Forecast 2024: What can industry expect

As we look back on 2023, one thing we all learned was the impact of the unpredictable. Climate, geopolitics, media messaging, and government impact our industry and shoppers’ behaviours. Predicting the effects of these forces in 2024 or when they will subside is impossible. Will we see erratic weather patterns again that could impact crops? Our western grain farmers are already raising concerns about potentially smaller yields without snowfall for ground moisture and the risk of springtime floods (hopefully, that will not be the case).

Managing Director for Canada, NIQ

So, how do we believe consumers will behave, and where are the opportunities for our industry in 2024? Consumers will remain frugal, and there is unlikely to be a significant shift from discount retailers to conventional retailers soon. With this, we will need to monitor both dollar and tonnage growth closely.

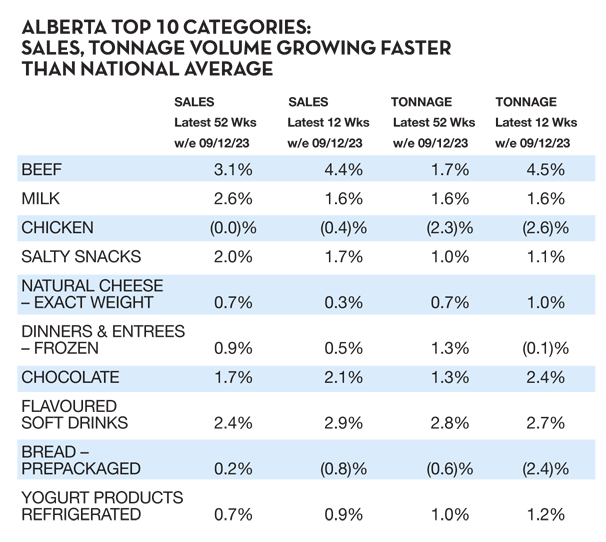

Over the past 52 weeks, the top 20 categories nationally have all seen growth in dollar sales, while tonnage has declined in 13 of the top 20, and only three (Yogurt, Eggs, and Pork) saw volume increases greater than 1%. The good news is that in the latest 12 weeks, we’ve seen volume increases in 12 of the top 20 categories, with 8 growing more than 1%, while Beef, Salty Snacks, Chocolate, and Face Care declined. Is the story the same across the country and regions? No, and one market to keep a close eye on is Alberta. With immigration fueling our population growth, we know that Alberta has become a destination with more affordable housing. It could be why we’re seeing strong dollar and tonnage growth versus the national average.

In the latest 52 and 12 weeks, Alberta is growing faster in dollar and tonnage volume versus the national average. More importantly, tonnage volume has grown in 14 of the top 20 categories, while three-quarters have remained or improved, and four categories (chicken, pre-packaged bread, face care, and luncheon meats) have lost volume. If the trend continues, it’s important to start understanding the consumer cohorts in this province, what’s leading to higher increases in volume sales, and how much is being fueled through population growth.

The one noticeable category whose tonnage volume has picked up in the latest 12 weeks nationally, at +3.5% versus flat in the latest 52 weeks, is chicken. Quebec is the main province driving sales and volume increases, where dollar growth in the latest 12 weeks was two times the national average at +10% and volume was almost three times at +9.7%. Again, who are the consumer cohorts, channels, variety, etc.? Not only is this the third largest category in dollar sales, but it is also a basket driver, so understanding who, where, and why goes beyond just the category itself.

ALBERTA TOP 10 CATEGORIES: SALES, TONNAGE VOLUME GROWING FASTER THAN NATIONAL AVERAGE

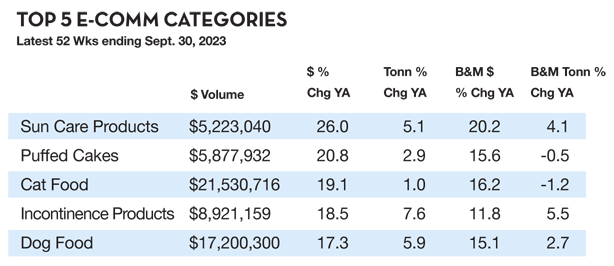

We will continue to see growth in omni-shoppers, and the overlap between bricks and mortar and online shopping will continue to increase. In our last President’s report, we showed that half of the Top 15 e-commerce categories with sales greater than $5 million were outpacing growth in bricks and mortar. We’re seeing similar trends across other categories, where e-commerce dollar volumes are smaller but online growth is outpacing bricks and mortar. It’s imperative to ensure we’re measuring our performance both online and offline to look for opportunities with brands/items that are over-indexing, and trade planning accordingly.

TOP 5 E-COMM CATEGORIES

Latest 52 Wks ending Sept. 30, 2023

Getting out and visiting stores is essential, including those in our GDM network and smaller specialty/ethnic independents. Living in the west end, I drew a four-kilometer radius from my home, and in this vicinity are Loblaws, Metro, Walmart, Farm Boy, Food Basics, No Frills, SDM, and Rexall to choose from. In addition, I have more than 14 specialty/ethnic shops. Most are high concentration of deli, fresh meats and dairy, and food items such as coffee, beverages, condiments, oils, etc. What stands out for me with the latter is that they’ve grown in numbers over the past 10 years. As I regularly visit these establishments, especially on weekends, the early mid-morning to early afternoon line-ups cannot be ignored. In most cases, the deli, cheese, and fresh meat counters are busier than my local grocery store during the same time periods.

In the past, I would have said it’s the product selection and ethnic makeup, but that’s not the case today. From Central Europe, the Middle East, and Asia, the diversity in shoppers is noticeable, and it’s fueled by selection, service, and price. I’d encourage anyone in our industry to take more time to visit and observe these stores.

So, as we enter 2024, let’s remain focused on our shoppers – observe, listen, and leverage insights and solutions to help win with them!

Source: grocerybusiness.ca