Next month, the U.S. Senate plans to hold a hearing to examine competitive and consumer concerns arising from the Kroger-Albertsons merger deal.

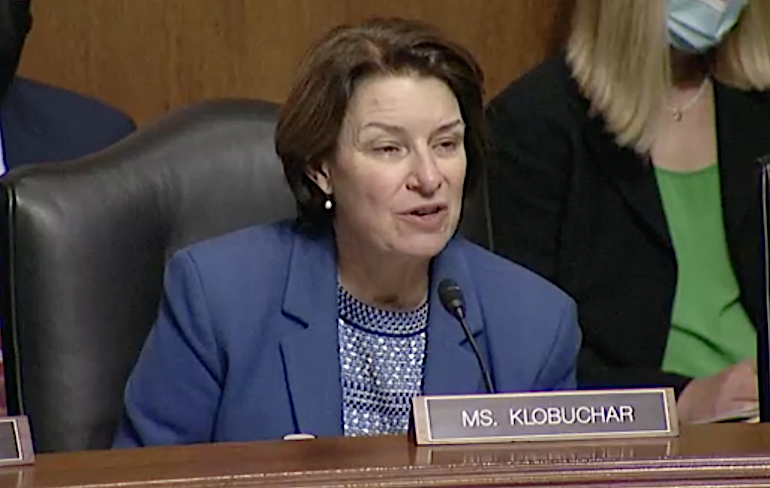

U.S. Sens. Amy Klobuchar (D., Minn.), chair of the Senate Judiciary Subcommittee on Competition Policy, Antitrust and Consumer Rights, and ranking member Mike Lee (R., Utah) said yesterday that the subcommittee will convene a panel in November to address the $24.6 billion transaction, in which The Kroger Co. is slated to acquire Albertsons Cos. The lawmakers noted that a potential of the nation’s two largest supermarket chains raises an array of issues for both the grocery industry and its shoppers.

“As the chair and ranking member of the Subcommittee on Competition Policy, Antitrust and Consumer Rights, we have serious concerns about the proposed transaction between Kroger and Albertsons,” Klobuchar and Lee said in a joint statement. “The grocery industry is essential, and we must ensure that it remains competitive so that American families can afford to put food on the table. We will hold a hearing focused on this proposed merger and the consequences consumers may face if this deal moves forward.”

On Tuesday, Klobuchar and fellow Sens. Richard Blumenthal (D., Conn.) and Cory Booker (D., N.J.) also called on the Federal Trade Commission to investigate the Kroger-Albertsons merger agreement, citing particular concern over the deal’s ramifications for consumers. In a letter to FTC Chair Lina Khan, they said the blockbuster supermarket merger comes at a time when Americans already are grappling with high food pricing.

“We write to express our serious concern about the recently announced merger between Kroger and Albertsons and to ask for your assurance that this proposed deal will be carefully and thoroughly investigated by the Federal Trade Commission (FTC). As food prices remain elevated, too many American families are struggling to put food on the table for their families. These issues are worse for families in areas without access to affordable, nutritious food. And across the country, more than 6 million American children suffer from not having enough food,” Klobuchar, Blumenthal and Booker said in the letter.

Sen. Amy Klobuchar (D., Minn.), chair of the Senate Judiciary Subcommittee on Competition Policy, Antitrust and Consumer Rights, said that her subcommittee will convene a panel on the Kroger-Albertsons deal in November.

“Against that backdrop, last week the nation’s two largest grocery chains, Albertsons and Kroger, announced a proposed $25 billion merger. This merger raises considerable antitrust concerns,” they wrote. “The grocery industry is essential to daily life, and Americans need the benefits that robust competition brings, namely lower prices, higher quality and innovation.”

Unveiled on Oct. 14 after news of talks leaked, the Kroger-Albertsons merger deal would form a national supermarket operator with 4,996 stores, 66 distribution centers, 52 manufacturing plants, 2,015 fuel centers and more than 710,000 associates across 48 states and the District of Columbia. The combined entity — serving some 85 million households — also would be the nation’s fifth-largest retail pharmacy operator, with 3,972 pharmacies.

The day of the merger announcement, Lee expressed concern over one grocery retailer wielding so much market power when U.S. shoppers have had to digest food prices up 13% from last year.

“Utahns, like all Americans, are suffering from skyrocketing food prices. As the senior Republican member of the Senate Antitrust Subcommittee, I will do everything in my power to ensure our antitrust laws are robustly enforced to protect consumers from anticompetitive mergers that could further exacerbate the financial strain we already feel in the grocery store checkout aisle,” Lee stated.

Assessing market overlap

In their letter to the FTC, Klobuchar, Blumenthal and Booker pointed to the 2015 merger of Albertsons and Safeway, which created a company with 2,230 stores, 27 distribution centers and 19 manufacturing plants and over 250,000 employees across 34 states and D.C. They urged the FTC to exercise more scrutiny in its market-by-market analysis of a potential Kroger-Albertsons combination than the commission did in reviewing the Albertsons-Safeway deal.

