Reflecting changed consumer behavior since the COVID-19 pandemic, nearly a quarter of U.S. e-grocery customers aim to step up their use of online food shopping, new research from Acosta reveals.

Twenty-three percent of online grocery users polled in the October Acosta Shopper Community Survey said they expect to do more e-grocery shopping within the next year, while 64% plan to shop online for groceries at their current level, according to Acosta’s “Growth of Online Grocery Shopping Shows No Signs of Slowing Down” report, released this week. Just 8% of respondents to grocery-shop online less often, and only 1% said they plan to stop completely.

The findings from Acosta, a Jacksonville, Fla.-based CPG sales and marketing firm, also show significant percentages of consumers among varying levels of online usage who plan to increase e-grocery shopping. Of those describing online as their primary grocery channel, 31% aim to boost their food shopping that way. Similarly, 27% of respondents who shop regularly online for groceries but still mostly do so in-store expect their online activity to increase. Among those food shopping online only occasionally, 10% reported they plan to do so more often.

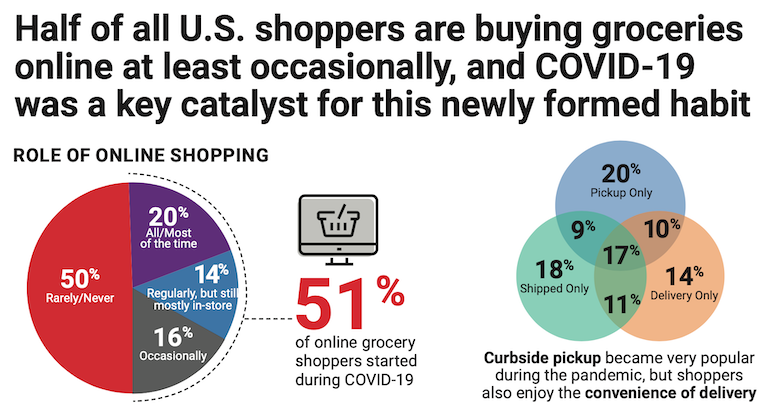

Overall, 51% of online grocery shoppers surveyed said they started during the pandemic. Of that percentage, 20% shop for groceries online all or most of the time, 14% do food shopping online regularly but still primarily in stores, and 16% shop online for groceries occasionally.

What do consumers like about online grocery shopping? Sixty-eight percent of Acosta survey respondents said they’re draw to the service’s convenience, with 56% noting that the channel enables fast shopping. Also, 60% cited a “stress-free experience” as a plus for food shopping online. Customers named lower prices (27%), lots of sale items (33%) and helpful customer service (34%) as the chief benefits for in-store grocery shopping.

Reinforcing the case for an omnichannel strategy, 59% of respondents in Acosta’s poll said they stay with their primary grocery store when doing their food shopping online. Click-and-collect is the preferred service, as 20% of online grocery shoppers said they use pickup only versus 14% opting for delivery only and 18% relying on ship-to-home only. Seventeen percent indicated they use all three services.

“COVID-19 significantly accelerated shoppers’ reliance on e-commerce,” according to Colin Stewart, executive vice president of business intelligence at Acosta. “Half of all online grocery shoppers developed their current preferences after the pandemic began. This widespread embrace of online grocery platforms is expected to notably impact the CPG industry.”

Indeed, Acosta found in its study that online food shoppers are expanding their purchases to most store departments. The top three center-store categories purchased among those polled were salty snacks (cited by 64%), coffee/tea (62%) and condiments (57%). In the frozen department, dinners/entrees (35%), desserts/ice cream (35%) and breakfast items (30%) were the leading online purchases. The top three non-edible categories bought online were toilet paper and paper towels (57% apiece) and laundry products (56%). Meanwhile, produce (46%), milk (46%) and packaged cheese (43%) led in perimeter categories purchased online.

About one in three online grocery shoppers (31%) reported at least one subscription service, led by pet care (50%) and coffee/tea (41%). Just over a third of respondents said they had a subscription for shelf-stable foods, paper/cleaning supplies, over-the-counter medicines, shaving items, meal kits or beauty care.

Notably, online grocery pickup orders are feeding in-store transactions, Acosta’s research showed. Twenty-seven percent of online shoppers surveyed said they run into the store often (27%) or occasionally (46%) when picking up an order. Of those customers, they enter the store to buy something they forgot (61%), purchase items they prefer to pick out themselves (60%) or to buy products they can’t get online (48%).

“Shoppers who have grown accustomed to the convenience of online grocery shopping will likely maintain their new habits long after the pandemic ends,” Stewart added.

Those habits include 47% of survey respondents saying they often place grocery orders via a retailer’s website, while 37% often view product details for items they may buy. Other behaviors that online grocery shoppers often engage in included reordering products from their order history (34%), using digital coupons (33%), adding to their virtual cart over several days (30%) and placing an order via a retailer’s mobile app (28%).

High levels of satisfaction in various areas of online shopping are driving those behaviors for grocery consumers. About 84% of Acosta survey respondents said their orders arrived on time/as scheduled and were accurate, and the same percentage found it easy to add items to their online shopping cart and pick up their orders at the store. Also getting strong satisfaction marks from online shoppers were quality of perishables (cited by 65%), substitutions for unavailable products (59%), ease of finding sales or digital coupons (58%) and personalize product recommendations (54%).