Fertilizer needs fair trade balance: Canadian Association of Agri-Retailers on tariffs

Glacier FarmMedia – Both Canadian and American farmers will be in the same bad situation without a fair trade balance on farm inputs.

That’s according to Stu Rasmussen, board chair of the Canadian Association of Agri-Retailers (CAAR).

Follow all our tariff coverage here

Read Also

Coal fuels potential clean animal feed

Methanol from unmined coal might help produce the next high-protein, low-carbon-footprint livestock feed.

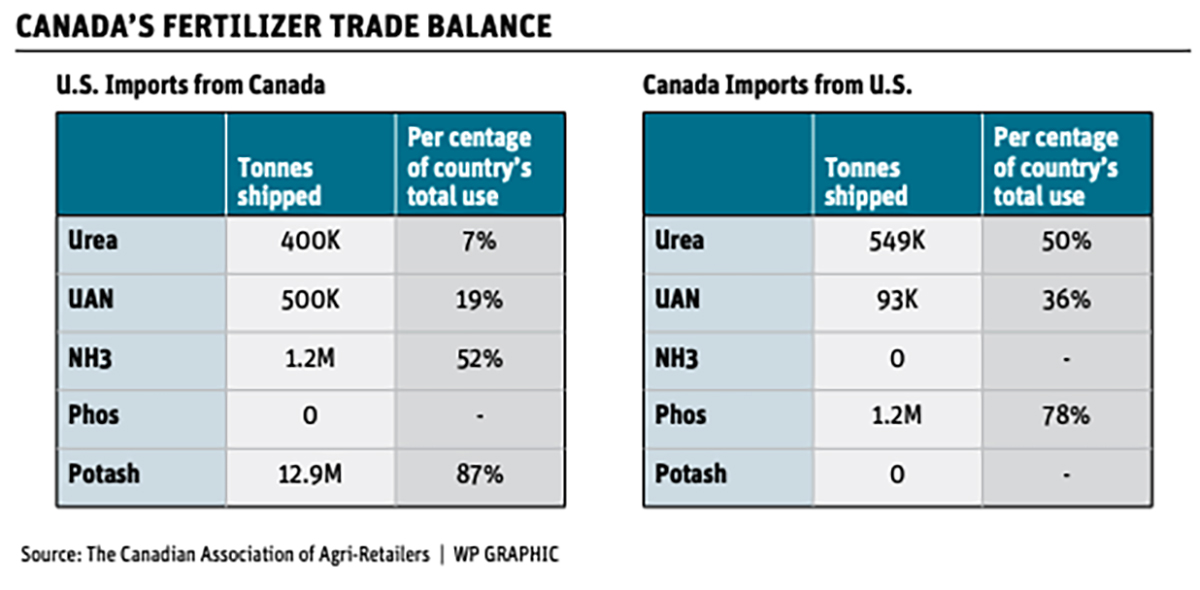

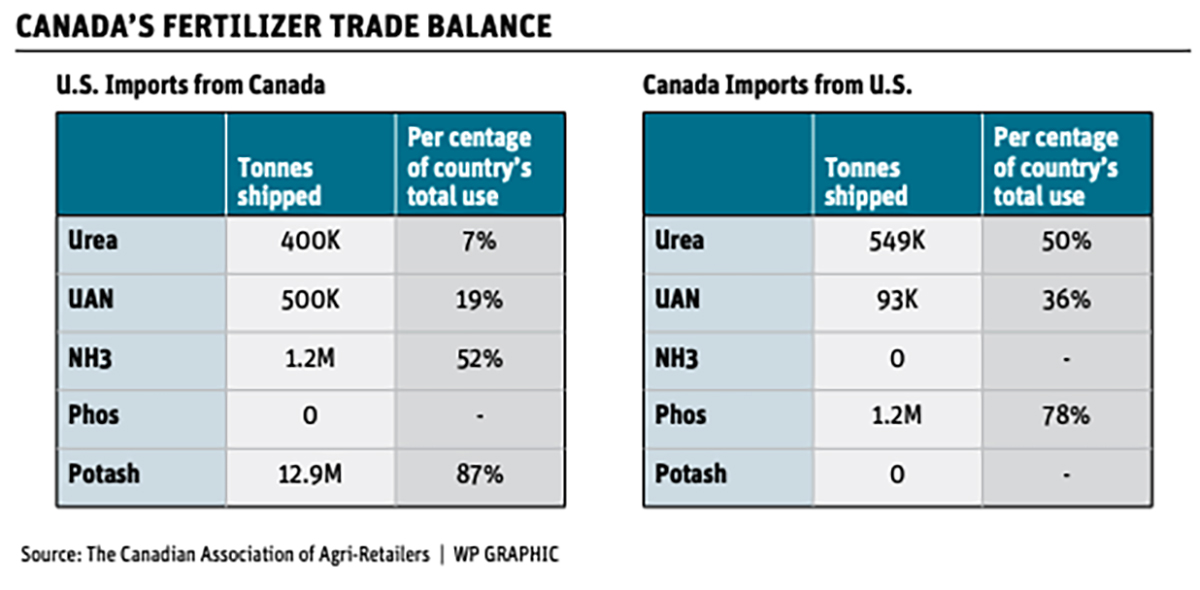

He told attendees of his talk at the Saskatchewan Ag Summit in Saskatoon that Canada is heavily reliant on phosphate from the United States, to the tune of 78 per cent of our phosphate used. Canada, meanwhile, sources 87 per cent of the U.S.’s potash.

That interdependence stresses the need for balance in order for food production to occur positively and effectively, he said.

“If you look at it long-term, there’s a whole bunch of market volatility and uncertain supply,” Rasmussen said. “If the potash producers start closing plants, shutting down shifts and things like that, that could be a major problem of all of us.”

There is an overall lack of clarity on the situation. Analysts have tagged possibilities of increased cost of production and freight as tariffs continue to shift.

Canadian potash was briefly subject to 25 per cent U.S. tariffs in early March, before rates were reduced to 10 per cent. As of the time of writing, that rate had survived the U.S.’s April 2 tariff announcements that imposed 10 per cent tariffs or higher on a wide swath of countries.

It’s not yet clear what Canada’s reciprocal tariff response might mean for farm inputs. Canada currently has retaliatory tariffs on US$30 billion worth of goods from the U.S.

Fertilizer products were scheduled as part of a future round of retaliatory tariffs worth US$125 billion of U.S. goods that the federal government threatened in the weeks leading up to April 2, when an exemption for goods compliant with the Canada-U.S.-Mexico Agreement was set to expire. As of the time of writing, that exemption was still in effect.

Many retailers in Canada are alongside farmers, with their concern around input price and impacts to their bottom line, Rasmussen said. That has put them against the stance of many product manufacturers who jumped onto the tariff bandwagon.

“Our price increased at the first announcement. Our price to phosphate increased overnight. So we started looking for a different source, and we found that,” he said.

For 2025, retailers are considering themselves safe. Most have locked in and are stocked with product purchased before tariffs increased prices. Most farmers have also already received their product. For those who hadn’t, Rasmussen had a warning:

