Molson Coors settles trademark case involving Vizzy hard seltzer

Dive Brief:

- Brizzy hard seltzer will no longer be made or marketed under terms of the settlement of a trademark dispute between Future Proof Brands and Molson Coors, a spokesperson for the beverage giant told Food Dive in an email. The small alcoholic beverage maker sued Molson Coors last year, accusing the big brewer of stealing its product name for its then-new hard seltzer brand Vizzy. Future Proof demanded that the court prohibit Molson Coors from using the Vizzy name.

- The final judgment in the case was approved by the court on June 2. Court documents indicate both parties had come to an amicable settlement, but they do not say what that settlement entails. Future Proof did not respond to a request for comment.

- The quiet settlement is somewhat of a surprise, given that both parties in this case had been outspoken about their viewpoints from the time before the case was filed up until December, when the trial judge ruled against postponing the case and a motion to dismiss. Molson Coors provided no further details on the settlement terms.

Dive Insight:

The biggest outlying question is how the two sides went from hurling accusations at each other six months ago to a peaceful resolution now. When we last heard from the companies in this dispute, Future Proof board member Jeff Cuban railed on Molson Coors for showing “such disregard” for smaller brands, meaning his company had to “fight back, not just for the Brizzy brand but for those that might face the same treatment from a market dominant brand with the clout of a Molson Coors.”

In a statement emailed to Food Dive at the time, Molson Coors said that “Future Proof continues to live in fantasy-land, not reality.”

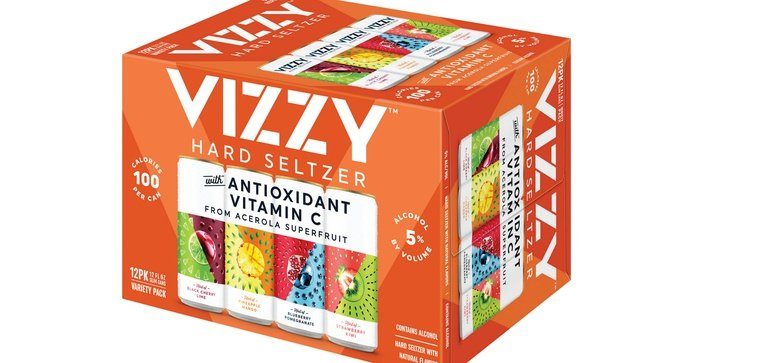

But a lot has happened since then. Since its launch last year, sales of Vizzy have taken off. In the company’s most recent earnings call, Molson Coors CEO Gavin Hattersley cited IRI data showing that Vizzy was a top 10 industry growth brand in the first quarter of 2021. Vizzy Lemonade, which launched this spring, has already shown promising growth, Hattersley said. Vizzy’s differentiating factor in the crowded hard seltzer category is its health profile. It’s made with acerola cherry, a superfruit with 50 times more vitamin C per cup than an orange. Each can has 100 calories, 1 gram of sugar, and 5% alcohol by volume.

“We think we’ve got a real winner with Vizzy,” Hattersley said during the April earnings call. “It’s achieved almost a 3% share in 2020 with only one SKU, and that SKU moved faster in Q1 than all Bud Light Seltzer variety packs put together.”

In May, Molson Coors announced a $100 million investment to more than quadruple production of hard seltzers, including Vizzy, in Canada. Hattersley touted the great potential to grow Vizzy sales in Canada on the earnings call, saying the brand became one of the nation’s top five hard seltzer brands after being on the market for just a month. A similar expansion in the United States last year helped grow Molson Coors’ seltzer and innovation production capacity by 400%.

Brizzy, which was conceived as a craft hard seltzer for foodies, had high sales projections for a company with the reach of Future Proof, but that is small in comparison to Molson Coors. According to the lawsuit, Future Proof anticipated Brizzy’s sales would eclipse $2 million in its first year. But as of now, product information about Brizzy has disappeared from Future Proof’s website.

The company has been active, however, building and promoting its BeatBox Beverages — high-alcohol single-serve boxed drinks, which brought Future Proof a $1 million investment from Mark Cuban on “Shark Tank” in 2014. BeatBox was named the fastest selling wine and RTD cocktail brand at the end of 2020 by IRI. According to a press release from Future Proof, the company has seen nearly 100% year-over-year growth in both 2019 and 2020 — and it expects to see the same in 2021. The release cited IRI data that found BeatBox had $2.7 million sales per point of distribution, which outweighed all others when looked at proportionally. In April, BeatBox launched a zero-sugar version.

Regardless of whether Future Proof might have succeeded on the merits of its case against Molson Coors, it would have taken the smaller company an outsized amount of time, energy and money to fight its battle in court. With the case settled, Future Proof can concentrate on expanding its unique product that is growing rapidly. It’s likely that the settlement may have included funds or distribution expertise for Future Proof, both of which could help the company continue to achieve exponential growth and broaden its reach.

For Molson Coors, being able to continue Vizzy’s success helps the company in its quest to diversify beyond beer. As the company’s beer sales fell and Hattersley was elevated to CEO in 2019, Molson Coors began rolling out products in new segments — including nonalcoholic functional beverages, energy drinks and regional CBD beverages.

Source: fooddive.com