Grocery and restaurants were among U.S. retail sectors generating double-digit, year-over-year sales growth in May, according to Mastercard SpendingPulse.

Grocery sales rose by 13.8% and restaurant sales by 17.5% for the 12 months through May, Purchase, N.Y.-based MasterCard said Tuesday. Both retail segments also registered big increases over a three-year span, from the pre-pandemic period in May 2019 to May 2022, with grocery sales surging by 30.2% and restaurants by 26.7%. Mastercard SpendingPulse measures in-store and online retail sales across all forms of payment, not adjusted for inflation.

Total U.S. retail sales (excluding automotive) climbed 10.5% year over year for May and were up 21.4% from May 2019, outpacing year-over-year monthly growth thus far in 2022, according to Mastercard SpendingPulse. In-store sales were a key driver, up 13.7% from pre-pandemic levels.

Total U.S. retail sales (excluding automotive) climbed 10.5% year over year for May and were up 21.4% from May 2019, outpacing year-over-year monthly growth thus far in 2022, according to Mastercard SpendingPulse. In-store sales were a key driver, up 13.7% from pre-pandemic levels.

“The continued retail sales momentum in May aligns with the sustained growth rates we’ve seen so far this year,” Michelle Meyer, U.S. chief economist for the Mastercard Economics Institute, said in a statement. “The consumer has been resilient, spending on goods and increasingly services as the economy continues to rebalance. That said, headwinds have become stronger, including gains in prices for necessities like gas and food, as well as higher interest rates.”

Besides grocery and restaurants, other segments saw significant year-over-year (YOY) and three-year (YO3Y) growth. Apparel sales rose 17.4% YOY and 26.4% YO3Y; department stores 12.% YOY and 16.7% YO3Y; electronics and appliances 5.9% YOY and 21.9% YO3Y; fuel and convenience 19.9% YOY and 31.4% YO3Y; jewelry 22.3% YOY and 65.4% YO3Y; and luxury (excluding jewelry) 20.2% YOY and 52.9% YO3Y.

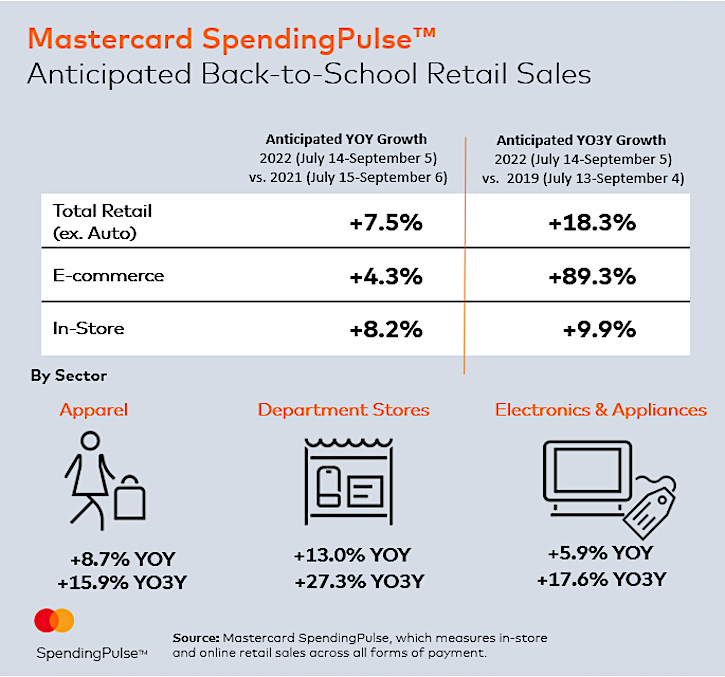

Just around the corner is retail’s critical mid-July through Labor Day back-to-school selling season, for which Mastercard SpendingPulse forecasts U.S. retail sales to grow 7.5% (excluding automotive) from the 2021 period. Sales are projected to rise 18.3% compared with pre-pandemic 2019, with department stores expected to maintain the segment’s recent rebound.

This back-to-school season will be defined by the resilience and flexibility of the consumer, noted Mastercard, which expects the following back-to-school retail trends:

• The In-Store Experience: Shopping for back-to-school becomes an experience of its own, from trying on new sizes to browsing the latest fashions in person. The return to stores is expected to grow 8.2% year-over-year and 9.9% since 2019.

• Department stores continue rebound: After a multi-year decline, department stores have made their way into the spotlight after 15 consecutive months of sustained growth. Mastercard anticipates the back-to-school season will drive the one-stop-shop sector up 13% YOY and 27.3% YO3Y.

• Stacked social calendars drive apparel growth: With weddings, events and vacations already lined up many consumers, the demand for apparel both in-store and online isn’t likely to slow, as Mastercard forecasts sales upticks of 8.7% YOY and 15.9% YO3Y.

“Back-to-school is the second-biggest season for retailers and is often looked at as an early indicator of retail momentum ahead of the traditional holiday season,” according to Steve Sadove, senior adviser for Mastercard and former CEO and chairman of Saks Inc. “While Mastercard SpendingPulse anticipates growth across sectors, retailers will need to find innovative ways to entice shoppers as discretionary spending potentially stretches thin as a result of increasing prices.”