Feeder cattle market braces for heifer retention

For the week ending May 9, western Canadian feeder cattle markets traded steady to $5 higher, on average.

Quality packages of lighter calves were priced $10-$15 above week ago levels.

Many auction barns are only holding sales every two or three weeks at this time of year with limited numbers on offer. This made the market hard to define in certain weight categories.

Read Also

Canfax Report

The western Canadian fed cattle market continues to be nothing short of impressive, with new record-high prices set yet again on the week ending May 9.

Ontario buying interest has subsided, while certain operations from Alberta have also halted purchases for the time being.

The feeder market is functioning to ration demand. Prices are now high enough so that feedlots are backing away from the market.

Alberta packers were buying fed cattle on a live basis at $292-$294 per hundredweight f.o.b. feedlot, unchanged from last week. Current break-even pen closeouts are in the range of $260-$265.

While margins are favourable in the short term, feeders coming into the feedyards this week don’t pencil profitably.

The October live cattle futures have been hovering around $206, which is a $12 discount to the nearby U.S. cash market. If the deferred live cattle futures don’t strengthen by US$15, southern Alberta losses during October are going to be in the range of $300-$400 per head.

Needless to say, there is a fair amount of risk owning replacements at the current levels.

At the Ponoka, Alta., sale, medium to lower flesh Charolais Angus blended steers on corn silage and grain screening diets with full processing records averaging 993 pounds traded for $379.

At the same sale, a handful of larger frame red Angus based steers weighing 882 lb. with full feeding and processing data notched the board at $401.

In central Alberta, larger frame Simmental-based heifers with various flesh levels weighing slightly more than 900 lb. on light grain and silage diet were valued at $370 f.o.b. farm.

In southern Alberta, wide frame lower flesh black Limousin based steers weighing 805 lb. reportedly traded for $451. In the same region, Simmental cross heifers averaging 802 lb. were quoted at $405.

At the Rimbey, Alta., sale, a handful of Charolais Simmental cross steers on silage and hay diet with preconditioning health with a mean weight of 743 lb. set the bar at $464.

In southern Alberta, quality genetic packages of steers weighing 700 lb. were quoted from $480-$495.

In the Calgary region, a smaller package of mixed steers with a mean weight of 600 lb. supposedly traded for $560.

At the Lloydminster sale, a package of black steers evaluated at 500 pounds silenced the crowd at $617. At the same sale, Angus based heifers weighing 498 lb. made notched the board at $540.

In Western Canada, total yearlings (heifers and steers) outside finishing feedlots on July 1 are estimated at 1.045 million head, down 5.8 per cent, or 63,000 head, from July 1, 2024.

The lower expected yearling supplies in the fall period have contributed to the market strength for replacements weighing less than 725 lb.

On May 7, wholesale Choice beef was trading at US$346 per cwt., while Select was quoted at $334 per cwt. This is up about $1-$3 per cwt. from last week and a fresh historical high.

In Kansas and Texas, live cattle were trading in the range of $218-$220, steady to $2 per cwt. higher than last week.

U.S. fed cattle prices are also at record highs.

Beef and cattle prices are at record highs, while beef demand appears to be peaking.

McDonald’s sales dropped in the first quarter of 2025, marking the second consecutive quarter of declines as customers pull back spending amid economic uncertainty.

Visits from low-income consumers are down nearly double digits from last year, and middle income is also declining. U.S. same-store sales dropped 3.6 per cent, which was the worst drop since the COVID-19 pandemic in 2020.

U.S. restaurant and grocery store spending tends to make a seasonal high in May and then plateau during June and July before decreasing in August.

The main point is that demand is not increasing. Despite the tariffs, U.S. beef imports during the second quarter of 2025 are expected to reach 1.1 to 1.2 billion lb., up from the 2024 April-June imports of 1.0 billion lb.

U.S. slaughter is coming in lower than anticipated as packing margins come under pressure. U.S. cattle on feed 150 days or more as of May 1 is estimated at 3.316 million head, up 239,000 head from last year.

We’re looking for U.S. market-ready supplies on June 1 to reach 2.250 million head, which would be up about 300,000 head from last year. Processing dressed weights in the United States are running 25 lb. above year-ago levels.

A similar situation is developing in Western Canada, with Alberta packers also curtailing the slaughter pace.

Market-ready fed cattle numbers move from an extremely tight situation in April and the first half of May to a burdensome supply situation in June and July. Market-ready fed cattle supplies in Alberta and Saskatchewan during June and July are expected to be above year-ago levels.

