The avoidance of steep hikes in the September Consumer Price Index (CPI) didn’t translate into much relief for grocery shoppers.

On a month-to-month basis, the September CPI for All Urban Consumers edged up 0.4% (seasonally adjusted), exceeding the 0.1% uptick in August, the U.S. Bureau of Labor Statistics (BLS) reported Thursday. Aside from flat results in July, the September gain remained well below the level of most increases this year, including 1.3% in June, 1% in May, 0.3% in April, 1.2% in March, 0.8% in February and 0.6% in January.

Year over year, the September CPI advanced 8.2% (unadjusted), down from a 12-month gain of 8.3% for August. That compared with increases of 8.5% for July, 9.1% for June, 8.6% for May, 8.3% for April, 8.5% for March, 7.9% for February and 7.5% for January.

The food CPI — including food-at-home and food-away-from-home — held firm month over month in September but rose on an annual basis. BLS said the food index came in up 0.8% for September — the same as in August — and is down from monthly increases of 1.1% in July, 1% in June, 1.2% in May, 0.9% in April, 1% in March, 1% in February, and 0.9% in January.

Over 12 months, the food CPI was up 11.2%, a decline from 11.4% in August yet still above annual increases of 10.9% in July, 10.4% in June, 10.1% in May, 9.4% in April, 8.8% in March, 7.9% in February and 7% in January.

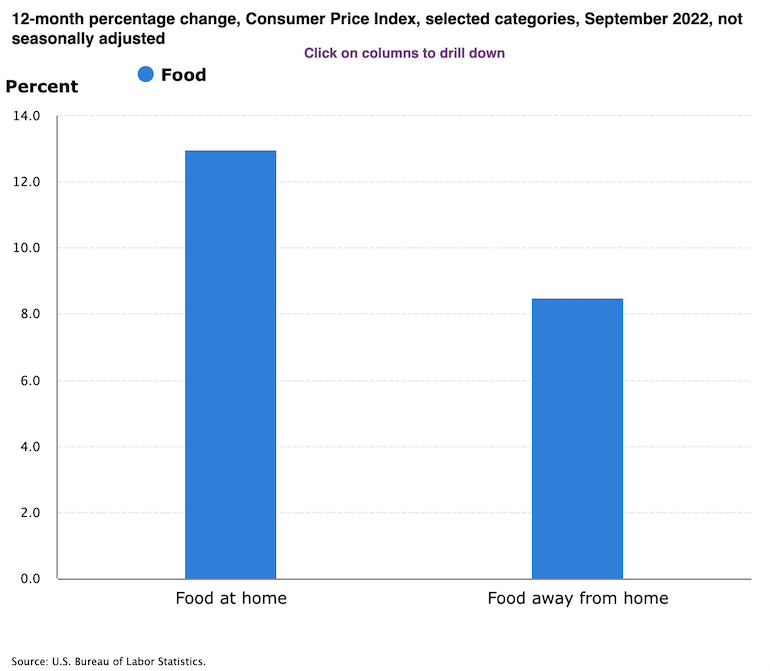

The food-at-home CPI for September climbed 13% year over year, less than increases of 13.5% in August and 13.1% in July. The September uptick also marked the end of escalating 12-month gains since the start of the year, as the food-at-home index rose 12.2% for June, 11.9% for May, 10.8% for April, 10% for March, 8.6% for February and 7.4% for January.

Month to month, the food-at-home CPI inched up 0.7% in September, the same as in August, when the monthly gains was the first below 1% since April. That compared with hikes of 1.3% in July, 1% in June, 1.4% in May, 0.9% in April, 1.5% in March, 1.4% in February and 1% in January. The latter gain came after just a 0.4% increase in December.

BLS reported that all six major grocery store food group indices for food-at-home rose on a monthly basis in September. The fruit and vegetables index increased 1.6%, while the cereals and bakery products index was up 0.9%. Nonalcoholic beverages gained 0.6% in September, ahead of increases for other food at home (+0.5%); meats, poultry, fish and eggs (+0.4%); and dairy and related products (+0.3%).

In the food-at-home segment, the sharpest 12-month price hikes for September came from cereals and bakery products (+16.2%), dairy and related products (15.9%) and other food at home (+15.7%). Of the remaining major grocery store food groups, year-over-year increases were 12.9% for nonalcoholic beverages; 10.4% for fruit and vegetables; and 9% for meat, poultry, fish and eggs.

The food-away-from-home index also held firm on a monthly basis in September, edging up 0.9%, the same as in August, according to BLS. The 12-month uptick was 8.5% for September, up from 8% in August.

Backing out food and energy, the September CPI rose by 6.6% from a year earlier and by 0.6% from a month ago, roughly in line with the increass of 6.3% year over year and 0.6% month to month in August.