“The grocery industry has become increasingly consolidated. When Albertsons merged with Safeway in 2015, the FTC found that the merger was likely to harm competition in 130 separate markets and required the company to sell more than 150 stores. Given the increases in food prices recently, we question whether the divestitures that the agency secured when approving that deal were sufficient, especially since Albertsons was allowed to buy back many of the stores that the FTC required it to sell,” the lawmakers said in the letter.

“We understand that, last fall, the FTC launched an investigation into grocery prices and the availability of food products, sending data requests to a number of companies, including Kroger,” they added. “We ask that the agency incorporate the findings from that investigation in its analysis of this newly proposed merger.”

Sens. Bernie Sanders (I., Vt.) and Elizabeth Warren (D., Mass.) on Twitter gave thumbs-down to a possible union of Kroger and Albertsons. They said the deal would lift grocery prices higher, lead to job cuts and impact the supply chain.

“At a time when food prices are soaring as a result of corporate greed, it would be an absolute disaster to allow Kroger, the 2nd-largest grocery store in America, to merge with Albertsons, the 4th-largest grocery store in America. The Biden administration must reject this deal,” Sanders tweeted on Oct. 13, when news of a potential merger emerged.

Likewise, Warren tweeted on Oct. 15, “Grocery chains like @Kroger and @Albertsons are price-gouging families with inflated food prices, and further corporate consolidation would result in higher prices, employee layoffs and weaker supply chains. The @FTC should oppose this deal.”

To help win regulatory approval of the merger, Kroger and Albertsons plan to form an Albertsons Cos. subsidiary dubbed SpinCo that would be spun off to Albertsons shareholders just before the transaction’s closing and operate as a stand-alone public company. The two grocers said store divestitures are expected, and the retailers would work together to determine which locations would become part of SpinCo. They estimated that SpinCo would comprise 100 to 375 stores and “create a new, agile competitor.”

Together, before store divestitures, a merged Kroger-Albertsons would hold an estimated 19% of the U.S. grocery market, putting it second to a 25% share for leader Walmart (30% including Sam’s Club) and just ahead of third-largest player Costco Wholesale at a 9% share, according to BofA Securities analyst Robert Ohmes. In a research note, he said Southern California, Chicago, the Pacific Northwest, eastern Texas (Dallas and Houston), Denver, Phoenix and greater Washington, D.C., currently present the heaviest market overlap for Kroger and Albertsons in terms of store locations.

“The regulatory review process for the Kroger/Albertsons merger could last more than a year, as the two companies will need to work with each other and the FTC on which stores will be divested into this newly created stand-alone company (“SpinCo.”),” CFRA Research analyst Arun Sundaram said in an email. “Kroger and Albertsons estimate SpinCo will have between 100 and 375 stores (2% to 7.5% of total Kroger/Albertsons store base), but we think this number could be revised higher given Kroger/Albertsons store overlap issues in the Midwest/West Coast and the need for SpinCo to have adequate size and scale to effectively compete with the grocery giants.”

Added scrutiny required?

According to Christine Bartholomew, a State University of New York at Buffalo law professor and antitrust scholar, the ability for a combined Kroger-Albertsons to better compete against grocery market giants like Walmart and Amazon in itself doesn’t justify such a large merger.

“Regulators should not approve the merger simply because two competitors want to compete more effectively with the prevailing dominant big box or online retailer. Nor is inflation enough to justify losing one of the top-three market players,” Bartholomew said in commentary on the proposed Kroger-Albertsons transaction. “If regulators treat these justifications as reason enough to approve the merger, the long-term ramifications are significant. It could drive further consolidation across multiple industries at a period in time already marked by significant market concentration. Long term, this would mean less consumer choice.”

If a merger is approved, the benefits that Kroger-Albertsons expects to achieve from economies of scale and synergies — including lower prices for consumers — would still remain to be seen, Bartholomew noted.

“Most every merger includes promises of lower prices. But merging doesn’t magically reduce costs — and not all cost reductions impact our pocketbooks,” she explained. “While merging may allow the grocery chains to reduce redundant overhead, it’s not clear that those gains will be passed on to consumers. This is a particular concern when the second- and third-largest players in an industry are planning to merge.”

On the regulatory side, the Kroger-Albertsons deal presents a litmus test for the Biden administration, which has espoused a more consumer-protection stance in terms of mergers-and-acquisitions oversight.

“The Federal Trade Commission under the current administration has publicly articulated a more pro-consumer, stronger oversight posture,” Bartholomew stated. “Its position on this merger will be the first real test of whether the FTC plans to align its words and regulatory actions.”