Shopper cost sensitivity amid elevated inflation is leading consumer packaged goods (CPG) manufacturers and retailers to keep a tighter rein on pricing, new research from Advantage Sales shows.

Just 38% of manufacturers polled plan to enact price hikes in response to increased costs, according to the October 2022 Advantage Sales Outlook. Of those companies, 13% aim to implement a first or second price increase, 18% a third increase, 6% a fourth increase and 1% a fifth or more increase. Another 1% haven’t raised pricing since the onset of COVID-19, and 24% don’t plan to lift prices further.

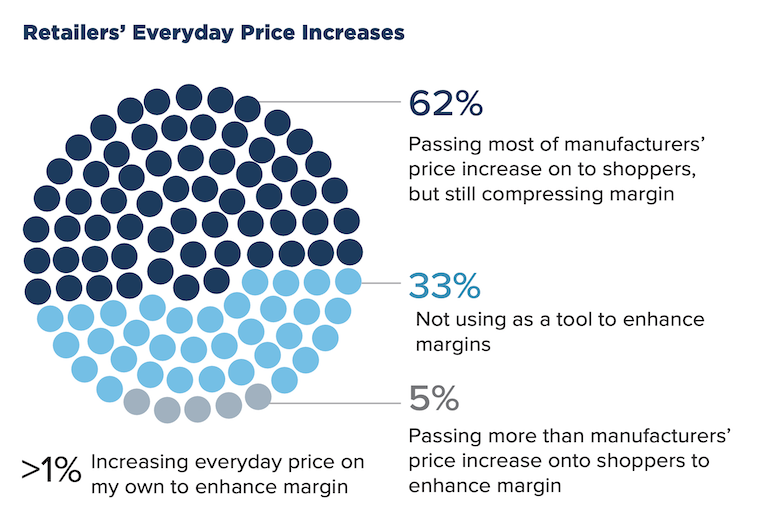

At the customer end, 62% of retailers surveyed reported passing most of manufacturers’ price hikes on to shoppers but with compressed margins, the study said. Five percent of retailers indicated they are passing more than manufacturers’ price upticks on to customers to bolster margins, while 1% of retailers are hoisting their everyday price on their own to improve margins. Meanwhile, 33% of retailers said they’re not using everyday price increases as a tool to aid margins.

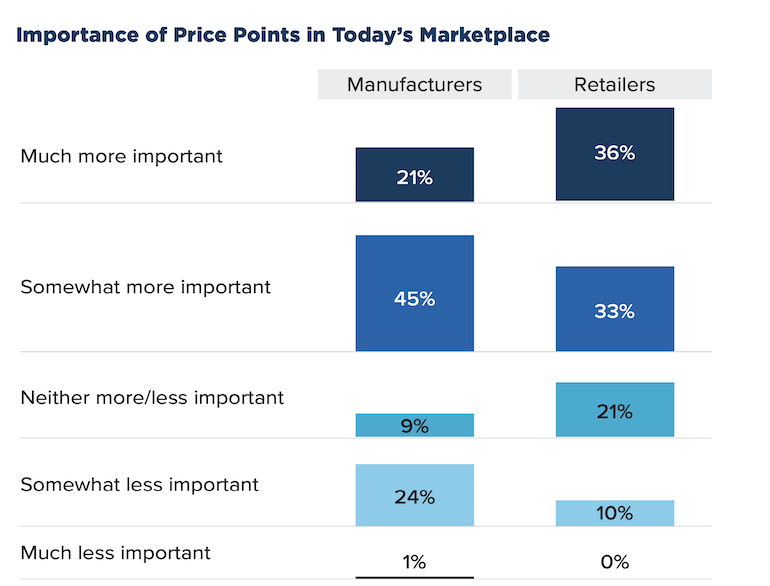

CPG manufacturers and retailers, certainly, know how touchy the price topic is these days with consumers. Among manufacturers, 21% agreed that price points are “much more important” in today’s marketplace, and 45% think they’re “somewhat more important.” Retailers, being closer to the shopper, have a higher view of pricing’s importance. Of those surveyed, 36% see price points as “much more important” and 33% as “somewhat more important” nowadays.

“We’re seeing manufacturers and retailers considering and implementing new tactics to combat the effects of inflation on their costs and on shoppers’ price sensitivity and the negative impact of continued supply chain challenges,” according to Jill Blanchard, president of client solutions for Irvine, Calif.-based Advantage Solutions, the parent of retail and consumer goods sales and marketing firm Advantage Sales. “In some areas, they’re on the same page and working together for mutual benefit. But there are areas where their individual goals may be at odds with those of their business partners.”

Private brands lead retailer price strategies

Private label will play a big role for retailers in addressing consumer price sensitivity. Advantage Sales found that 75% plan to boost availability/distribution of private-brand products over the next six months, and 40% aim to widen the price gap versus national brands. Only 26% expect to narrow the price difference between store and national brands.

Other retailer strategies to aid consumers amid higher prices include increase promotions (cited by 60%), more longer-term temporary price reductions (50%), more displays of lower price point products (48%), lower private-label prices (18%), lower everyday pricing for key national brands (10%), reduce premium brands in favor of less-expensive brands (8%) and priority shelf placement for lower price point products (3%).

