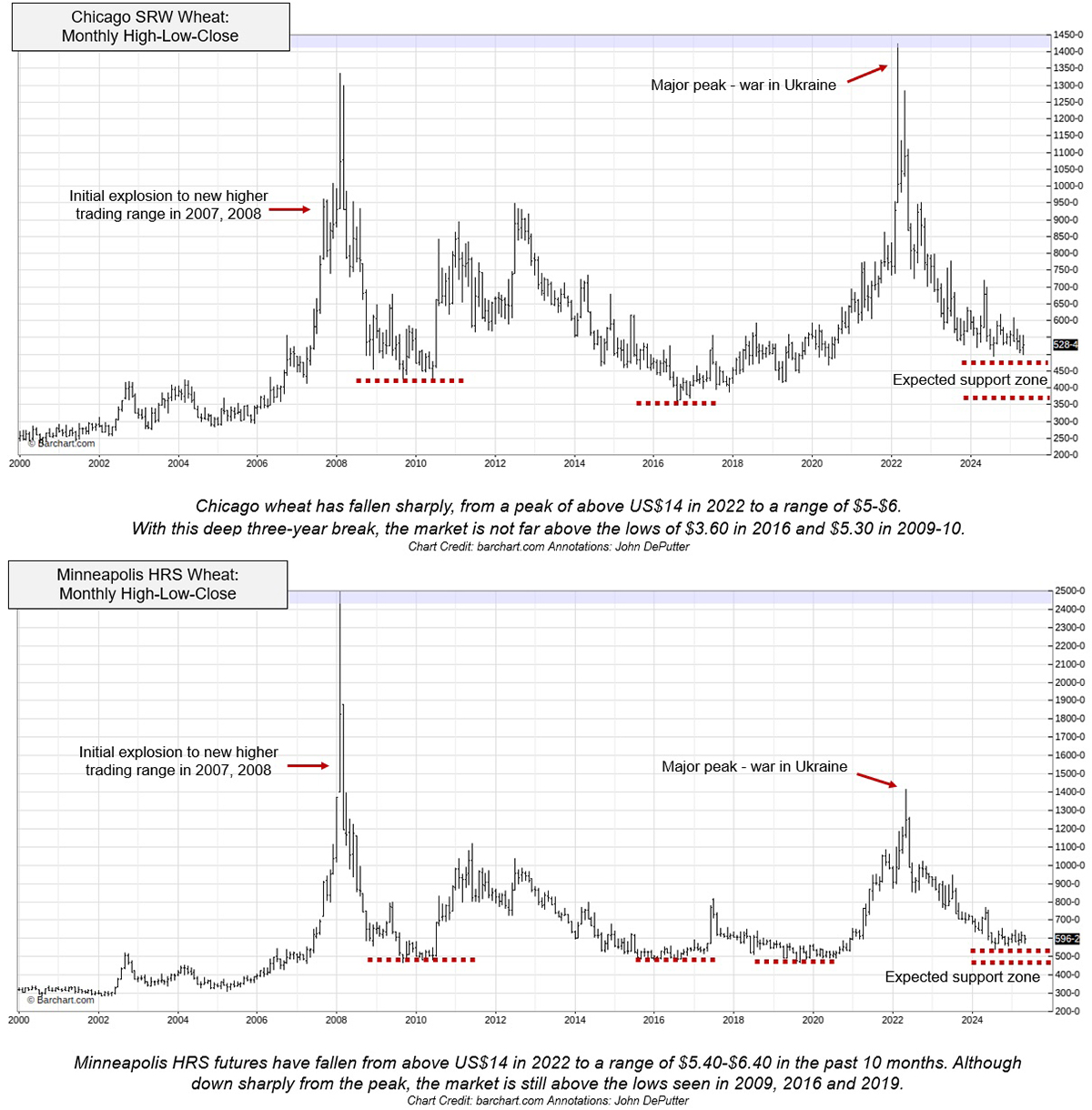

Have the wheat bear markets run their course?

Wheat futures keep trying to rally. Time after time, the rallies fail. The markets seem stuck in low-level ruts.

Wheat markets have been under pressure from the impending harvest in the Northern Hemisphere.

Winter wheat harvests in India and China are essentially complete.

The start of the wheat harvest in the United States has begun in southern Texas. Harvest should rapidly gain momentum in the coming weeks as the crop matures in the southern Plains.

Europe and the Black Sea region will see harvest activity in late June and July. The prospect of the arrival of new crop supplies has been the most significant factor in pressuring wheat markets.

The U.S. Department of Agriculture’s first report of the 2025-26 crop year was released in early May, which also provided some negative news for the wheat market.

U.S. winter wheat production was forecast to increase by two per cent in 2025-26 from the previous crop year. The Hard Red Winter wheat crop was estimated at 784 million bushels, which is an increase of 14 million bu. from last year.

Recent rain in the southern Plains has helped maintain the condition of the crop through the filling stage. The U.S. production estimates combined with favourable weather have been negative for wheat markets.

There has been some positive news that has helped support the spring wheat market.

Spring wheat conditions have provided some support for the recent rally in Minneapolis futures.

The initial crop ratings for spring wheat surprised the market with only 45 per cent of the crop rated as good to excellent. Ratings for the past two years have ranged from 64 to 74 per cent good to excellent.

This news helped boost spring wheat futures. The dry conditions in the northern U.S. Plains and Canadian Prairies are also supporting spring wheat prices.

Managed money funds had been amassing a record short position in spring wheat futures over the past two months.

Although this has pressured wheat futures, it is actually positive. Funds started to buy back their position in the week ending May 27, but still maintained a short position of 30,518 contracts. Fund buying will likely be a significant factor in supporting the spring wheat market in the coming weeks.

The rally in the spring wheat markets will need additional bullish news in order to sustain the current gains in the market.

The primary concern for spring wheat markets is the current dryness in the North American spring wheat growing areas. There has been some relief in the region during the last week of May, but amounts were relatively light.

As with most years, the direction of the spring wheat market will be largely determined by weather during June and July. The spring wheat market has added a significant weather premium into current prices. It is important to realize that this premium is only one general rain away from disappearing.

Bruce Burnett is Glacier FarmMedia’s senior editor for weather and markets.

Source: producer.com