Microwave popcorn startup Opopop raises $5M ahead of product launch

Dive Brief:

- Microwave popcorn startup Opopop has raised $5 million in a Series A funding round led by Valor Siren Ventures ahead of its official product launch on June 7, 2021. Other investors in the round include Peter Rahal, founder of RXBAR and Litani Ventures; Batsh** Crazy Ventures; DJ and music producer Tiësto; and director Jimmy Chin. This brings Opopop’s total funding to $11.6 million.

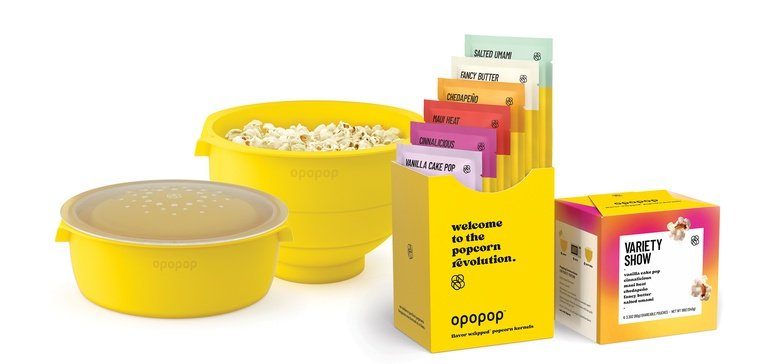

- Opopop is launching a direct-to-consumer microwavable popcorn called Flavor Wrapped Popcorn Kernels. It claims its technology wraps each kernel in flavoring before popping. The snacks will be available in six flavors: Salted Umami, Fancy Butter, Chedapeno, Maui Heat, Cinnalicious and Vanilla Cake Pop.

- The startup is launching its first product in the fast-growing popcorn category as snacking enjoys a boost during the pandemic, with consumers upping their consumption of sweet and salty items.

Dive Insight:

In its announcement on the funding round and product launch, Opopop cites the popcorn category’s 13% growth rate in 2020. At the same time, it claims there has not been any major innovation in the space since the late 1970s, and aims to be a disruptor.

“Let’s be honest, putting popcorn in a potato chip bag isn’t exactly inspiring. Popcorn lovers have had to settle for less than the best popcorn for too long. And we’re here to fix that once and for all,” said Jonas Tempel, co-founder and CEO of Opopop, in a statement. Tempel and co-founder Bradley Roulier have an entrepreneurial background in the music industry.

Popcorn has seen new interest from consumers who started upping their intake in 2018, according to research from Mintel. Between 2012 and 2017, retail popcorn sales grew 32%. The biggest growth driver in the segment has come from ready-to-eat brands and consumers’ hunger for savory and indulgent flavors including cheese, chocolate and caramel.

Opopop’s emphasis on unique flavors like Chedapeno and Salted Umami could help it capture consumers’ interest, as well as classic varieties like butter. Covering both bases could help it appeal to a broader audience as many consumers turned to familiar flavors and eating experiences during the pandemic.

Opopop is also launching with backing and leadership from CPG snacking veterans. This includes RXBAR founder Rahal, who shifted to a strategy role with the clean-label bar brand since it was acquired by Kellogg in 2017. Company president Sarah McDowell served in marketing and brand-building roles for better-for-you snack maker Larabar before and after its 2008 acquisition by General Mills.

Having a focus on flavor and experienced players at the helm will be assets for Opopop as it enters the highly competitive popcorn segment, where legacy brands and new entrants are aiming to snag a share of the increasing demand. In the microwave popcorn space, this includes Conagra Brands’ Orville Redenbacher‘s and Act II, and Jolly Time’s Blast O Butter.

Within ready-to-eat popcorn, which has taken a considerable bite out of microwave popcorn’s market share, Opopop faces competition from several Big Food players. In 2017, Conagra bought Angie’s Boomchickapop for $250 million, which also focuses on unique flavor combinations. Later that same year, Hershey announced it was acquiring SkinnyPop parent company Amplify Snack Brands for $1.6 billion.

Hershey also owns a stake in what may be one of Opopop’s most direct competitors, Quinn Snacks. The company launched with a focus on transparency and has its own line of non-GMO, organic microwave popcorn in unique flavors such as White Cheddar & Sea Salt and Aged Parmesan & Rosemary. It also has expanded into pretzels and has a retail footprint at more than 7,500 stores.

Opopop will be placing its pure DTC approach, flavoring technology and CPG leadership up against a range of competitors, big and small, who bring their own strengths in the fight for snacking market share.

Source: fooddive.com