Shoppers would rather wait longer for their grocery delivery than pay more for faster service, especially in light of inflation’s impact on household budgets.

That’s a principal conclusion of new shopper behavior research from Mercatus, a Toronto-based grocery e-commerce specialist, and Brick Meets Click, a Barrington, Ill.-based strategic advisory firm, which found that many consumers simply avoid grocery delivery services because of higher costs and because they’d rather select their own produce. Specifically, customers are turned off by additional service-related costs, not the prices paid for products online.

One in five U.S. households used an online grocery delivery service during the prior month, according to the study, released Wednesday by Mercatus. Among the households that chose not to use delivery, the top two reasons were tied at 62% each between “I do not want to pay for the extra charges, fees and tips” and “I like to select my own fruits and vegetables.”

The oldest customer group, those over age 60, was significantly more concerned with picking their own produce versus younger shoppers (75% vs. 53%), while the desire to avoid paying the service-related costs was the same across all age groups. Only one in seven households (14%) cited “the products are more expensive online than in the store” as a reason for not using a delivery service.

“If you are a grocery delivery customer — especially one using a third-party marketplace — it’s understandable that you may want to find ways to pay less given inflation’s impact on purchasing power,” explained Mark Fairhurst, vice president of marketing at Mercatus. “These incremental costs, including delivery fees, shopper service charges, fuel surcharges and even a very modest tip, are some of the last things customers view during the checkout stage, and they can add $20 or more to the bill.”

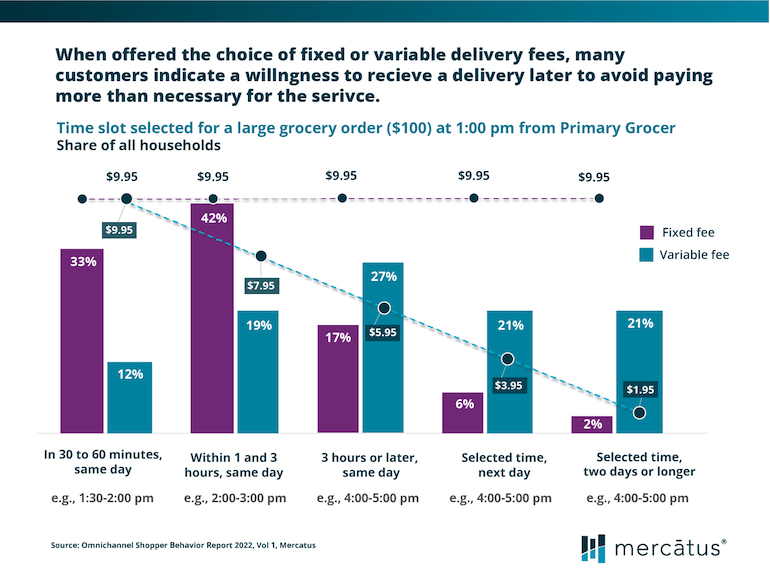

So given the choice, customers are much more likely to select a time slot later the same day, or even the next day, if that meant they could pay a lower delivery fee, Mercatus found.

When presented with a fixed fee of $9.95 for a large order (greater than $100), over 30% of customers selected to receive their order within 30 to 60 minutes, more than 40% selected to receive it within one to three hours, and fewer than 10% opted for the next day or later. However, when offered a variable fee that scaled down as the delivery time was extended, the share of shoppers that selected delivery within the 30- to 60-minute and one- to three-hour windows declined by more than half, while over 40% of customers selected to receive the order next day or longer.

“These findings reinforce the idea that customers are more sensitive to the added service costs that they can plainly see,” commented David Bishop, partner at Brick Meets Click, which focuses on how digital technology impacts food sales and marketing. “This makes sense, because accurately perceiving differences in product pricing online versus in-store, even with known value items, requires more effort on the customer’s part.”

Today, most customers only need to choose when they’d like to receive their order, as the delivery fee at that point is usually fixed. But the Mercatus/Brick Meets Click research found grocers should consider a variable fee approach based on when a customer would like to receive the order.

“Grocery customers don’t want to pay more than they must, and the explicit fees that come with online delivery are a big speed bump,” noted Sylvain Perrier, president and CEO of Mercatus. “Other aspects of this research reinforce that grocery customers shop regional grocers for different reasons than big-box mass retailers like Target or Walmart. Being more convenient is the main reason customers prefer grocery over a mass retailer, followed by the quality of the products they want to buy.”

The Mercatus omnichannel shopper behavior research was conducted by Brick Meets Click via an online survey on June 30 and July 1 with 1,847 U.S. adults. The current research, the first of a three-part series, also explored other areas of importance for regional grocers, including where households primarily shopped, how the customer demographics varied by retailer type and reasons for selecting a primary grocery store.