So far in the 2021 second half, Halloween candy sales, trips and household penetration are exceeding 2020 and pre-pandemic levels amid an overall market upsurge in the candy category, according to consumer data specialist Numerator.

Chicago-based Numerator said Thursday its new Candy Tracker shows that pre-Halloween candy buying period is drawing more consumers than ever before this year. Omnichannel seasonal candy sales from July 1 to Oct. 3 were up 29% from a year ago and 43% from the same 2019 period.

The market gain reflects increased household penetration in the candy category, fueled by the seasonal segment. As of early October, seasonal candy household penetration stood at 37.9%, up 4.5% from 2020 and 5.9% from 2019.

“Household buying rates are also up slightly compared to years past,” Numerator noted in its report, which listed an $11.25 buy rate for the period, up $1.31 from 2020 and $1.84 from 2019. “We saw slight early-season increases in seasonal candy sales leading up to Halloween 2020, though less pronounced.”

Meanwhile, shopping trips for seasonal candy have climbed 19% year over year in the July-to-October period and are up 30% on a two-year basis.

Numerator projects seasonal candy sales of $550 million for 2021, which would mark gains of 29.4% from 2020 and 42.7% from 2019.

“After a full year of celebrating seasons through the pandemic, people have expanded their ways of celebrating, adding more at-home activities while resuming cherished community and social traditions,” Phil Stanley, global chief sales officer for The Hershey Co., told Numerator. “For Halloween, we have seen a continued increase in many early and mid-season activities like decorating, baking and movie nights, and our insights signal more will re-engage this year in away-from-home events like parades, parties and trick-or-treating.”

Total sales of nonseasonal candy will reach $6.5 billion in 2021, up 19% from 2020 and 23.8% from 2019, Numerator estimated. The July-to-October period saw nonseasonal candy sales grow 19% year over year and 24% on a two-year stack.

Numerator attributed nonseasonal candy sales gains to higher buy rates per household, rising to $53.41 for the period, an increase of $7.54 from 2020 and $9.59 from 2019. The segment also saw an uptick in overall household penetration to 94.8%, up 1.4% versus 2020 and 0.8% versus 2019. Trips for non-seasonal candy, too, are up 12% from 2020 and 13% from 2019.

“Everyday candy continues to satisfy sweettooths everywhere. Sales of nonseasonal candy, which make up the bulk of overall candy sales throughout the year, also remain elevated versus 2020 and 2019,” Numerator stated. “Last year, nonseasonal candy saw a pronounced boost the week of Halloween, as consumers supplemented their traditional Halloween candy purchases with some of their everyday favorites.”

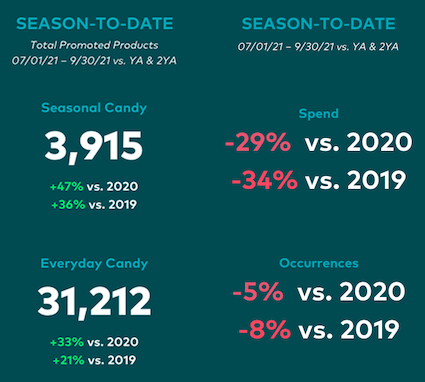

Promotions are providing a big boost, especially to seasonal candy. Numerator said total promoted seasonal candy products for the July-to-October time span have increased 47% from a year earlier and 36% from two years ago. Nonseasonal, or “everyday,” candy promos have been on the upswing as well during that period, up 33% from 2020 and 21% from 2019.

“Seasonal candy promotions are feeling a sugar rush in 2021,” Numerator observed. “These increases were seen most significantly early in the season, with promoted products up over 200% in July versus year-ago. Promotions for everyday candy are up as well, though less significantly than seasonal candy.”

However, the candy sales and promotional lift has come amid less advertising, Numerator added. Candy-related ad spend from July to October plunged 29% from a year ago and 34% from two years ago, with ad occurrences for the category declining 5% from 2020 and 8% from 2019.

“Advertising is looking a little less sweet this year, with overall ad spend and occurrences down in the candy category,” said Numerator. “While candy-related ad occurrences are down slightly, candy ad spend is down even more significantly.”