SpartanNash hit sales and earnings targets for its fiscal 2022 first quarter after reporting strong preliminary results last month.

The Grand Rapids, Mich.-based grocery distributor/retailer also topped Wall Street’s earnings per share forecast for the quarter and raised its full-year guidance across the board.

For the 16-week quarter ended April 23, net sales totaled $2.76 billion, up 4% from $2.66 billion a year earlier, SpartanNash said Thursday. The Grand Rapids, Mich.-based grocery distributor/retailer attributed the uptick mainly to sales increases in all three of its business segments — food distribution, retail and military distribution — amid the current inflationary environment. The gain represented a significant improvement from the 2021 first quarter, when net sales were down 7% as the company cycled a pandemic-driven sales surge.

In the core food distribution segment, 2022 first-quarter net sales rose 2.8% to $1.37 billion from $1.33 billion a year ago, when SpartanNash saw sales dip 2.6%. The company noted that the sales uptick primarily reflects the inflationary impact on pricing.

Net sales for the retail business unit came in at $781.3 million, rising 5.7% from $739.4 million in the prior-year period, which saw an 5.5% decrease. Comparable-store sales climbed 7.2% year over year after a 7% decline a year ago. SpartanNash finished the 2021 first quarter with 145 company-owned supermarkets, versus 154 a year ago, under such banners as Family Fare, Martin’s Super Markets, D&W Fresh Market, VG’s Grocery and Dan’s Supermarket.

Military distribution net sales in Q1 advanced 4.7% to $611.5 million from $584.3 million in the 2021 quarter, when sales fell 17.1%. SpartanNash said the increase reflects inflationary pricing, that was partially offset by reduced case volumes, though the latter trend slowed compared with the previous year.

“Our first-quarter results reflect the significant momentum under way at SpartanNash, driven by ‘Our Winning Recipe’ plan,” SpartanNash President and CEO Tony Sarsam said in a statement. “Our team’s keen focus on operational excellence helped deliver on our supply-chain transformation initiative. During the quarter, we achieved more than $15 million in run-rate cost savings, already meeting our full-year 2022 run-rate goal of $15 million to $30 million annualized supply-chain savings.”

At the bottom line, SpartanNash posted first-quarter 2022 net income of $19.3 million, or 53 cents per diluted share, compared with $19.5 million, or 54 cents per diluted share, a year earlier.

Excluding $11.04 million (30 cents per diluted share) in adjustments net of taxes, SpartanNash reported adjusted net earnings (continuing operations) of $33.3 million, or 83 cents per diluted share, versus nearly $21.3 million, or 59 cents per diluted share, in the 2021 quarter.

Analysts, on average, had projected adjusted EPS of 64 cents, with estimates ranging from 55 cents to 67 cents, according to Refinitiv.

SpartanNash said it also turned in record first-quarter adjusted EBITDA of $76.6 million, up 18.2% from $64.8 million a year ago.

Citing the progress in driving operational cost savings, Sarsam noted that SpartanNash is lifting its guidance for fiscal 2022.

“Because we achieved this significant milestone ahead of schedule, we are now updating our commitment to an annualized savings range of $25 million to $35 million by year-end,” he explained. “In addition, our full-year outlook and long-term financial targets show a clear path for growth for the next several years.”

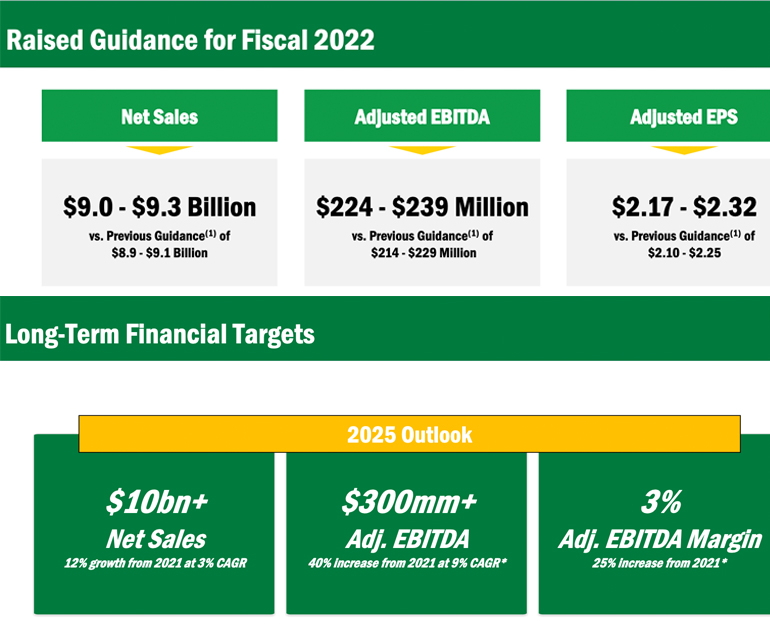

Fiscal 2022 adjusted EPS is now pegged at $2.17 to $2.32, up from the previous forecast of $2.10 to $2.25. Analysts’ consensus estimate, prior to the first-quarter report, was for adjusted EPS of $2.11, with projections running from $1.92 to $2.24, according to Refinitiv.

In other raised guidance, fiscal 2022 net sales now are projected at $9 billion to $9.3 billion, up from the earlier outlook of $8.9 billion to $9.1 billion. Sales now are expected to rise 3% to 5% for food distribution (up from 2% to 4%) and come in down 4% to flat for military distribution (up from a decrease of 7% to 3%). Retail comparable-store sales stand to grow 1% to 3%, up from the previous outlook of flat to 2%.

Adjusted EBITDA for the year is projected at $224 million to $239 million, a $10 million uptick at the bottom and top ends of the prior estimate $214 million to $229 million.

Long-term financial goals also have been raised. By 2025, SpartanNash said it expects to top $10 billion in net sales, which would mark a gain of at least 12% from fiscal 2021. The company also is aiming for adjusted EBITDA of over $300 million, which would be an increase of at least 40% from fiscal 2021, as well as adjusted EBITDA margin of 3% of net sales, an uptick of 20% from fiscal 2021.