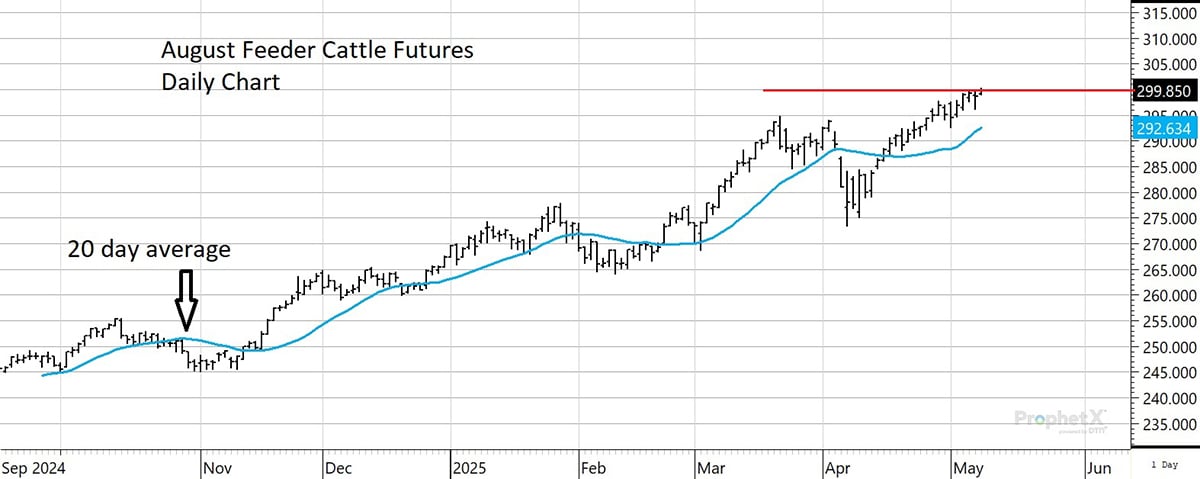

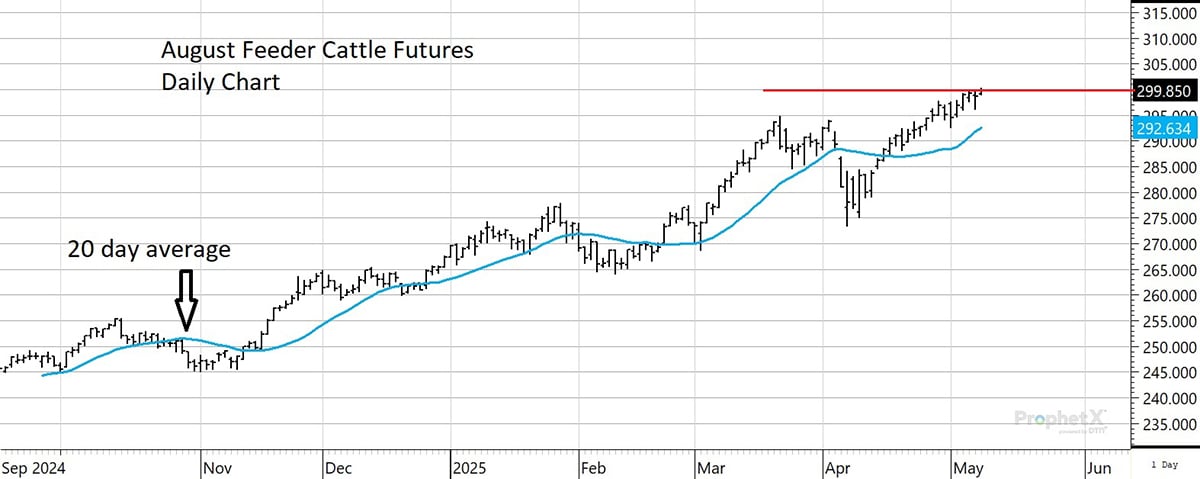

The weaker fed cattle outlook for the summer months will temper the upside in the feeder market from May through July. We’re starting to see a softer tone to U.S. cash feeder prices.

The cash index feels somewhat toppy at the current levels because the value is down $2.60 from the recent high.

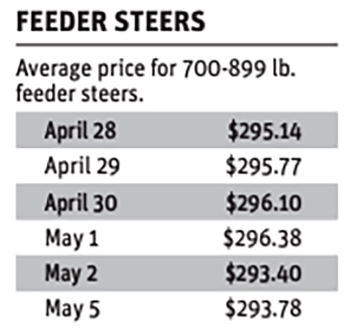

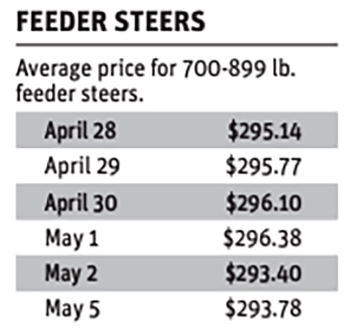

The CME composite price is the official cash settlement price for the CME feeder cattle futures at contract final settlement. Figures have been calculated by the CME Group from prices reported by the U.S. Department of Agriculture.

Below is the seven-day average price for 700-899 pound feeder steers.

At historically high prices, the feeder market also encourages production.

We continue to project that U.S. cattle producers will hold back about 500,000 to 600,000 heifers for herd expansion.

In Canada, we could see about 70,000 to 100,000 heifers held back for herd building.

When the first round of heifer retention occurs, feedlot margins move deep into red ink, so this is something to be mindful of later in fall and winter of 2025-26.

The fed market falls while the feeder market remains elevated. Past history tells us that feedlots usually have to endure one full round of negative margins before there is a serious downward adjustment on feeder cattle prices.

Jerry Klassen is the president and founder of Resilient Capital, specializing in proprietary commodity futures trading and market analysis. He can be reached at 204-504-8339 or via his website at resilcapital.com.

Source: producer.com