Grocery shoppers got a potential sign of relief as the October Consumer Price Index (CPI) food price inflation hikes in the didn’t translate into much relief for grocery shoppers.

Month-to-month, the October CPI for All Urban Consumers rose 0.4% (seasonally adjusted), the same as in September, the U.S. Bureau of Labor Statistics (BLS) reported Thursday. Except for flat growth in July, the October growth followed upticks of 0.1% uptick in August, 1.3% in June, 1% in May, 0.3% in April, 1.2% in March, 0.8% in February and 0.6% in January.

On a year-over-year basis, the October CPI climbed 7.7% (unadjusted), down from a 12-month increase of 8.2% in September. The decrease marked the lowest annual gain since a 7.5% rise for January, compared with year-to-year growth of 8.3% for August, 8.5% for July, 9.1% for June, 8.6% for May, 8.3% for April, 8.5% for March and 7.9% for February.

The food CPI — including food-at-home and food-away-from-home — dipped to a 0.6% month-over-month uptick in October from 0.8% in September as well as August, according to BLS. The food index remains down from monthly increases of 1.1% in July, 1% in June, 1.2% in May, 0.9% in April, 1% in March, 1% in February, and 0.9% in January.

Likewise, over 12 months, growth in the food CPI fell to 10.9% in October from 11.2% in September and 11.4% in August. The annual gain hadn’t been that low since a 10.9% increase in July, which was higher than increases of 10.4% in June, 10.1% in May, 9.4% in April, 8.8% in March, 7.9% in February and 7% in January.

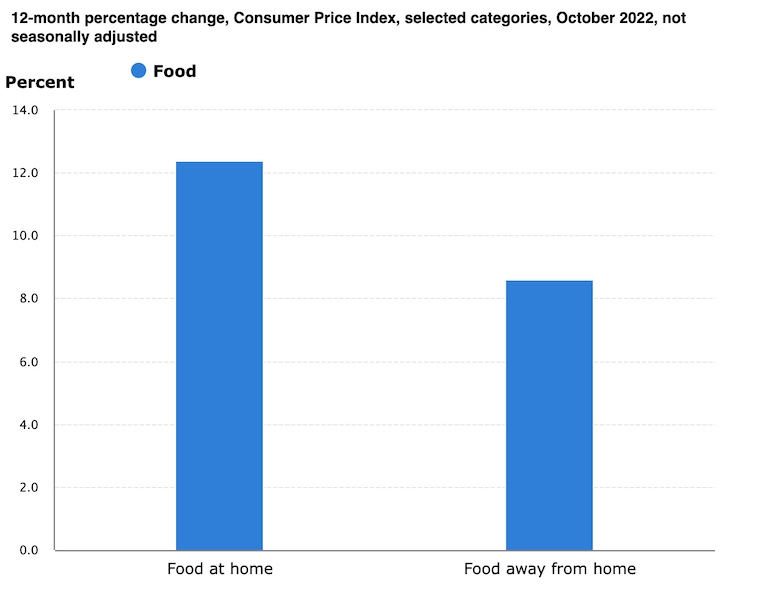

The food-at-home CPI for October showed a 12.4% year-over-year increase, indicating still-high grocery inflation but a decrease from 13% in September, 13.5% in August and 13.1% in July. The October and September numbers also signaled the end of rising 12-month gains since the beginning of the year, as the food-at-home index rose 12.2% for June, 11.9% for May, 10.8% for April, 10% for March, 8.6% for February and 7.4% for January.

Sequentially, the food-at-home CPI edged up 0.4% for October — the smallest monthly increase since December 2021 (0.4%) — and down from 0.7% in September and August, when the monthly gain was the first below 1% since April. That compared with hikes of 1.3% in July, 1% in June, 1.4% in May, 0.9% in April, 1.5% in March, 1.4% in February and 1% in January.