“If you got more land, if you haven’t got all your fertilizer, I would get into your ag retail right away to figure that out. Because, again, we don’t know (what’s going to happen).”

North American interdependence

The 78 per cent of Canadian-used phosphate that comes from the U.S. equates to about 1.2 million tonnes.

Canada has previously tried to import phosphate from Morocco, but shipping to Canada still required routing through the New Orleans channel. It is unclear if that product, if it touches U.S. soil, would then be subject to the very tariffs Canada is trying to dodge.

Other major fertilizer imports from the U.S. include urea, responsible for 594,000 tonnes, or about half the urea used in Canada, and UAN at 93,000 tonnes, about 36 per cent of what Canada uses.

Imports are also dependent on manufacturers and their location in Canada. A manufacturer in Western Canada may currently see its largest demand from across the border as opposed to shipping to Eastern Canada. Thus, under that scenario, customers in Eastern Canada will import what they need from the U.S. instead. Under the previous free trade landscape, that wasn’t a problem.

It ultimately comes down to manufacturer priority as well as interprovincial trade regulations, infrastructure and transport means to ship product cross country, summit attendees heard.

Additional supply concerns

Rasmussen also noted the need for farmers to watch seed supply and crop protection supply chains, on top of fertilizer.

Seed prices are so far safe for 2025, but producers can expect possible issues with seed supply and prices in 2026, he warned.

While many seed companies are Canadian, they replicate in the U.S., and it’s unclear if seed will be then be subject to tariffs when coming back to Canada.

Final pesticide manufacture, meanwhile, largely happens in the U.S. before being shipped to Canada to be packaged and sold, but initial steps often come from China, currently embroiled in their own trade spat with the U.S., as well as Canada. On April 2, U.S. President Donald Trump announced 34 per cent tariffs against China, on top of the 20 per cent already imposed later this year. China announced two days later it will impose 34 per cent tariffs in response.

Rasmussen singled out glyphosate, phenoxy 2,4-D / MCPA and clethodim for that China-U.S.-Canada supply chain.

“I think that we should be looking for alternative suppliers for some instances,” he said. “Like I said about fertilizer, we need to maybe learn how to negotiate better terms, and maybe even look at changes to crop practices, selection, rotations and things like that.”

Source: www.producer.com