U.S. online grocery sales remain elevated despite decreasing slightly in September, according to the latest Brick Meets Click/Mercatus Grocery Shopping Survey.

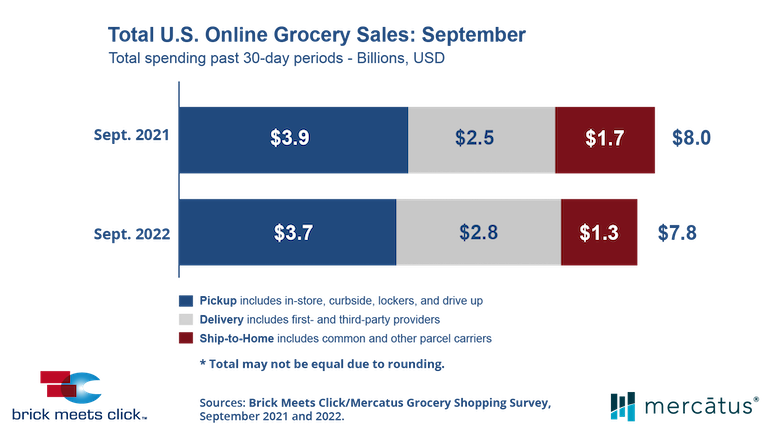

For September, the online grocery market totaled $7.8 billion, down 2.5% from $8 billion a year earlier and marking a sequential decline of 8.2% from this past August. On a year-over-year basis, delivery was the only channel posting a gain for the month, up 12% to $2.8 billion versus decreases of 5.1% to $3.7 billion for pickup and 23.5% to $1.3 billion for ship-to-home.

Click-and-collect, however, ended up as the only segment generating a month-to-month increase in September, with sales up 5.7% from August compared with falloffs of 20% for pickup and 7.1% for ship-to-home.

Third-quarter 2022 U.S. e-grocery sales came in at $24.1 billion, up 7.6% from $22.4 billion in the second quarter and 3.4% from $23.3 billion in the 2021 third quarter, Barrington, Ill.-based strategic advisory firm Brick Meets Click reported. Annually, Q3 pickup sales edged up 0.9% to $10.7 billion (+7% from $10 billion in Q2), while Q3 delivery sales jumped 20.8% to $9.3 billion (the same increase as from $7.7 billion Q2). Ship-to-home sales were $4.2 billion in Q3, marking declines of 6.7% from $4.5 billion in Q2 and 16% from $5 billion a year ago.

“These quarterly results reflect the fact that there are now an increasing number of ways to receive e-grocery orders via delivery,” explained David Bishop, partner at Brick Meets Click, which focuses on how digital technology impacts food sales and marketing. “Today, customers who want to shop their local grocery store typically have the choice of several different delivery providers and platforms, but that is not necessarily the case for pickup. In addition, national grocers are investing in growing more integrated first-party services that could offer a more acceptable alternative for customers attracted to delivery.”

Conducted Sept. 29 and 30 by Brick Meets Click, and sponsored by grocery e-commerce specialist Mercatus, the survey polled 1,752 U.S. adults who participated in their household’s grocery shopping and made an online grocery purchase in the previous 30 days. Delivery includes retailer and third-party services (e.g. Instacart, DoorDash, Shipt), while pickup includes in-store, curbside, locker and drive-up services. Ship-to-home sales cover online grocery purchases delivered by parcel couriers like Federal Express, UPS and the U.S. Postal Service.

Pickup, the biggest online grocery channel, turned in a mixed sales performance as the growth in quarterly sales stemmed from shifts in its user base and order frequency, offset by ongoing spending gains each month, Brick Meets Click said.

Monthly active users (MAUs) for click-and-collect fluctuated between July, August and September, leading to a 2% decrease in the channel’s MAU base for the third quarter year over year. The pattern was similar in order frequency, with the number of orders received by active pickup users rising in July but falling in August and September, resulting in a just over 1% dip for the quarter. Meanwhile, average order value (AOV) rose each month and wound up growing 4% for the quarter versus a year ago. Pickup closed out Q3 with a 44% share of sales, down 1.2 percentage points versus a year ago.

Brick Meets Click noted that new service options from national players and new third-party providers helped drive the more than 20% year-over-year lift in Q3 sales for delivery. Each month’s total sales growth, though, slowed sequentially through the quarter, with September finishing up 12% from a year earlier.

Delivery’s MAU base grew faster each month versus a year ago, spurring growth of more than 6% for the quarter compared with 2021. Order frequency basically held firm on a quarterly basis versus a year ago yet tailed off annually for August and September. AOV for delivery advanced 12% year over year, topping pickup spending by about $5 per order over the same period, according to Brick Meets Click. Consequently, delivery gained 5.4 points of share in the third quarter from a year earlier, raising its share of Q3 online grocery sales to nearly 39%.

The continued sales decline in the ship-to-home channel reflects its MAU base shrinking at a faster rate each month during the quarter, down almost 11% in September and ending Q3 down more than 6% year over year. Order frequency, too, slowed at a faster rate monthly, falling 11% for September and about 7% for the quarter. Ship-to-home’s AOV gained 2% in September versus a year ago, but spending per order dropped almost 5% for the quarter. The channel ended the third quarter with a 17% share of e-grocery sales, down 4.3 points versus 2021.

Online grocery cross-shopping between grocery and mass retail channels increased by over 2 percentage points in September and 3 percentage points in Q3 from a year ago. The share of households that used both a grocery and mass e-grocery service was 28% for September and 29% for the quarter.

Repeat intent, or the likelihood of an online grocery shopper to use the same service again within the next 30 days, climbed 3 percentage points to 63% in Q3. This measure underscores the need for traditional supermarkets to monitor cross-shopping, Brick Meets Click pointed out. In September, the repeat intent rate for mass customers came in 10 percentage points higher than for grocery customers, and the gap has expanded nearly 7 points since a year ago.

“Successful online grocery retailers are able to navigate competing business priorities, manage through resource constraints and keep a tight focus on building customer demand,” commented Sylvain Perrier, president and CEO of Toronto-based Mercatus. “Getting an online customer to shop again is directly linked to the shopping experience, from the moment they start to build a basket to the moment they receive it. Retailers who can consistently deliver against the promise and expectations associated with online grocery shopping are being rewarded by customers with repeat business.”