From pot to plant-based food: Bruce Linton talks about his newest venture

Why is Bruce Linton getting into plant-based food?

“Well, I would say marijuana, and your assumption would be that I’ve got the munchies,” said Linton with a laugh.

As the founder and former co-CEO of Canopy Growth, one of the world’s largest cannabis companies, it could be reasonable to assume that anything Linton does goes back to marijuana. As Canopy Growth grew, it caught the attention of alcohol seller Constellation Brands, which purchased a more than $4 billion stake in 2017 and 2018 — and then fired Linton in 2019 when the company posted a wider-than-expected net loss.

In March 2020, he launched Collective Growth, a $150 million special-purchase acquisition company, with the intent of using it to bring a hemp company public. Hemp, which is in the cannabis family but doesn’t have the psychoactive chemical THC, became legal for cultivation in the United States in 2018. The market for that plant, which contains the popular relaxation and pain relief chemical CBD, is very open. The deal didn’t work out as planned, since many of the startup companies using hemp for purposes other than CBD extraction didn’t have the revenues or financial data to qualify for a SPAC deal. Collective Growth’s funds went to an Israel-based self-driving car sensor company. But Linton learned a lot about the hemp space, and began to build a passion for it — and its potential.

Hemp is not only a sustainable and easy-to-grow crop that enriches the soil it’s planted in, Linton said. It’s also an underappreciated plant protein for human consumption. Pursuing this idea led Linton to Lionel Kambeitz, executive chairman of Canadian plant-based company Above Food. Kambeitz has a large farm and the same kind of passion for plant-based food that Linton is known for having about any project he gets involved in.

“Through a conversation with him, I could tell that he was fully engaged in the process of massively disrupting the current best practices for what we call plant-based food,” Linton said. “That is a welcoming call to me. So it was that path, arriving at that person, that said, ‘Yes, I want to do this.’ “

Linton recently became the chairperson of Above Food’s Above Innovation Advisory Council, which is tasked with driving organic growth and strategic acquisitions for the company. Linton, who calls this group the “Above the Bottom Line Advisory Council,” sees his job as thinking about the future and helping Above Food own the ingredients and processes that will create revolutionary plant-based items.

Above Food is an established company that has mainly been in the B2B space, creating plant protein products from heirloom pulses and gluten-free grains. Linton said it will be getting into the consumer space later this year, with new plant-based products that are both tasty and sustainable.

“I think this is a very ambitious platform which has a long history, and now is the rocket ship is lifting off,” Linton said.

Products never dreamed as possible

While Linton is new to the plant-based food space, he’s full of ideas and enthusiasm about its potential. He talked quickly about several ingredient providers, technologies and potential acquisitions that could help Above Food meet its potential.

One thing Linton is looking for is “intellectual property components that process ingredients in ways that are not currently known, which allows you to actually make products that people couldn’t have dreamed of because [they] didn’t have the ingredients.”

Above Food is actively making these new acquisitions, with a share purchase agreement of Farmer Direct Organic Foods (FDO) announced last week. Financial details were not disclosed. Canada-based FDO, founded in 2018, has a product portfolio of legumes, grains and hemp and a comprehensive regenerative organic supply chain that is fully traceable. FDO co-founder and CEO Jason Greeman will continue to lead the company and become Above Food’s director of organic supply.

There is great untapped potential in many ingredients — hemp especially, Linton said. There are also many opportunities to create new plant-based products to improve consumers’ health, sustainability as a whole, and create second-to-none culinary experiences.

KF Kambeitz Farms in Saskatchewan, Canada, produces ingredients for Above Food’s products.

Permission granted by Above Food

Linton wants Above Food to be able to do what Just Egg has done: Create a plant-based product with a good taste and function that consumers could like even better than the traditional animal product. The mung bean-based egg substitute from Eat Just is a favorite of Linton’s, but he said there are some things about the product behind the scenes that he wishes could be better. For example, Eat Just imports the mung bean protein from Africa and Asia because the legume does not grow well in North America.

Because locally grown ingredients don’t have to travel as far and the supply chain is shorter, Linton said they have a smaller environmental footprint. Above Food has the advantage of controlling large amounts of farm land in Canada that can produce a diverse array of crops — especially hemp. Above Food has the ingredients, the processing and the manufacturing products all in the same area, which gives it a short supply chain, he said.