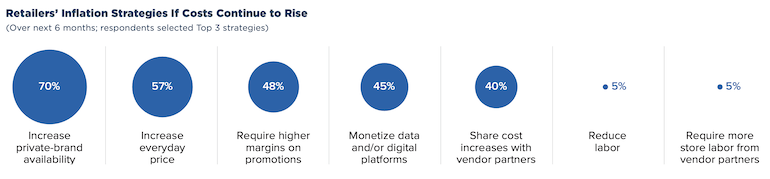

If costs continue to escalate over the next six months, 57% of retailers listed “increase everyday price” among their top three strategies, behind only expand private-label availability (70%). Those were followed by require higher margins on promotions (48%), monetize data and/or digital platforms (45%), sharing cost hikes with vendor partners (40%), reducing labor (5%) and requiring more store labor from vendor partners (5%).

Manufacturer efforts to ease pricing

Advantage Sales noted in its outlook report that, to blunt the impact of elevated prices on consumers, 95% of manufacturers are looking to market their products as trusted, high-quality brands over the next six to 12 months, and most expect to use this tactic often.

Slightly over 60% of CPG makers said they will position their products as affordable indulgences, while the same percentage plan to step up promotions.

Another approach cited by 44% manufacturers is marketing products as less-expensive options. Twenty-six percent are considering an acquisition, and 19% aim to make more private-brand items.

Everyday low pricing, too, will be an area of focus. Thirty-three percent of manufacturers report they will introduce products at a lower everyday price over the next six to 12 months, whereas 12% said they will lower their everyday price.

Supply-side challenges

Neither CPG manufacturers nor retailers have been able to stay immune from supply-chain concerns, as the vast majority of companies said they continued to be plagued by one issue or another, Advantage Sales’ research revealed.

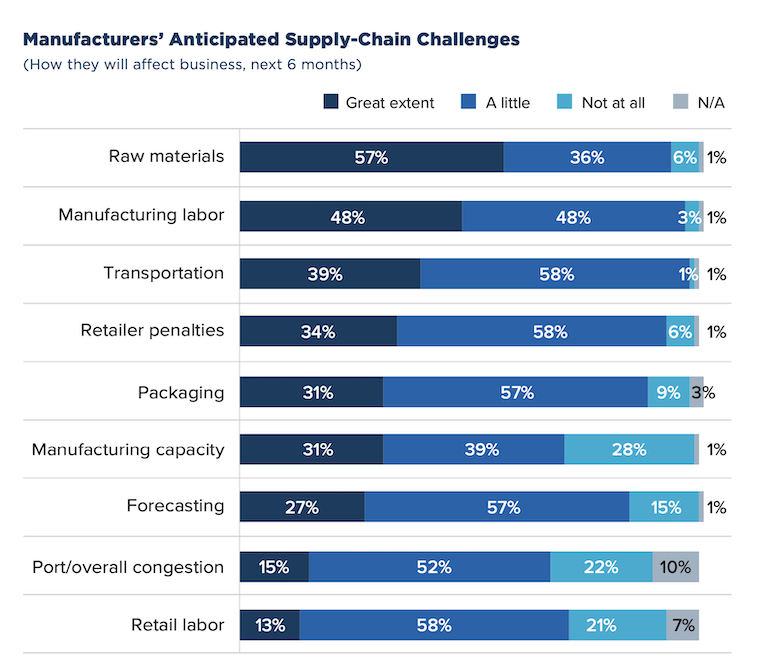

Among manufacturers, 57% expect raw materials and 48% manufacturing labor to affect business “to a great extent” over the next six months. Other top concerns that will significantly impact their business include transportation (39%), retailer penalties (34%), packaging (31%) and manufacturing capacity (31%). Also expected to present challenges “to a great extent” are forecasting (27%), ports and overall shipping congestion (15%), and retail labor (13%).

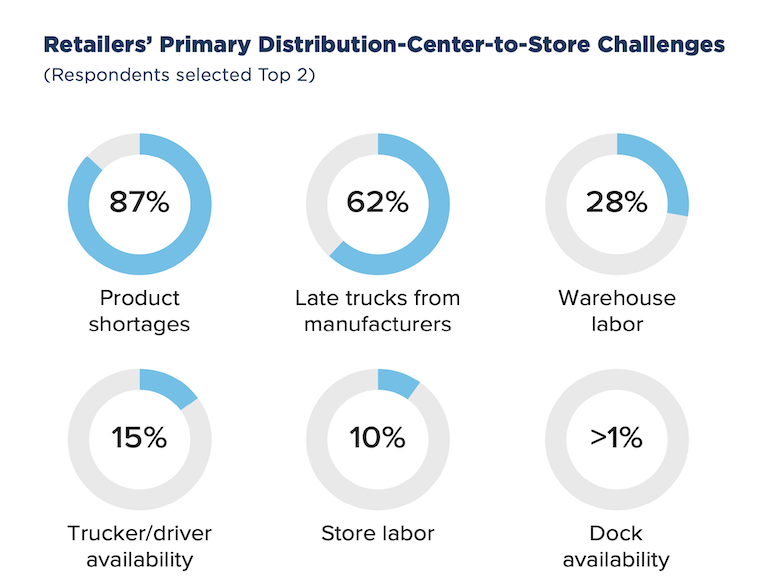

Retailers indicated that they have their share of supply challenges from the distribution center to the store. Asked to name their top two concerns over the next six months, 87% cited product shortages, followed by 62% pointing to late trucks from manufacturers. Retailers’ other top supply issues, Advantage Sales said, include warehouse labor (named by 28%), trucker/driver availability (15%), store labor (10%) and dock availability (over 1%).