St Lucia’s forgiving government: One who gives and takes back more: Part 2

- St Lucia’s hand-to-mouth economy is reaching a boiling point;

- Robbing selected Peter to pay for the collective Paul;

- The Adventures of Robin Hood.

By Caribbean News Global ![]()

CASTRIES, St Lucia, (CNG Business) – During Caribbean News Global (CNG) discussions and analysis with finance experts including current and former public officers of the Ministry of Finance, about – The authorities need more time to consider the publication of the staff report and the related press release – scenarios were noted that – timing is everything, to figures and analysis that are indifferent and financial language that may need articulating.

“It may simply mean that the political narrative does not match the figures or that, the statistics are off-base to attain the desired results, absent the mathematical process to rebase.

“Broadening that horizon includes capabilities to defend publicly acknowledge and real worries that the economy is unmasking, captured in untruths.

“However, the purpose of financial reporting is to provide insight and transparency into Saint Lucia’s financial position and public management operations to assist citizens and business concerns with better-informed decisions.”

St Lucia’s 2.5 percent health and security levy is an investment, says OPM

Subject to the so-called tax gurus of 2.5 percent to acclaim insignificance, CNG welcomes alternative views and rebuttals from “political hacks, professional hacks and the new crop of connoisseurs who ascribe to “people in power” set of symptoms,” in anticipation of manna from heaven.

In simple terms, ‘tax deferral takes advantage of the time value of money. Tax avoidance is the legal method to minimize the amount of income tax owed by an individual or business.’ Tax evasion is an illegal practice, (person or corporate) intentionally to not pay due taxes.’

Tax administration and legislation in Saint Lucia first require the government to abide by its obligation on tax returns (where applicable) and the enforcement of duly applicable legislation.

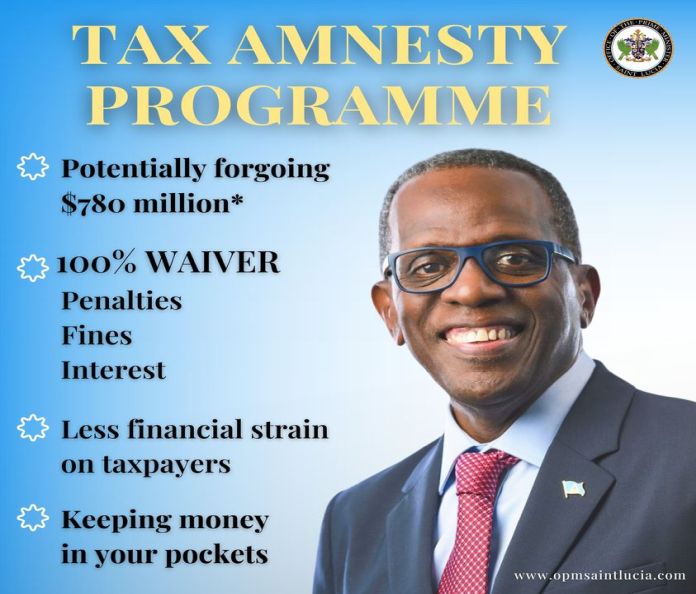

Delaying payment of taxes to the government is costly, on account of the interest accrued and other penalties. It hurts government planning and program execution.

It is likewise a financial management weakness of the government, the Ministry of Finance, and IRD to adjudicate, make alternative arrangements via negotiations, and seek redress on state taxes.

This is of merit, in particular dealing with the hospitality industry, where hotel accommodation tax, PAYE, hotel accommodation tax (all inclusive), other withholding tax, and VAT are often used as derivatives for negotiation.

This also reflects on the public management function of the Ministry of Finance, and IRD, that are far too often delinquent in service to the public.

St Lucia PM distances himself from ‘Draft Tax Administration and Procedure Act’

It is the responsibility of the government to meet international tax transparency standards and make legislative amendments concerning the Foreign Account Tax Compliance Act (FATCA); the Automatic Exchange of Financial Account Information (AEOI), and the Organization for Economic Cooperation and Development (OECD) Inclusive Framework on Base Erosion Profit Shifting (BEPS).

