US economic outlook and housing price dynamics

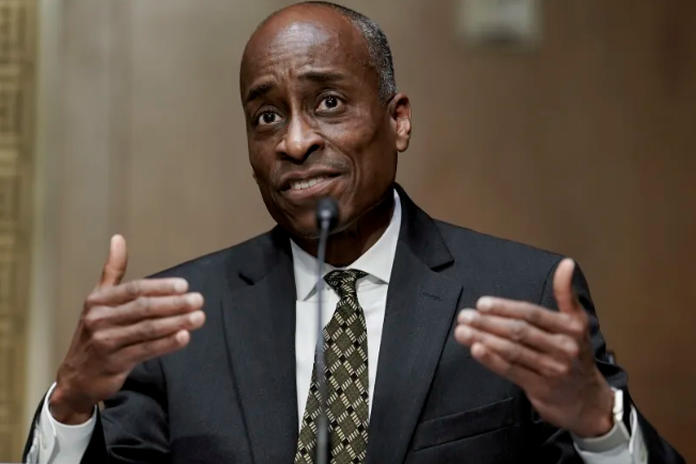

By Vice Chair Philip N. Jefferson

- At the Mortgage Bankers Association’s Secondary and Capital Markets Conference and Expo 2024 New York, New York

First, I’ll share with you my current outlook for the US economy. Second, I’ll discuss my thinking on the current stance of monetary policy. Third, I’ll review the dynamics of housing prices which can feed into the persistence of inflation.

My focus on housing price dynamic stems from the role housing plays in the American economy. For most families, a home is their largest-ever purchase and their most valuable asset. Capital markets professionals in real estate finance, like you, are crucial to the smooth operation of the housing sector. Families making housing decisions rely on a healthy and productive housing finance sector.

The housing sector is also one of the most interest rate–sensitive sectors of the economy. As such, it’s an important channel of monetary policy transmission. Understanding the various channels of monetary transmission is crucial to fulfillment of the dual mandate given to the Federal Reserve by the Congress: maximum employment and stable prices. This mandate guides my thinking about monetary policymaking. With that, I’ll turn to my outlook for the US economy.

Aggregate economic activity

The US economy continues to grow at a solid pace. Adjusted for inflation, GDP was reported to have increased at a 1.6 percent annual rate in the first quarter of 2024. That was a moderation from a 3.4 percent expansion in the fourth quarter of last year. However, private domestic final purchases, which excludes inventory investment, government spending, and net exports and usually sends a clearer signal on underlying demandgrew 3.1 percent in the first quarter. That was about as strong as the second half of 2023.

Indeed, consumer spending has been robust over the past several quarters. Nevertheless, I expect spending growth to slow later this year as restrictive monetary policy weighs on demand, particularly on interest-sensitive spending.

Another reason for the strong performance of the US economy over the past year is improving supply conditions as pandemic bottlenecks have unwound. I will be monitoring incoming data to understand better how much more help we will get from the supply side to bring inflation down further.

The labor market

The labor market remains solid. Monthly payroll gains slowed in April, with employers adding 175,000 jobs. Still, employers added an average of 242,000 jobs in the three months ended in April, and the unemployment rate remained below 4 percent last month.

The supply of workers and the demand for labor continue to come into better balance. The labor force participation rate of individuals aged 25 to 54 is now higher than before the pandemic began, as shown in figure 1. Employers’ need for workers, as measured by job openings, declined 12 percent from a year earlier, as shown in figure 2. This rebalancing of the labor market has resulted in nominal wage growth easing even as unemployment remains historically low.

Inflation

Of course, I have been keeping a close eye on inflation. The good news is that inflation has eased dramatically from the peak reached almost two years ago, as shown in figure 3. However, inflation remains above the Federal Open Market Committee’s (FOMC) 2 percent inflation objective.

Core personal consumption expenditures (PCE) prices, which exclude volatile food and energy costs, rose at a faster pace over the first three months of the year than they did in the latter part of 2023. The April consumer price index and producer price index data point to a more modest increase last month. Even so, Federal Reserve staff estimate that core PCE prices rose at an annual rate of 4.1 percent over the first four months of the year. That is well above the 12-month change, which we estimate at 2.75 percent. It is too early to tell whether the recent slowdown in the disinflationary process will be long lasting. The better reading for April is encouraging.

