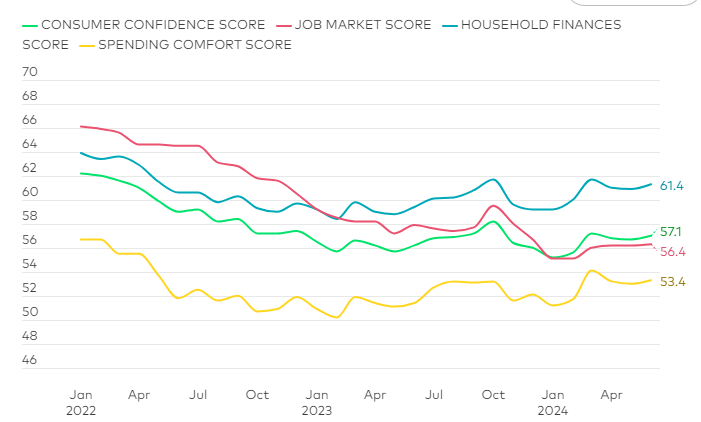

Consumer confidence inched up by 0.3% to 57.1 month over month in June “with growing levels of comfort across the board,” according to Numerator’s Consumer Sentiment Tracker.

Forty percent of consumers said it is easy or very easy to find a job compared to 27% who believe it is somewhat or very difficult to find work.

Survey respondents were also more confident in their financial situation, with 49% saying it is good or very good, which is slightly higher than the previous month. Only 16% said their finances are poor or very poor.

Comfort with spending held steady from the previous month, with 41% saying they’re comfortable spending money on discretionary purchases. Discomfort with discretionary spending was also consistent with last month’s survey at 31%.

Roughly a third of consumers said they are saving money (36.2%) or using it to pay down debt (33.3%)

“Most activities were down compared to last month and last year. Consumers continue looking for ways to save, as well — they’re shopping on sale, using coupons/discount codes when possible, and cooking at home. Many cost-saving measures were down slightly this month,” the report noted.

Most consumers saved money by using coupons or discount codes on their purchases at 42.8%, down 1.9 percentage points from the previous month and up 0.8 percentage points from the previous year.

They also saved money by shopping for sale items (42.6%), cooking at home (40.9%), spending less (34.9%), budgeting (29.4%), shopping for store brands (23.5%), canceling subscriptions (23%), delaying large purchases (22.3%),

Survey respondents also had a neutral take on the outlook for their household finances, with a quarter saying they expect their finances to be better a year from now, a quarter expecting their finances to be worse, and 53% believing their finances will remain the same.

“This is up slightly from last month and up compared to the back half of 2023. Black consumers and Gen Z consumers are the most optimistic about their financial situations, while white consumers and Boomers are the least,” the report added.