Hershey to buy low-sugar confectionery brand Lily’s

Dive Brief:

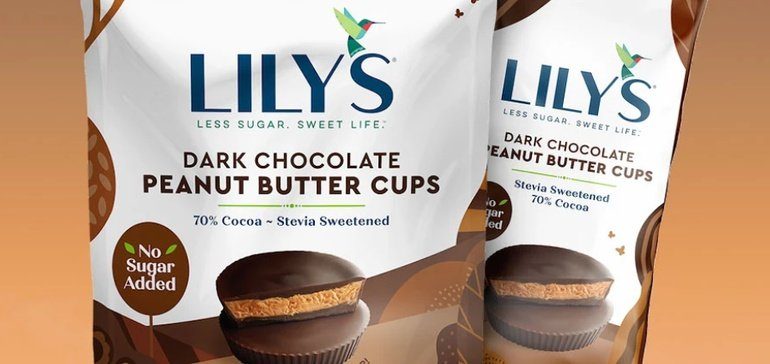

- Hershey is buying Lily’s, a fast-growing, better-for-you confectionery brand whose low-sugar products include dark and milk chocolate style bars, baking chips and peanut butter cups.

- The maker of Kisses, Milk Duds, SkinnyPop and other treats said the purchase will help it expand its healthier confectionery portfolio, which has been a major focus. The cost of the transaction, which is expected to close in the next few months, was not disclosed.

- As consumer tastes evolve, the 127-year-old Hershey is not only looking outside the company for acquisitions but also innovating its core brands through low- or no-sugar, organic and bite-size offerings.

Dive Insight:

Many consumers will want to continue to indulge with a sweet treat from candymakers such as Hershey or Mars. But increasingly many large food companies are realizing that giving shoppers more choice is paramount — in particular with treats that have a better-for-you halo.

Only 6% of candy, mint and gum sales or about $1.3 billion per year come from products defined as better-for-you, according to IRI data cited by Hershey. Kristen Riggs, Hershey’s chief growth officer, told Food Dive in February if that share rose to as high as 20%, putting it closer to the average found in other snacking categories, sales of better-for-you confections could surge to more than $4 billion.

For Hershey, which posted $8.1 billion in sales in 2020, it could provide an opportunity to boost its annual revenue anywhere between $500 million and $1 billion, she said.

“We are really putting a big bet in growth in the better-for-you area,” Riggs said at the time. “If we want to participate in that growth then we need to have more solutions.”

For years, Hershey’s efforts to expand its reach in better-for-you sales have focused on portion-controlled sizes. But recently, the company has done more to expand its portfolio to deliver more reduced sugar, organic and plant-based alternatives. The purchase of Lily’s and the rollout of Organic Reese’s Peanut Butter Cups earlier this year are two examples that build on the company’s multiprong strategy. Hershey also has put more weight behind its no-sugar line with a rebranding and new packaging.

In 2012, Lily’s launched chocolate-style bars nationally in Whole Foods, and today its expanded line of bars, baking chips and other confections can be found across the country at key retailers. The purchase by Hershey will allow Lily’s to tap into the the confectionary giant’s ingredient sourcing, marketing, innovation and retail partnerships. This will allow Lily’s to grow its product offerings, cut costs and make its way into more stores.

For its part, the acquisition not only gives Hershey another product that consumers can choose when they want to snack, but also a startup it could potentially learn from as it innovates many of its other iconic brands.

Most of Hershey’s M&A under CEO Michele Buck has been in acquiring healthier snacks. Since Buck took over in 2017, Hershey purchased fast-growing SkinnyPop popcorn — the largest deal in the company’s history — protein-bar maker One Brands and Pirate Brands, the manufacturer of better-for-you snacks like Pirate’s Booty. In October, Hershey invested an undisclosed amount in Quinn, a natural foods snack manufacturer.

But Buck, whose goal has been to turn Hershey into a snacking powerhouse, has said she wouldn’t rule out buying more confections that are premium or help fill in a hole in the company’s portfolio. As Hershey broadens its reach to provide more sweets and snacks for more occasions, acquisitions targeting smaller companies like Lily’s are likely to be a key part of its growth strategy.