Supermarkets again ranked high in pharmacy customer satisfaction — with H-E-B earning the top overall score — in the J.D. Power 2022 U.S. Pharmacy Study.

The annual survey, released Thursday, polled 12,142 customers who filled or refilled a prescription in the previous 12 months. To assess pharmacy customer satisfaction, J.D. Power examines areas such as prescription ordering and filling, cost competitiveness, pharmacists, non-pharmacist staff, prescription pickup, the store and prescription delivery at chain drug, supermarket, mass merchant and mail-order pharmacies and rates them on a 1,000-point scale.

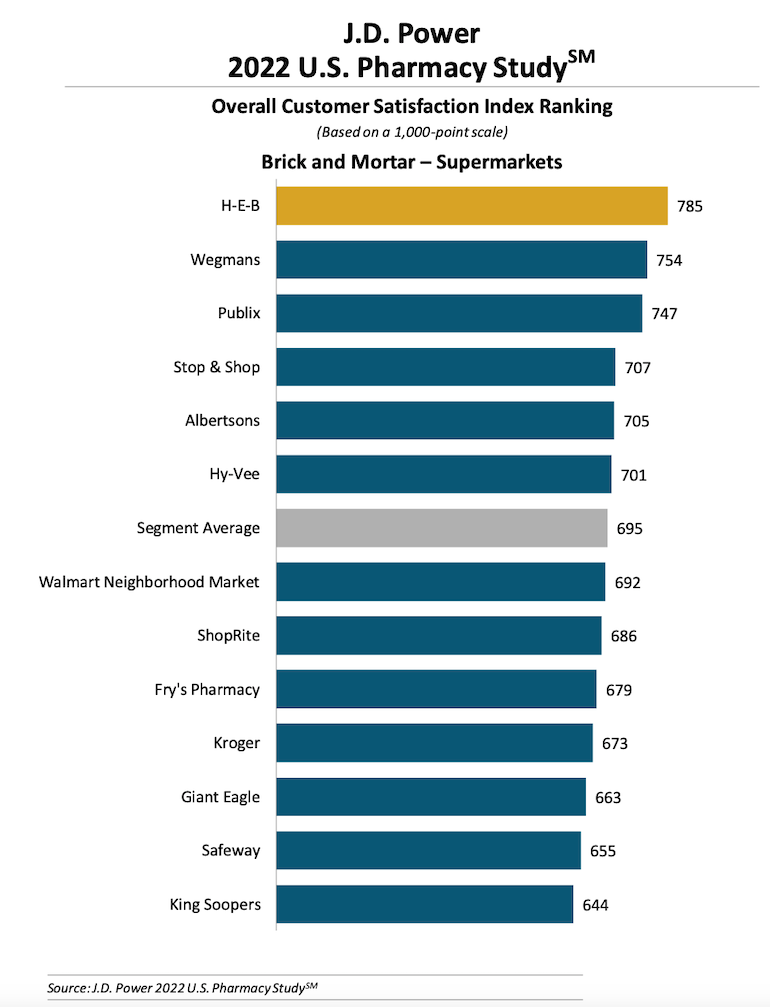

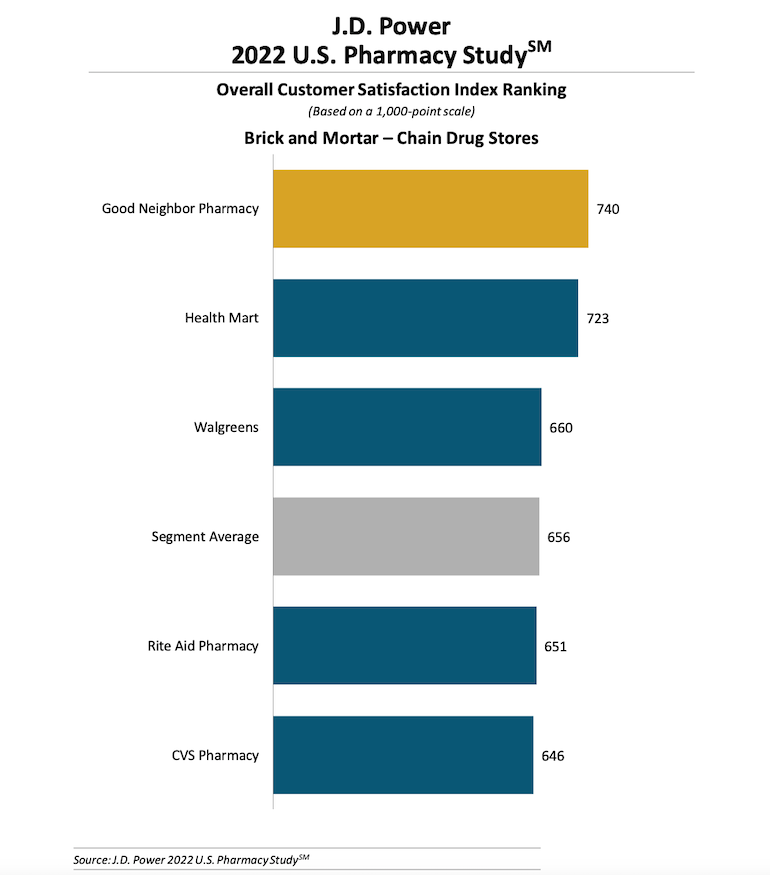

For the second straight year, Texas grocer H-E-B came in No. 1 in the supermarket category with a pharmacy customer satisfaction score of 785. That rating also toppled last year’s overall winner, independent drugstore network Good Neighbor Pharmacy (part of AmerisourceBergen), which recorded a score of 740 in the 2022 study. Rounding out the top five overall scores after H-E-B this year were Sam’s Club (759), Wegmans Food Markets (754), Costco Wholesale (749) and Publix Super Markets (747).

