Farmland value growthslowed in 2023, FCC says

Glacier FarmMedia – Farmland is getting more expensive, but not quite as quickly as in recent years, according to the latest farmland value report from Canada’s biggest agricultural lender.

Read Also

Global demand for pork remains strong, buoying industry optimism

Ontario Pork’s outgoing chair delivered a sombre but optimistic assessment of the industry’s future during the organization’s annual general meeting…

Farm Credit Canada put average national farmland value growth in 2023 at 11.5 per cent, down from 12.8 per cent in 2022.

Why it matters: The Bank of Canada has yet to lower interest rates but that hasn’t deterred farmland purchasers.

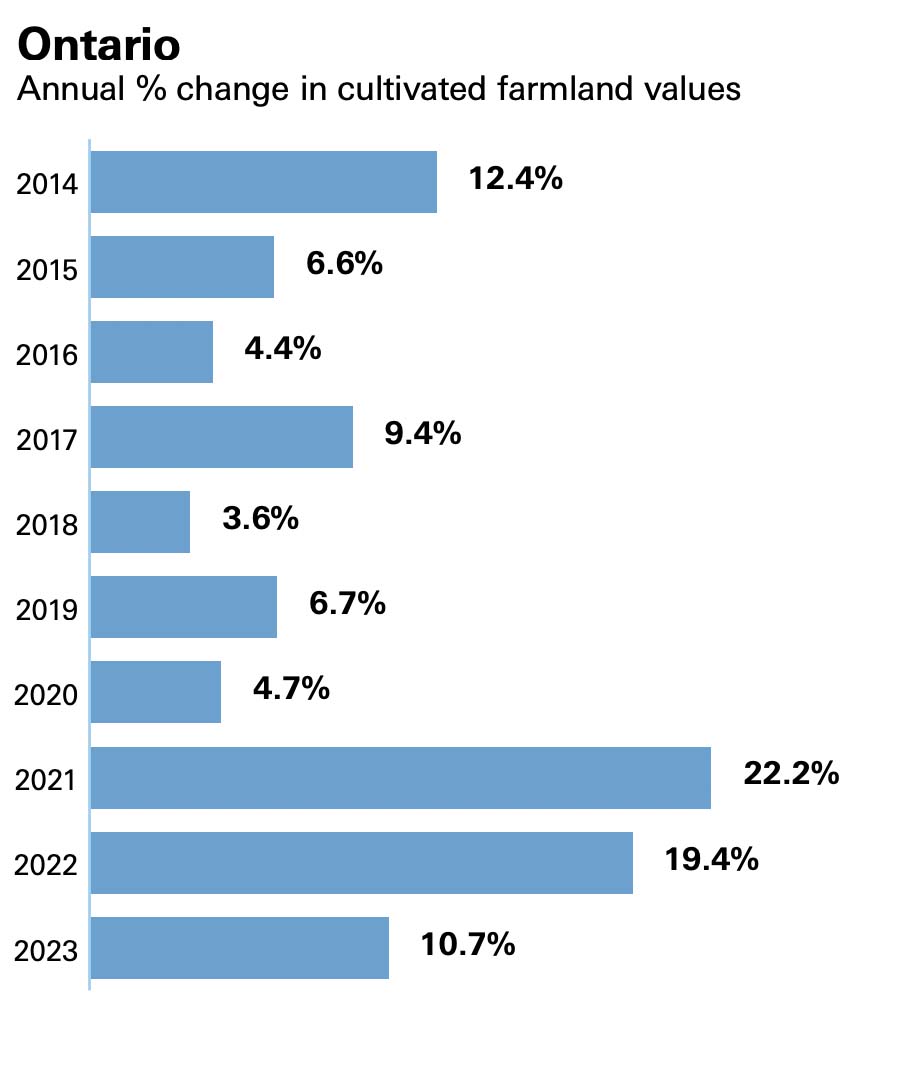

Ontario’s growth in farmland value slowed to 10.7 per cent in 2023, down from 19.4 per cent growth in 2022.

“We had three consecutive years of … land values climbing, and so we’re seeing a little bit of a pullback,” said FCC chief economist J.P. Gervais. “It’s still double-digit, still a very significant increase.”

Given global geopolitical events, which led to market volatility in the last few years, Gervais said he expected even more of a pullback.

There was significant variability. Land value growth in some provinces, including Ontario, remained above 10 per cent, while British Columbia’s pace dipped into the red by 3.1 per cent, although that province also had the highest average land value on a per-acre basis.

The highest average provincial increases in farmland values were found in Saskatchewan, Quebec and Manitoba, with increases of 15.7 per cent, 13.3 per cent and 11.1 per cent, respectively.

That’s up from 14.2, 11 and 11.2 per cent, respectively, in 2022.

Rates from other provinces included 7.8 per cent in Nova Scotia (down from 11.6), 7.4 per cent in Prince Edward Island (down from 18.7), 6.5 per cent in Alberta (down from 10 per cent) and 5.6 per cent in New Brunswick (down from 17.1 per cent in 2022.)

In 2022, Ontario, Prince Edward Island and New Brunswick topped the list for the quickest growing farmland values.