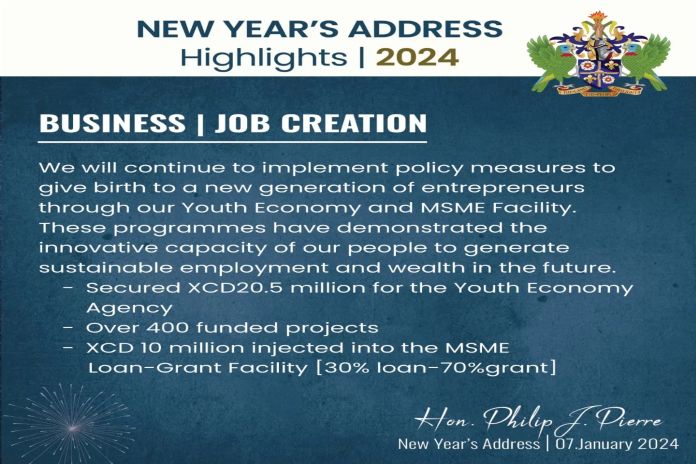

“We will continue to grow the economy by empowering all sectors. Our tax reform and tax amnesty policies will be reviewed so that more disposable income will be placed in the hands of businesses and individuals.” Philip Pierre, New Year’s address, 2024.

Hand-to-mouth economy

Currently, there are too many grim reminders of blind dates, professionally speaking, “Kill it” – “Keep it!”

Thus far, secret deals from secret dates that are usually “pregnant with opportunities” seem a misconception. Unemployment, poverty, inflation, crime and health care are worse than in previous years, while the political and economic brass cannot prepare for the potential fallout.

Policy deficiencies and outdated ideology are starving Saint Lucians to death – unable to buy basic foods. Healthcare and education priorities are exposed downwind. Sustainable investment is sleeping away, unable to negotiate one successful national project/development to bring sustainable jobs to the people of Saint Lucia to gain public poise and investor confidence.

The current posture of [strategic] temporary relief is towards political manipulation. It is unproductive to keep giving “so-called relief” – derived from loans, grants and taxes – without upskilling recipients and preparing for new avenues of production.

The Adventures of Robin Hood

Saint Lucian has a problem where the devil is in the detail. No amount of retrofit legislation will woo investors. The “best brains” of the “talk shop variety,” don’t see the need to revisit death-defying policy positions.

While access to Saint Lucia’s financial data is “bottled up,” [to some extent] a wave of anxiety is rippling through. The genuineness is quite the same, as compared to 2014, to the juvenile manoeuvre of the then-prime minister, to challenges at distracting the population from debt, inflation, labour market needs and to grasp a real-world understanding.

Evasive action is counter-productive to overestimate growth and job creation from reaching a boiling point. It is even more difficult to hide that economic buoyancy is underway. The economy is flat and in grave danger of generating the investment needed to achieve key priorities. [Health care, education, infrastructure development, security, climate adaptation].

“Our overall revenue performance also increased, driven by the expansion in domestic economic activity and elevated imported prices.” Philip Pierrre, budget address 2023.

CNG Insights

Saint Lucians are staggered as their finances disintegrate. The political and economic stimulation is unreal. The full impact of bad ideas, politically motivated decisions, indecisiveness, and gross negligence in economic management, finance, and foreign affairs is vivid.

Peter will pay for Paul. It is déjà vu! Saint Lucia’s governance weakness is adversely visible. The number-crunching and fancy statistics cannot change that reality. You never see what you’re getting and what you hear is not what you get. The adventures and tenacity to give a little and take more seem the contemporary of Robin Hood.

The government needs to be upfront about liquidity challenges to mitigate the high external debt they are facing, and the urgent liquidity support needed. This requires an architecture to focus on debt vulnerabilities, risk perceptions and capital inflows for timely capital and operating outflows. The upcoming budget 2024/2025 is a further test of debt vulnerabilities, the fiscal space for debt restructuring (debt service external and domestic) and the fiscal space for infrastructure and economic development, domestic and Foreign Direct Investment (FDI) opportunities.

It is not enough to claim and/or to regain lost ground from COVID-19 global decline. The situation requires access to financial data, credible discourse on national issues, action on policies to release long-lasting drag on growth prospects, discipline on government spending, and adoption of flexible frameworks for the international movement of capital to create jobs and economic development. Improving health, education, food security, and the labour force through upskilling initiatives.

This seems a deliberate strategy to defeat misery and poverty, with handouts and personal favours along party lines. This methodology, accompanied by delinquent decision-making, is unfit for purpose.

St Lucia’s forgiving government: One who gives and takes back more: Part 1

Source: caribbeannewsglobal.com