With many consumers less concerned about the pandemic, reliance on online grocery services is expected to dissipate, an analysis by category growth design firm ChaseDesign finds.

According to the ChaseDesign Online Shopper Survey, released this week, the share of customers relying on home delivery of groceries purchased online will decline by nearly 25% in the near term. Likewise, the number of shoppers using buy-online-pickup-in-store (BOPIS) services “all the time” fell by a third — from 45% to 32% — last year and stands to shrink further in 2022. Meanwhile, in-store shopping remains the dominant channel for purchases of consumer goods and looks to grow further in 2023, according to Syracuse, N.Y.-based ChaseDesign.

In the study, conducted through ChaseDesign’s mPulse proprietary research platform, 1,000 consumers ages 25 to 54 were polled online in June. Respondents were screened to be the primary or secondary grocery shopper in their households.

The fading of pandemic restrictions appears to be transforming online shopping from a need to a convenience — and one that comes at a price premium, the research indicates. For example, home delivery — a linchpin of many grocery customers’ shopping routine during the pandemic — now wrestles with issues in terms of the value delivered by the service, possibly accelerated by high food price inflation, according to ChaseDesign. The survey found that the number of people who said they “always” use home delivery when buying groceries dropped to 16% in 2022 from 31% in 2021.

The chief reason: Most consumers said they prefer to shop for groceries in a physical store over shopping online.

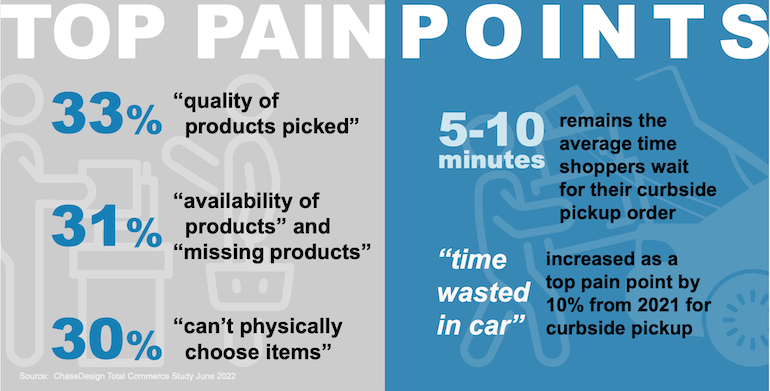

“This is driven by a lack of trust in having retailers pick and deliver exactly what the customer wants,” according to Joe Lampertius, president of ChaseDesign. “Our survey shows 33% of shoppers have issues with the quality of products selected and a slightly lower percentage are worried about availability through the digital platform.”

Of those polled, 32.3% said they now buy groceries online for in-store or curbside pickup and/or delivery “all of the time,” compared with 50.2% who do so “some of the time” and 17.5% using those services “hardly any of the time.”

However, when asked about their use of in-store pickup “once the pandemic has passed,” 32% of consumers said they plan to buy groceries through the service “occasionally,” with 15.2% planning to do so “rarely” and 5.4% saying “never.” The percentages were virtually the same for curbside service. And for home delivery, 27.9% expect to use the service occasionally, 14.5% rarely and 12.3% never.

Post-pandemic, 45.3% aim to purchase groceries for delivery always (16.8%) or most of the time (28.5%), versus 44.2% for curbside pickup (17.2% always and 27% most of the time) and 47.4% for in-store pickup (18.5% always and 28.9% most of the time).

The main reasons cited by consumers for using online grocery pickup and/or delivery included convenience, safety/cleanliness, time savings, ease of product returns, need and “laziness,” ChaseDesign reported. For in-store and curbside pickup, customers also named avoidance of shipping costs or fees as a factor in choosing click-and-collect service.

On the flip side, the top reasons online grocery users cited for stopping the use of pickup service were “I prefer to shop in a physical store, “I like to pick items myself,” “expense is too high” and “unsatisfied with out-of-stocks and/or replacement choices.” They also expressed dissatisfaction with the pickup experience and the selected products and, for curbside service specifically, that the wait is too long.

Overwhelmingly, online grocery customers who said they plan to stop home delivery post-pandemic named “delivery fees are too high” as the reason, followed by difficulty in managing their schedule around a delivery, inability to add last-minute items, wrong or missing products, concern about packages being stolen and poor quality of products selected. Other reasons included damaged products and difficulty in applying coupons, discounts or gift cards to these orders.

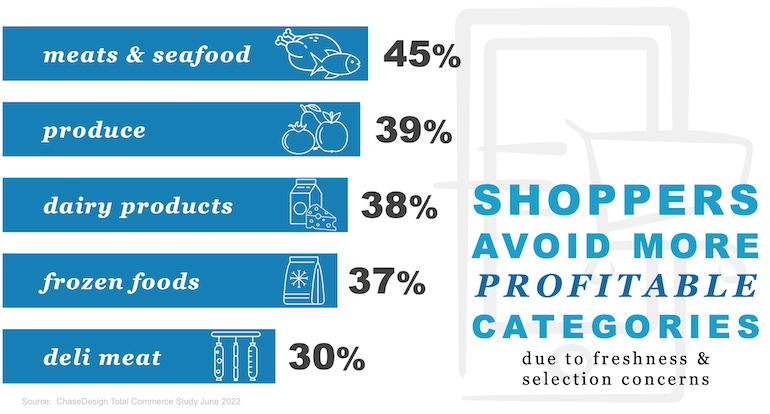

Fresh foods and perishable goods, unsurprisingly, were the chief product categories that consumers surveyed said they avoid purchasing online, led by meat and seafood, produce, dairy, frozen, deli, bakery and floral. ChaseDesign noted that these items are primarily products in which “careful selection matters most” to shoppers.

“Our survey pinpoints several opportunities for retailers trying to take advantage of the new shopping environment,” Lampertius explained. “For instance, 10% more curbside pickup shoppers complained about the time wasted in their cars waiting for their order in 2022 over last year. If the retailers use that captive time average five to 10 minutes with some shopper engagement and improved impulse merchandising strategies, brands and retailers will be rewarded with a more loyal customer and incremental purchases.”

To that end, ChaseDesign’s research revealed a $50 million “commerce gap” between in-store and curbside pickup. Among shoppers who buy online and pick up their groceries in the store, 42% purchase additional items, compared with 32% of curbside customers doing so.

“We have been working to improve the curbside pickup experience across several leading clients,” Lampertius added. “A great example is the conceptual work we’ve done for Planters nuts that uses digital integration of last-minute add-on items in the retailer’s app, while also providing impulse merchandising units at point of pickup, to create new opportunities for impulse sales.”

On the retail side, consumers cited Walmart, Target and Kroger as having the best in-store and curbside pickup experiences for groceries, with Costco, Amazon, Whole Foods Market, Sam’s Club, Albertsons, Walgreens, CVS, Publix and Meijer also named. Walmart and Amazon led by far in consumer perceptions of the online grocery delivery experience, followed by Target, Kroger, Whole Foods, Costco, Sam’s Club, Walgreens, CVS and Albertsons in the top 10.