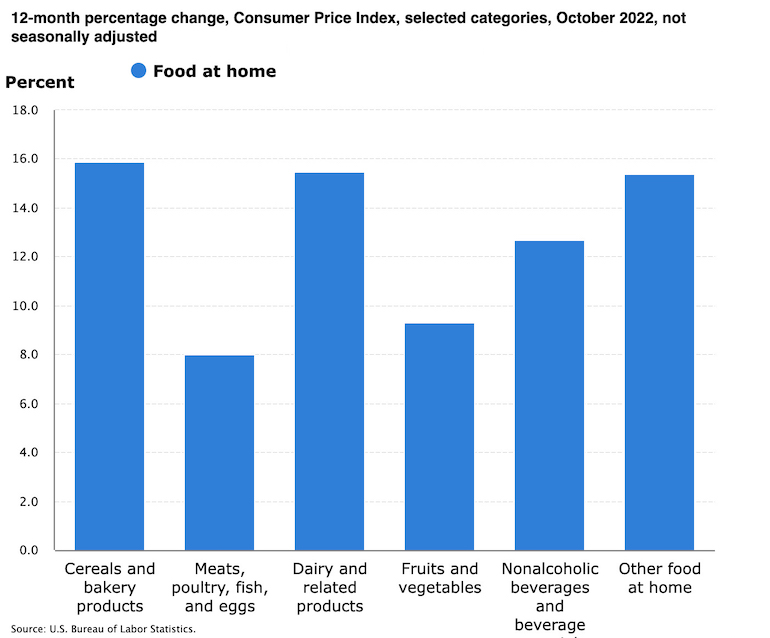

Four of six major grocery store food group indices for food-at-home gained on a monthly basis in October. The cereals and bakery products index rose 0.8%, and the meat, poultry, fish and eggs index was up 0.6%. Also increasing were non-alcoholic beverages (+0.5%) and other food at home (+0.9%). Indices experiencing decreases were fruit and vegetables (-0.9%) and dairy and related products (-0.1%).

All six food-at-home food groups remained up in October on an annual basis. The steepest 12-month price hikes came from cereals and bakery products (+15.9%), dairy and related products (+15.5%) and other food at home (+15.4%). Those percentages compared with +9.3% for fruit and vegetables and +8% for meat, poultry, fish and eggs.

The food-away-from-home index again held firm on a monthly basis in October, up 0.9%, the same as in September and August, according to BLS. Yet the 12-month uptick for food-away-from-home was 8.6% in October, up from 8.5% in September and 8% in August.

Excluding food and energy, the October CPI rose by 6.3% from a year ago and by 0.3% from a month ago, down from 6.6% year over year and 0.6% month to month in September.

Energy costs remain the top factor behind elevated inflation, up 17.6% year over year and 1.8% month over month in October, compared with an annual gain of 19.8% and a monthly decline of 2.1% in September. Gas and fuel oil prices surged 17.5% and 68.5%, respectively, for the 12 months through October versus respective hikes of 18.2% and 58.1% in September. Month over month, prices were up 4% for gas and 19.8% for fuel oil in October.

“The October CPI further illuminates the challenge that Americans have faced for months. The cost of consumer goods continues to rise, adding pressure on budgets across the country. Grocery stores — and the entire food industry — are doing all they can to ensure Americans have options to stay within their grocery budget and remain committed to working with their customers to help mitigate the impacts of inflation,” Andy Harig, vice president of tax, trade, sustainability and policy development at FMI-The Food Industry Association, said in an emailed comment.

“Today’s numbers make it clear that this is still a difficult time for consumers,” Harig noted. “While myriad factors influence food prices, the food industry is collaborating throughout the entire supply chain to keep costs low for consumers.”

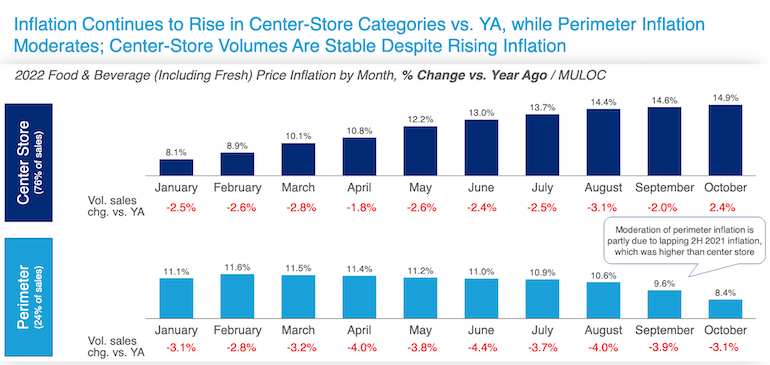

In its October 2022 Price Check report, CPG market researcher IRI pointed out that inflation varies across the store. Perimeter departments, including produce and deli, have seen inflation moderate to 8.4% year over year, whereas in center-store segments — including snacks, frozen meals and other frozen foods — inflation has climbed monthly this year and is now up 14.9% from a year ago.

IRI said the fresh meat and seafood and alcohol categories are up just 4.5% and 5.5%, respectively, versus the prior year compared with big increases in such segments as dairy (+21.3%) and frozen meals and other frozen foods (+18.4%).

Meanwhile, shoppers are reining in purchases of some food and beverage segments due to elevated prices. Volumes are down more than 10% in categories such as frozen poultry (-15.5%), deli service lunchmeat (-11.4%), frozen dinners (-10.9%) and shelf-stable dinners (-10.8%) due to hefty price increases, IRI reported.

“As overall food inflation continued to increase from September, consumers are trading down on several products, such as detergents and frozen meals, and are moving to value items,” according to Krishnakumar (KK) Davey, president of thought leadership for CPG and retail and IRI and NPD. “With the holidays approaching, shoppers are being mindful of their budgets and are looking for value. Yet we do see some segments of consumers continuing to pay a premium for differentiated or new products. Some shoppers buy larger packs, despite higher prices, in order to get good value for money.”