“I see ‘the country as your kitchen’ as a message people actually want to hear, understand and will adopt, and it hasn’t been broadcast anywhere and pushed,” Linton said. “I think with Above, we’re actually going to be able to deliver that and give you fantastically interesting food that would otherwise come from around the world. …I think it’s a ready-to-be-had novel positioning, which will have others on the back foot.”

Linton said Above Food is ready to slide into the plant-based meat space and become a major player. While he couldn’t talk about the new products under development, Linton said “we’re not trying to knock somebody’s space out” with the exact same product. He mentioned the company had prototypes of sausages, as well as plans to create plant-based products to replace overfished items from the ocean.

While it’s a challenge to make plant-based ingredients look and taste like animal products, Linton said the biggest issue can be texture. And Above Food is ready to mirror that. He mentioned how a high-quality fresh shrimp has a distinct snap when bitten it that is difficult to replicate.

“And so that whole tensioning of the inputs, there’s a bunch of methods that, when you take the ingredients that we control, put them through a processing process that we control … you get that snap, [that] pull you get with the right, fresh shrimp,” he said. “Show me anybody else who’s doing that.”

How to build the next big thing

A decade ago, Linton’s recent career path wouldn’t have made much sense. Cannabis was widely seen as an illicit drug and the term “plant-based” wasn’t really associated with food. Consumers who didn’t want to eat meat would have natural whole proteins — including vegetables, nuts or legumes — or perhaps tofu or a veggie burger.

“I would say there’s a negative bias in a lot of people’s minds about plant-based food. When I was a kid, the only thing you could get that was plant-based food that wasn’t just a plant was awful. …It didn’t start off well, but I can’t believe how rapidly it’s changing — and better products are just gonna keep changing it faster. There’s a negative bias you’ll overcome.”

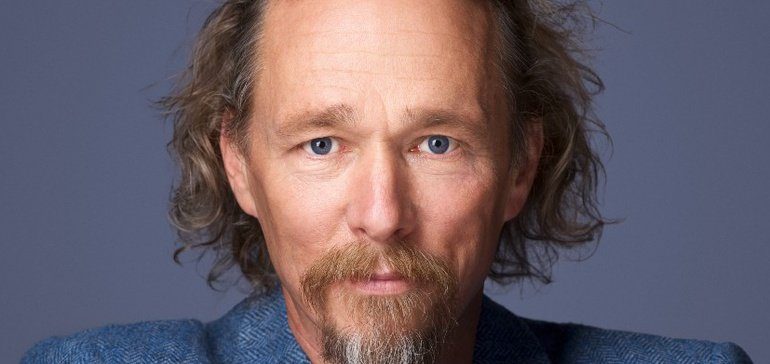

Bruce Linton

Chairperson, Above Food Innovation Advisory Council

Since then, both have become major trends and multimillion-dollar industries. But the similarities go beyond that, Linton said: Both are industries that can reach their potential with a shift in public perception and policies. Adding a federal incentive for farmers to grow hemp, for example, could truly jumpstart the perception of the plant and its ability to be made into food, he said.

“No one can make any capital return in cannabis or plant-based foods if you don’t see those things happen,” Linton said. “And there’s a natural negative. A whole bunch of people, including Big Alcohol and Big Pharma and others would love to say that no one wants cannabis. Well, no. What they didn’t want is breaking laws and they didn’t want uncertainty, but they’re happy to buy it when it’s regulated.

“I would say there’s a negative bias in a lot of people’s minds about plant-based food,” Linton continued. “When I was a kid, the only thing you could get that was plant-based food that wasn’t just a plant was awful. … It didn’t start off well, but I can’t believe how rapidly it’s changing — and better products are just gonna keep changing it faster. There’s a negative bias you’ll overcome.”

When Linton founded Canopy Growth, he saw an opportunity to bring many smaller entities in the cannabis space into one larger company. He took the cannabis business from “a really bad idea, where nobody would actually work on it with me for the first month — including my brother” to a leader in a multibillion-dollar enterprise. At Canopy Growth, Linton said he took 31 different companies in the space of six years and structured them into a publicly traded company with a $25 billion market cap. Part of Canopy’s success was pulling together several different pieces of the whole business in order to make it work. Linton wants to bring that to plant-based food.

“I think that the only way that we can make this into a billion-then-multibillion-dollar enterprise and have real meaningful market share is that we need to find the best pieces of science and art and put them together,” Linton said. “…And then you have to make sure that when you bring those people together, they’re aligned in how the culture of the place works, the measurement of intensity, and you accelerate like crazy.”