U.S. e-grocery sales are maintaining the significantly high plateau they reached when the COVID-19 pandemic triggered a dramatic surge in online shopping activity.

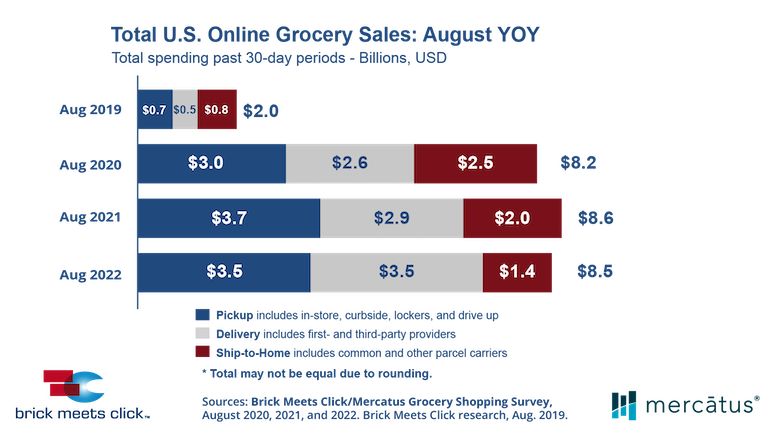

Total U.S. online grocery sales dipped less than 1% in August versus last year but still racked up an impressive — and consistent — $8.5 billion in total sales. Following the $2 billion in sales reported in August 2019 before the pandemic changed everything, e-grocery sales quadrupled in 2020 and have maintained at least $8.2 billion in sales for three straight Augusts, according to the latest Brick Meets Click/Mercatus Grocery Shopping Survey.

The substantially elevated sales levels — including $8.2 billion in 2020 and $8.6 in 2021 — also reflect shifting online shopping patterns, according to the survey. All three segments — pickup, delivery and ship-to-home — have grown since pre-pandemic, but delivery has consistently grown year over year while sales have migrated from ship-to-home. Pickup is also growing but it gave up a small share this August versus 2021.

“The COVID pandemic motivated trial of delivery and pickup services at a scale that no one could have predicted,” according to David Bishop, partner at Barrington, Ill.-based strategic advisory firm Brick Meets Click, which focuses on how digital technology impacts food sales and marketing. “And, as the pandemic evolves, it’s increasingly clear that many households find online grocery shopping an acceptable option to complement their new in-store shopping behaviors.”

The survey is an ongoing independent research initiative conducted by Brick Meets Click and sponsored by Toronto-based grocery e-commerce specialist Mercatus. Delivery includes retailer and third-party services (e.g. Instacart, Shipt), while pickup includes in-store, curbside, locker and drive-up services. Ship-to-home sales cover online grocery purchases delivered by parcel couriers like Federal Express, UPS and the U.S. Postal Service.

During August 2022, over 68 million households placed at least one grocery order online. The total base of monthly active users (MAUs) for August 2022 slipped just over 1% versus 2021, but it’s still up 23% from 2020 — and a whopping 116% compared with 2019. The share of MAUs engaged with ship-to-home fell from 58% in 2019 to 44% in 2022, while delivery’s share rose from 25% in 2019 to 44% this year, and pickup rose from 32% to 54%.

Consumers are shopping online more frequently, the research shows. The average number of orders received by an MAU jumped by 40%, from 2.0 to 2.8, between August 2019 and August 2020; it gradually declined to 2.7 in 2021 and 2.6 in 2022.

“This downward trend in order frequency is largely the result of a growing MAU base that is still influenced to some degree by concerns about catching the virus,” Bishop noted.

Weekly grocery spending for August 2022 does show signs of the impact of inflation, but “that’s in part due to where customers are shopping as well as the size of the average order,” Brick Meets Click stated. Overall grocery spending in August was up 14% year over year, while households reported spending just over $200 during the most recent seven-day period.

Mass and dollar formats reported larger user bases in August 2022, whereas grocery remained relatively flat. Mass saw a 7% gain, effectively serving 45% of the overall base, up from 42% in August 2021. Dollar, which has a much smaller MAU base, reported a gain of over 70% versus 2021. The composite average order value (AOV) for delivery and pickup rose 10% versus the prior year to $87 during August, while ship-to-home’s AOV plummeted 20% to $40.

“An important leading indicator, the likelihood that an online grocery shopper will use the same service again within the next month, has remained extremely stable during 2022, finishing August at 63%,” the Brick Meets Click report said. That is three points higher than 2021 but almost 10 points lower than 2020. Grocery continued to lag mass by nearly 10 points.

Cross-shopping between grocery and mass remained elevated at 29% in August, three points higher than last year and 11 points and 14 points higher compared with 2020 and 2019, respectively.

“This suggests that grocery operators need to focus on closing this gap by improving various aspects of the online shopping experience, ranging from how orders are placed to when they are received,” according to the survey.

“The strategies that mass retailers use are difficult for most grocery retailers to imitate for various reasons,” observed Sylvain Perrier, president and CEO of Mercatus, whose U.S. offices are located in Charlotte, N.C. “Price inflation plays to their competitive advantage, but only up to a point as online shopping still is about convenience. Conventional grocers should emphasize the cost savings and convenience of their pickup services.

“At the same time,” he added, “consider implementing a variable service fee structure that offers customers more control over the extra costs and grocers better ways to lower costs through operational efficiencies.”