J.D. Power’s 2022 study again showed supermarkets being edged out by mass retailers in the highest satisfaction rating by segment. Mass merchants posted an average segment score of 700, just above supermarkets at 695 and higher than last year’s top scorer mail-order pharmacies at 675 and chain drug stores at 656.

Also making the top 10 in customer satisfaction with brick-and-mortar pharmacies were Good Neighbor (740), McKesson’s Health Mart (723), CVS Pharmacy at Target (713), Stop & Shop (707) and Albertsons Cos. (705).

Like last year, supermarket chains represented five of the top 10 brick-and-mortar players. Other grocery store banners rated this year by J.D. Power were Hy-Vee (701), Walmart Neighborhood Market (692), ShopRite (686), Fry’s (679), Kroger (673), Giant Eagle (663), Safeway (655) and King Soopers (644).

Walmart, the third-largest U.S. pharmacy retailer, again received a below-average score (667) in the mass merchant pharmacy category, with its Sam’s Club subsidiary and Costco coming in well above the segment’s mean score of 700, which also was topped by CVS at Target.

Kaiser Permanente Pharmacy finished first in the mail-order segment with a score of 734, followed by CenterWell (formerly Humana Pharmacy) at 699, UnitedHealth’s OptumRx at 694, Walgreens Boots Alliance’s AllianceRx Walgreens Prime service at 661, Cigna’s Express Scripts at 660, Walmart Pharmacy Mail Services at 660 and CVS Caremark at 651.

Troy, Mich.-based consumer and brand market researcher J.D. Power noted that the 2022 U.S. Pharmacy Study’s findings show U.S. consumers as “very comfortable with” receiving health care services beyond prescriptions at retail pharmacies — especially after the administration of more than 258.1 million total doses of the COVID-19 vaccine and approximately 40 million flu vaccinations seasonally.

According to Christopher Lis, managing director of global health care intelligence at J.D. Power, health and wellness services — on top of current medication management program — may be the key to retail pharmacy industry growth, namely amid increasing competition from online retailers like Amazon.

J.D. Power said 66% of brick-and-mortar pharmacy customers now have an Amazon Prime account, and 48% are aware of pharmacy services offered by Amazon. In addition, 14% of those aware of Amazon’s pharmacy offerings have used its Pill Pack service, filled via Amazon Pharmacy. And of that group, 38% reported that they “definitely will” switch pharmacies in the next 12 months.

“Customers are beginning to embrace their retail pharmacy as a hub for a broad range of routine health and wellness services,” Lis explained. “This transformation is happening simultaneously with rising competition from online retailers such as Amazon, which is raising the stakes for local retail pharmacies. This is an opportunity for more retail pharmacies to innovate as a one-stop shop for routine care and to leverage data and technology to create an increasingly personalized customer experience.”

San Antonio-based H-E-B, for one, has already been evolving its health care offering. The company recently opened several new H-E-B Wellness Primary Care clinics — providing basic care plus services such as physical therapy, health/nutrition coaching, clinical pharmacy, specialty referrals and lab testing — and said it plans to “rapidly expand” its clinic operation across Texas.

Among customers interested in receiving basic health care services at their pharmacy, 33% cited vision and hearing services and 27% named physical exams and routine lab tests, the J.D. Power study found. What’s more, the research indicated that health and wellness service usage correlates with higher loyalty and brand advocacy. On average, 52% of customers who rely on their pharmacies for these services said they won’t switch pharmacies, compared with 45% of those who haven’t used their pharmacy’s health and wellness services. Net Promoter Scores, too, are 14 points higher at pharmacies when customers use health and wellness services.

Mobile app use may mark another competitive battleground on the prescriptions front, J.D. Power added. Among brick-and-mortar customers who use their pharmacy’s mobile app, 59% do so to manage prescription refills and 57% to view prescriptions. Overall satisfaction among those who have used their pharmacy’s mobile app six or more times in the past 12 months rated at 715 on the 1,000-point scale, 32 points higher than those who used the app up to five times. The poll also found that frequent app users are less likely to say they will switch pharmacy providers.

J.D. Power noted that the U.S. Pharmacy Study, now in its 14th year, was redesigned for 2022, with survey respondents having filled a prescription within the past 12 months versus within the past three months in the previous studies. Scores also came in noticeably lower for 2022, compared with 2021 segment averages of 863 for supermarkets (versus 695 this year), 866 for mass merchants (vs. 700 this year), 856 for chain drugstores (vs. 656 this year) and 877 for mail order (vs. 675 this year).