Hot feedgrain market likely to soon ease: analyst

The burning question in the barley market and grain markets in general is — was China’s 2020-21 spending spree the start of a new trend or a one-off?

Chuck Penner, analyst with LeftField Commodity Research, believes it is the latter.

The country suddenly went from importing 12 to 18 million tonnes of grain per year to purchasing an estimated 28 million tonnes in the current crop year.

Some analysts believe that volume of corn, barley, wheat and sorghum was needed to feed China’s rapidly rebuilding hog herd.

But Penner told delegates attending a recent market outlook hosted by the Alberta wheat and barley commissions that the numbers don’t add up.

There is something else at the root of the abrupt doubling of feed grain imports.

He believes China’s 2020-21 corn crop was decimated by heavy flooding in that country, despite government reports of harvesting the 17th consecutive bumper crop.

“What it seems to be is the 2020 crop in China was really hammered,” said Penner.

That is why he believes the buying spree that has continued in the first half of 2021 will subside in the second half of the year. That could result in burdensome carryout stocks of Canadian barley, pressuring prices down.

Even if China buys the same volume of Canadian barley as this year, which is estimated at 3.5 million tonnes, there will still be heavy ending stocks.

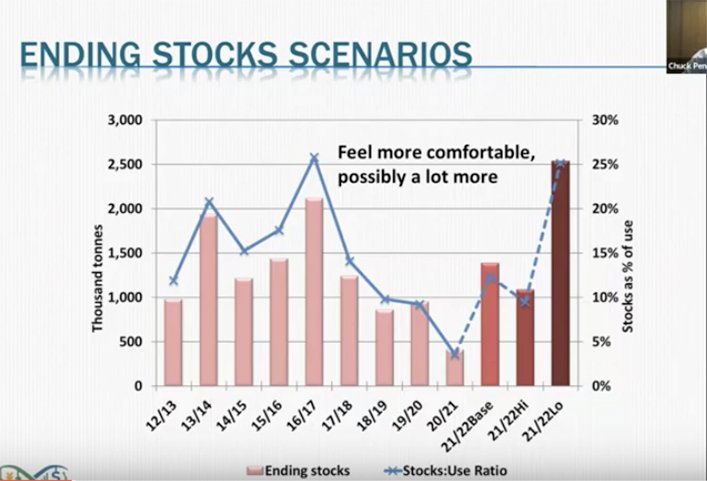

He is forecasting 1.4 million tonnes of carryout in 2021-22, up from an estimated record-low of 400,000 tonnes forecast for this year.

However, if export volumes to China revert to 2019-20 levels, ending stocks could blossom to 2.5 million tonnes resulting in a bearish 25 percent stocks-to-use ratio.

That is why Penner feels new crop barley values are fair despite being quite a bit lower than old crop values.

“I do think these new crop values are justified and are reasonable given what we know now,” he said.

The good news is that China has been buying lots of new crop barley and corn from around the world as it continues to restock supplies.

But Penner wonders what will happen in late 2021 and early 2022. He believes that is when prices could take a downward turn when Chinese buying subsides.

“I think there’s more downside risk than upside,” he said.

Canadian barley supplies are expected to increase by 1.4 million tonnes in 2021-22 despite the record small carry-in of the crop.

Production prospects also look promising in Europe and Ukraine. The only potential problem area right now is the United States, where 57 percent of the crop is in an area experiencing drought.

Canadian feed barley sales benefitted greatly from sky-high U.S. corn prices in 2020-21. Imported U.S. corn is still selling for about $50 per tonne more than Canadian barley in Lethbridge.

“Even though feed barley and feed wheat prices are at record levels, they’re still a bargain compared to corn,” said Penner.

The “elephant in the room” is the size of the 2021 U.S. corn crop. The U.S. Department of Agriculture is forecasting farmers will plant 91 million acres of the crop but some analysts think it will be as high as 97 million acres.

“That’s a big, big difference,” said Penner.

An extra six million acres of U.S. corn would more than compensate for what many analysts believe is a five million tonne over-estimation of Brazil’s crop by the USDA.

A larger-than-anticipated U.S. corn crop would drive down prices and make it more competitive with barley in the Lethbridge feed market. There are no current big weather concerns with the U.S. corn crop.

Another potential market risk for Canadian barley growers is the ongoing political dispute between China and Australia that resulted in an 80 percent import duty on Australian barley, creating increased Chinese demand for Canadian barley.

There has been no easing of those tensions but Penner said there could be a resolution in 2021-22 and that could curtail Canada’s shipments to China.

The malt premium for new crop barley is 50 cents per bushel over feed barley, which is about half of the usual amount.

Penner does not expect that to improve because there should be plenty of malt quality barley available with a 12 million tonne crop on the way.

Contact sean.pratt@producer.com

Source: producer.com