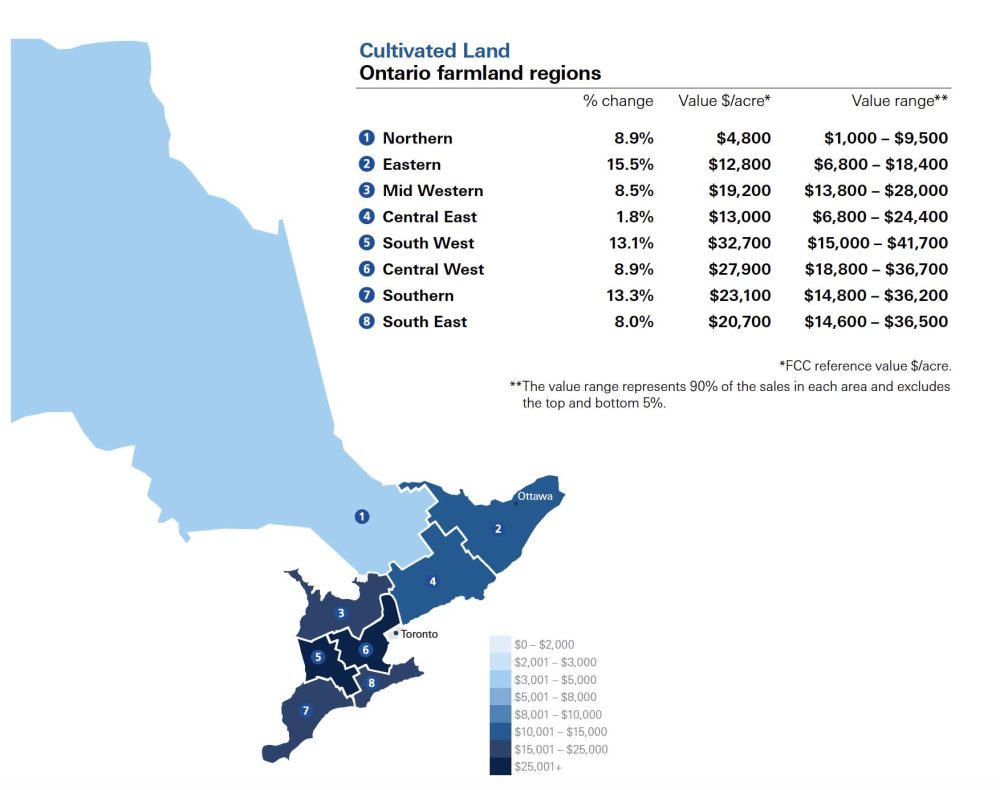

Eastern Ontario saw greatest value growth

FCC said real estate professionals reported fewer bidders on available properties in the province, but good land close to established operations sold quickly. Marginal land stayed longer on the market.

Demand for Ontario land came from a variety of sources, the report said, including intensive, supply-managed farm operations, cash crop producers, part-time farmers and investors.

The only region in Ontario with a higher growth rate than in 2022 was in the east, where values increased by 15.5 per cent.

However, FCC said the average price per acre in that region was still lower than most other regions in the province, so the gap in values is narrowing.

In the northern region, FCC reported farmland values increased by 8.9 per cent, adding this increase appeared larger because of the low price per acre.

Farmland values increased by 13.3 per cent in the southern region of the province.

The typically higher-priced region of the southwest saw an increase of 13.1 per cent, the third highest for Ontario, FCC said. The midwestern region increased by 8.5 per cent overall.

Other areas that were slower to increase still experienced “relatively good increases” in 2023, the report said.

There was an increase in values of 8.9 per cent in the central-west region. This area is closer to urban areas, and FCC said properties faced higher pressure from full and part-time producers as well as investors looking for rural properties close to the city.

The second smallest increase of 2023 was in the southeast, with eight per cent growth. This region had one of the highest growth values reported in 2022.

The central-east region had the smallest average increase in Ontario, at 1.8 per cent overall.

A cautious year ahead

It was a generally unaffordable year to buy land, Gervais noted, pointing to the double hit of high interest rates and flagging commodity prices. Actual farmland sales declined slightly from 2022 as producers exercised more caution around investment decisions.

He expects that caution to extend well into 2024 due to continued high interest rates, high input costs and lower grain prices.

In fact, he said farmland in many parts of the country is less affordable now than it has ever been. Fiscal circumstances have opened operations to more financial risk.

“It makes it more difficult for young farmers and young operations that have a desire to expand into the industry,” he said.

In the short term, farm receipts of grains, oilseeds and pulses are projected to decline by 13.2 per cent in 2024, in comparison to a 0.4 per cent increase in 2023. Earlier this year, Gervais predicted a 4.8 per cent decline in 2024.

Pastureland values

The newest report also marked the second year FCC reported on pastureland values.

Due to insufficient sales in Ontario, Quebec and the Atlantic provinces, it focused on data from sales in Western Canada.

The most significant of those were in Manitoba, which saw an average growth of 19 per cent. Saskatchewan recorded a hike of 12.7 per cent, followed by Alberta at 9.6 per cent and B.C. at 7.4 per cent.

Source: Farmtario.com