Year-over-year U.S. retail sales growth relaxed for September but maintained a recent sequential trend of flat to slight growth, with grocery stores following a similar trajectory.

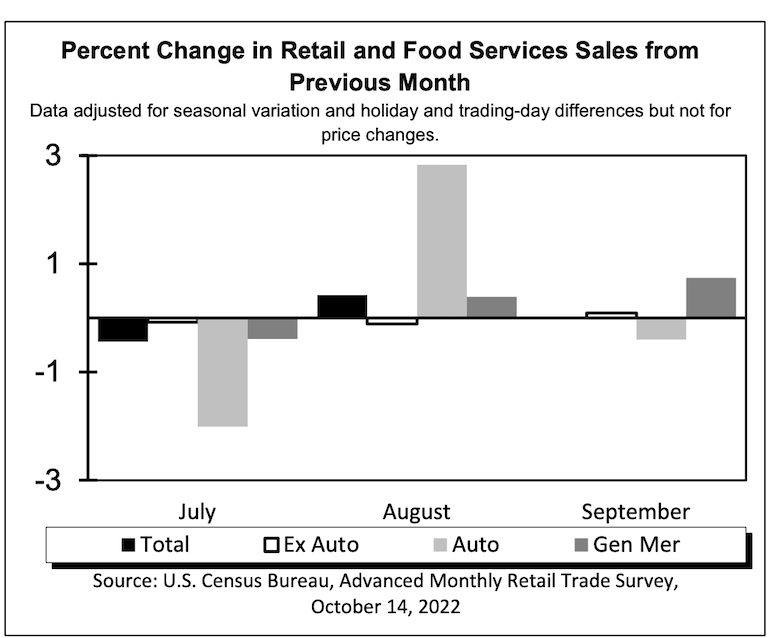

September retail and foodservice sales came in at $683.97 billion (seasonally adjusted), flat from August but up 8.2% from September 2021, the U.S. Census Bureau reported in advance estimates on Friday. Retail trade sales for September — excluding motor vehicles and parts stores, gas and repair stations — dipped 0.1% month over month to $596.75 billion but gained 7.8% year over year.

In August, total retail sales edged up 0.3% month to month but increased 9.1% from a year earlier. Retail trade sales for the month reflected a similar trend, inching up 0.2% to $611.19 billion but rising 8.9% year over year.

“Retail sales surprised to the downside, with retail and food services sales flat in September,” observed Scott Brave, head of economic analytics at data intelligence firm Morning Consult. “Keep in mind that these data are not adjusted for inflation, so once we factor in yesterday’s CPI print [for September], they suggest real spending actually declined in September.”

Grocery store retail sales for September rose 0.4% month to month to $71.17 billion (seasonally adjusted), exceeding the 0.2% sequential gain in August and climbing 6.8% from September 2021, compared with a 9.1% year-over-year gain in August. The Census Bureau reported that sales at all food and beverage stores in August were up 0.4% sequentially and 6.4% over 12 months to $79.49 billion, versus increases of 0.5% month over month and 7.2% year over year in August.

For the year to date through September, food and beverage store sales were up 7.7% year over year to $695.5 billion (unadjusted). That included 8.4% growth to $624.73 billion at grocery stores over the nine-month period.

“Retail performance stayed steady in September, as prices continued to increase and the Federal Reserve implemented higher interest rates to combat inflation. Food and beverage rose 0.4% in September. Gainers also include general merchandise, health and personal care and clothing stores, showing indication that consumers remain bullish and are focusing on necessities,” reported Naveen Jaggi, president of retail advisory services at commercial real estate firm Jones Lang LaSalle (JLL).

“However, retail foot traffic fell last month across the board, according to Placer.ai,” he noted. “We expect this to pick back up as we enter the holiday shopping season. Consumers will continue to pay attention to discounts more than they typically would through the end of this year.”

For the year to date through September, grocery store sales were up 8.4% year over year to $624.73 billion.

Indeed, shoppers have begun watching their dollars as they ready for more and bigger purchases in the approaching holiday retail sales season.

“Today’s retail sales report showing no change in sales from last month reflects consumers’ pull back on spending given ongoing high inflation,” commented Claire Tassin, retail and e-commerce analyst at Morning Consult. “Consumers are limiting their own regular spending and seeking out deals and discounts as we head into the expensive holiday season.”

The National Retail Federation said September retail sales (unadjusted) rose 0.3% month to month and 8.2% year over year, compared with gains of 0.1% sequentially and 8% annually for August. Washington-based NRF’s estimate focuses on core retail, excluding automobile dealers, gas stations and restaurants.

“Consumer demand remained intact during September and continues to be a key contributor to economic activity. But sales were uneven across retail categories and inflation is the main factor that is determining how much shoppers are willing to spend,” NRF Chief Economist Jack Kleinhenz said in a statement. “Households are tapping into savings, accessing credit and reducing their savings contributions as they meet higher prices head on. Shoppers are looking for bargains and value in the current economic environment and even more so as we head into the holiday season.”

September sales advanced in five of nine retail categories on a monthly basis (led by general merchandise stores, apparel/accessories stores, health/personal care stores, online/non-store retailers and grocery/beverage stores) and in eight of nine categories on an annual basis (with electronics/appliances stores posting the only decrease), NRF reported.

Grocery and beverage stores posted sales gains of 0.4% month to month seasonally adjusted in September and 6.7% unadjusted over 12 months. Among other retail categories in the food, drug and mass channel, sales edged up by 0.7% month over month seasonally adjusted and by 4.8% unadjusted year over year for general merchandise stores in September, while health and personal care stores (including drugstores) saw sales rise 0.5% month over month seasonally adjusted and 4.6% unadjusted year over year, NRF said.

“September retail sales confirm that even with rising interest rates, persistent inflation, political uncertainty and volatile global markets, consumers are spending for household priorities,” NRF President and CEO Matthew Shay commented. “As we enter the holiday season, shoppers are increasingly seeking deals and discounts to make their dollars stretch, and retailers are already meeting this demand.”