U.S. retail sales in August edged up from the previous month and, amid continued high inflation, remained well over the prior-year level, including for grocery stores.

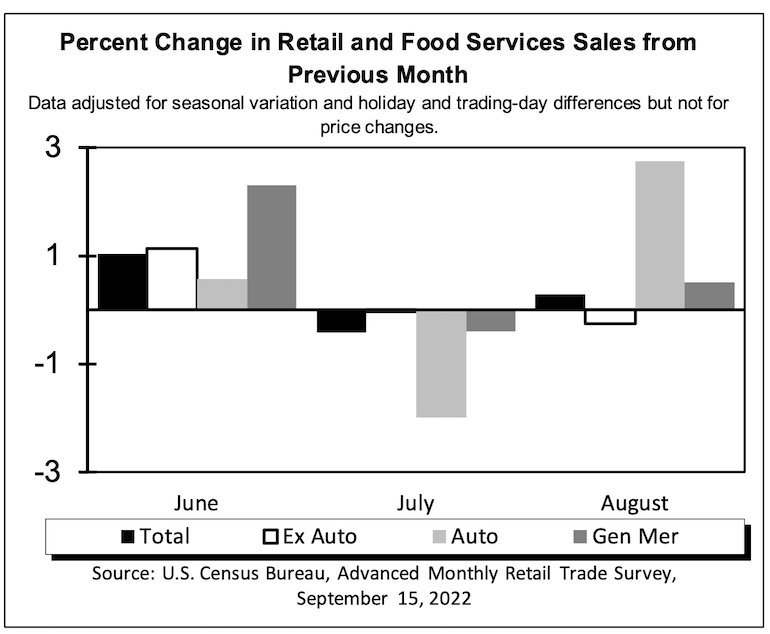

August retail and foodservice sales totaled $683.29 billion (seasonally adjusted), an uptick of 0.3% from July but rising 9.1% from August 2021, the U.S. Census Bureau reported in advance estimates on Thursday. August retail trade sales — excluding motor vehicles and parts stores, gas and repair stations — grew 0.2% to $611.19 billion, and were up 8.9% year over year.

In July, total retail sales were flat month to month but had increased 10.3% a year earlier. Retail trade sales for the month followed the same trend, no gain sequentially but 10.1% from July 2021.

Grocery store retail sales for August came in at $71.13 billion (seasonally adjusted), matching the 0.2% month-to-month growth in July and climbing 7.7% from August 2021, compared with a 9.2% year-over-year gain in July. The Census Bureau reported that sales at all food and beverage stores in August were up 0.5% sequentially and 7.2% over 12 months to $79.47 billion, versus increases of 0.2% month over month and 8.4% year over year in July.

For the year to date through August, food and beverage store sales were up 7.9% year over year to $618.15 billion (unadjusted). That included 8.7% growth to $555.34 billion at grocery stores over the eight-month period.

“Retail performance remains strong because, despite inflation, consumers continue to spend and be resilient,” according to Naveen Jaggi, president of retail advisory services at commercial real estate firm Jones Lang LaSalle (JLL).

“However, retail foot traffic fell month over month across many categories, but with the notable exception of categories where back-to-school shopping is likely to occur, like electronic stores, office supplies, discount and dollar stores and department stores, according to Placer.ai,” he explained. “It’s clear that, more than ever, consumers were paying attention to discounts more than they typically would over the course of the summer.”

The recent relaxation in fuel prices also has given shoppers a shot in the arm. “Consumers are beginning to breathe a sigh of relief from lower gas prices, giving shoppers the opportunity to spend on personal care and back-to-school items, and continue to return to pre-pandemic spending patterns,” Jaggi noted. “A category to watch in the upcoming month is the food services and drinking places, as consumers are becoming more cautious with spending at grocery stores due to rising food prices.”

Katie Thomas, lead at Kearney Consumer Institute (KCI), the retail think tank of global strategy and management consultancy Kearney, had forecast a “flat to slight softening” for August retail sales as consumers maintain tight purse strings at the grocery store, even amid decreased gas prices.