Energy costs, still the chief catalyst in driving up inflation, eased off again in September, up 19.8% year over year but down 2.1% month over month, compared with an annual gain of 23.8% and a monthly decline of 5% in August. Gas and fuel oil prices rose 18.2% and 58.1%, respectively, for the 12 months through September versus respective hikes of 25.6% and 68.8% in August. Month over month, prices fell 4.9% for gas and 2.7% for fuel oil in September.

“Inflation has caused the price of all consumer goods to increase, and the food sector has been particularly hard hit,” Andy Harig, vice president of tax, trade, sustainability and policy development at FMI-The Food Industry Association, said in an emailed comment. “We understand that inflation poses significant economic challenges and is making money tight for many families. Grocery stores, and the entire food industry, are doing all they can to ensure Americans their customers have resources to plan and budget and remain committed to working with their customers to help mitigate the impacts of inflation.”

Discount grocer Aldi, for example, yesterday announced price cuts on dozens of popular items running to the end of the year. Items include include frozen 85% lean ground beef chub, 1 lb. (to $3.89 from $4.49); Specially Selected cold smoked salmo, 3 oz. (to $4.39 from $4.99); Specially Selected raw honey, 24 fl. oz. (to $6.99 from $7.39); Emporium Selection gourmet snacking cheese, 9 oz. (to $2.99 from $3.29); Simply Nature premium 100% juice, 33 fl. oz. (to $3.99 from $4.25); Carlini canola or butter cooking spray, 8 oz. (to $1.99 from $2.25); Appleton Farms thick-sliced flavored bacon, 1.5 lb. (to $8.49 from $8.75); Fusia Asian Inspirations frozen sushi rolls, 11.5 oz. (to $4.89 from $5.89); and Simply Nature organic black beans, 15 oz. (to 99 cents from $1.16).

FMI’s Harig noted that the drivers behind lingering high inflation in the grocery sector remain complex and run from the source to the store.

“Spikes in costs due to labor, lower-capacity production disruptions, transportation demands and global conflict are affecting every aspect of the food business. Today’s numbers make it clear that there is still work to be done to address these issues,” he explained. “Many of these factors remain outside of our power to influence, but the food industry is collaborating throughout the entire supply chain to secure consumer-centric progress on prices, all while the grocery industry maintains a net 1% to 2% profit margin (which has been consistent for more than two decades). Even though food prices are higher today, the food system will continue to become more efficient and productive, thereby keeping food prices in check over the long haul.”

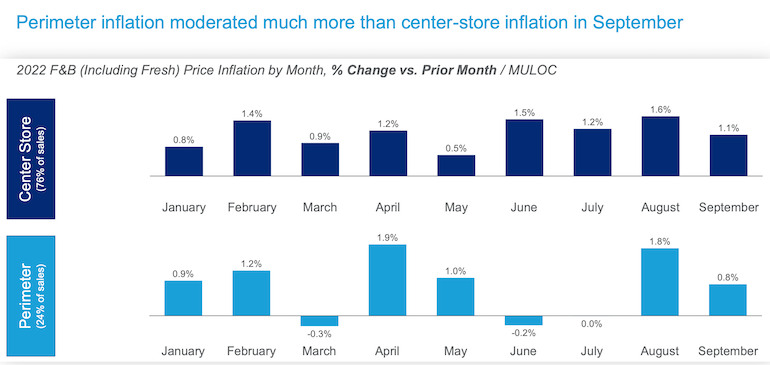

According to IRI, at-home food and beverage inflation for September rose 1% from August. Still, the CPG market researcher said, year-over-year price inflation is plateauing. Food and beverage pricing held at just over 13% higher in September compared with the year-ago period, in line with August and only slightly above July 12- month levels.

Perimeter categories also are offering some relief. Prices in these areas of the grocery store came in 9.6% higher in September versus a year earlier, yet year-over-year inflation in these product categories has decreased monthly since February. Inflation, too, has varied widely across the store. For the five weeks ended Oct. 2, prices in the alcohol category advanced 4.2% year over year, whereas in dairy (+19.6%) and frozen meals and other frozen foods (+18.4%), prices rose much higher.

“September data revealed some welcome news for consumers: Price inflation is slowing down for the first time this year in the perimeter categories that account for nearly $200 billion in annual retail sales,” according to Krishnakumar “KK” Davey, president of thought leadership for CPG and retail at IRI and sister research firm NPD. “However, overall grocery bills are still significantly higher than this time last year, causing shoppers to shift their purchase habits. IRI is continuing to track food and beverage price inflation carefully to ensure that manufacturers and retailers are able to respond to shifts in consumer behavior and execute price, promotion and supply chain strategies that help them drive growth in this dynamic economic environment.”