“Certain categories may be propped up slightly from back-to-school, including segments of apparel and general merchandise,” Thomas said in an email. “Otherwise, we expect discretionary categories, from restaurants to electronics, to continue to take the brunt of consumers cutting back. We expect that even home improvement will soften relative to last month.”

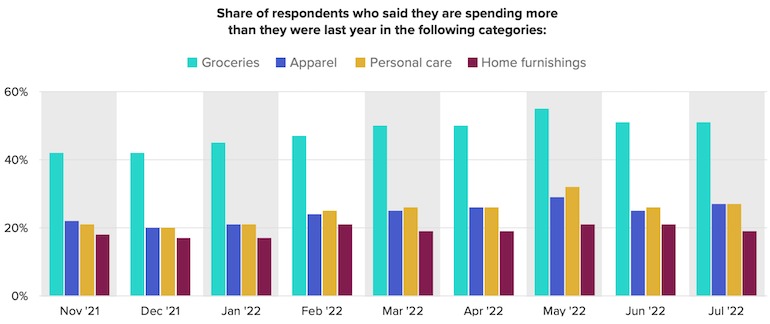

As in recent months, inflation’s effect on retail spending in August was evident, according to Claire Tassin, retail and e-commerce analyst at data intelligence firm Morning Consult. In a report earlier this month, Tassin had cited to figures from a Morning Consult survey showing that, through July, over half of consumers reported spending more than they were last year on groceries.

“August’s retail sales numbers exceeded expectations, but given the latest CPI numbers, we know that inflation is still having a major impact on spending. While gas prices are down from last month, prices are still up significantly from last year, and high grocery prices are reflected here as well,” Tassin observed.

Added fellow analyst Scott Brave, lead consumer spending economist at Morning Consult, “The higher-than-expected CPI print earlier this week was evident in today’s retail sales numbers. While retail and food services sales were up 0.3%, much of that came from spending on autos, with sales excluding autos falling by the same amount. When this data is folded into personal consumption expenditures later this month by the Bureau of Economic Analysis, it will confirm what we already see in Morning Consult’s consumer spending data for August — very little growth in real spending.”

The National Retail Federation pegged August retail sales (unadjusted) as rising 0.1% month to month and 8% year over year, compared with gains of 0.5% sequentially and 7.2% annually for July. Washington-based NRF’s estimate focuses on core retail, excluding automobile dealers, gas stations and restaurants.

“Household spending remains steady, even as costs continue to rise,” NRF Chief Economist Jack Kleinhenz reported. “Consumers continuing to spend more each month points to the benefits of strong job and wage growth and their use of pandemic savings to help handle persistent elevated prices. Consumers are showing their toughness, but they have limited options and cannot continue if prices do not begin to soften. This retail sales report comes amid mixed signals from the broader economy that show the headwinds against the consumer are strengthening.”

August sales grew in five of nine retail categories on a monthly basis (led by building materials/garden supply stores, grocery/beverage stores, general merchandise stores, sporting goods stores and apparel/accessories stores) and in eight of nine categories on a monthly basis (led by building materials/garden supply stores, online retailers, grocery/beverage stores and sporting goods stores), NRF reported.

Grocery and beverage stores posted sales gains of 0.5% month to month seasonally adjusted in August and 8% unadjusted over 12 months. Among other retail categories in the food, drug and mass channel, sales rose by 0.5% month over month seasonally adjusted and by 3.2% unadjusted year over year for general merchandise stores in August, while health and personal care stores (including drugstores) saw sales dip 0.6% month over month seasonally adjusted but edge up 3.7% unadjusted year over year, NRF said.

“August retail sales show consumers’ resiliency to spend on household priorities despite persistent inflation and rising interest rates,” commented NRF President and CEO Matthew Shay. “As we gear up for the holiday season, consumers are seeking value to make their dollars stretch. Retailers have been hard at work managing their supply chains and holiday inventories to provide consumers with great products, competitive prices and convenience at every opportunity.”