Fortunately, data on expectations suggest that the FOMC’s inflation-fighting credibility remains intact. While there has been a recent uptick in Americans’ inflation expectations over the next 12 months, long-term inflation expectations, over the next 10 years, remain close to pre-pandemic levels. That shows the American people believe that we will make good on our commitment to bring inflation fully back to our objective. I am acutely aware that high inflation imposes significant hardship as it erodes purchasing power, especially for those on fixed incomes and those least able to meet the higher costs of essentials, including housing, transportation, and food. That is why my colleagues at the Fed and I are so committed to returning inflation to our target.

Monetary policy

So, what does the current state of the economy mean for the policy rate we set at the Fed? At the most recent meeting, three weeks ago, my colleagues and I on the FOMC decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. I believe that our policy rate is in restrictive territory as we continue to see the labor market come into better balance, and inflation decline although nowhere near as quickly as I would have liked. The FOMC noted that it does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In making judgements about the appropriate stance of policy rate over time, I will be carefully assessing the incoming data, the evolving outlook, and the balance of risks.

At its last meeting, the FOMC also decided to continue the process of reducing our balance sheet, but at a slower pace. The cap on Treasury redemptions will be lowered from the current $60 billion per month to $25 billion per month as of June 1. Consistent with the Committee’s intention to hold primarily Treasury securities in the longer run, we’re leaving the cap on agency securities redemptions unchanged at $35 billion per month. We will reinvest any proceeds in excess of this cap in Treasury securities, as detailed in the May 1, 2024 operating policy statement published by the Federal Reserve Bank of New York.

The housing market

The Fed sets policy to promote its dual-mandate objectives of maximum employment and price stability, and employment and inflation depend on conditions in the entire economy. Still, given our gathering today, I thought it would be appropriate to dive a bit deeper into the housing and home finance markets.

As I said earlier, the housing sector is one of the most interest rate–sensitive parts of the economy. We have seen that sensitivity in mortgage rates and mortgage originations. As shown in figure 4, 30-year fixed-rate mortgage rates were close to 3 percent when the federal funds rate was near the zero lower bound in 2020 and 2021. Rates surged in 2022 as the federal funds rate increased. Consistent with the increase in mortgage rates, mortgage origination volume has fallen significantly.

The current restrictive stance of monetary policy has weighed on the housing market. That is helping to bring supply and demand into better balance and put downward pressure on inflation. One aspect of inflation that has gotten a fair amount of attention is housing and rental costs. This is because housing costs make up such a large share of household budgets. To calculate housing services inflation, government statistics don’t use home prices because a home is partly an investment.

Instead, housing services inflation is computed using monthly rents that capture what tenants pay to rent a house or apartment and what homeowners would, in theory, pay to rent their own home. The way this calculation is derived means changes in market rents – or what a new tenant pays to rent – take a long time to pass through to PCE housing services prices, as shown in figure 5. In this figure, notice that increases in market rents, the blue and red lines, peaked in 2022, and PCE housing services inflation, the black line, lagged market rents and peaked in 2023.

Lags in housing services inflation

The primary reason for this lag is that market rents adjust more quickly to economic conditions than what landlords charge their existing tenants. This lag suggests that the large increase in market rents during the pandemic is still being passed through to existing rents and may keep housing services inflation elevated for a while longer. This observation is important because it is an example of one of the underlying sources of lags with which monetary policy affects inflation.

Another factor affecting pass-through of restrictive monetary policy is that fixed-rate mortgages are common in the US. It is often argued that this loan structure dampens the effect of monetary policy. Figure 6 shows that the 30-year fixed mortgage rate is about 7 percent, while the average outstanding mortgage rate is about 4 percent. This lower outstanding mortgage rate is due to households who locked in rates during lower-interest periods, including when the Fed cut the target range for the federal funds rate to near zero shortly after the pandemic took hold. Fixed-rate mortgages do dampen the effect of monetary policy, but, according to recent research, not as much as previously thought.

There is a delay between when mortgage rates go up and when household mortgage payments go up, as shown in figure 7. Board staff research documents that mortgage payments go up over time because many households continue to refinance their mortgage or move. Despite higher rates, households in the US borrowed over $1.5 trillion in new mortgage loans in 2023. These borrowers include first-time homebuyers, existing homeowners moving between homes, and homeowners obtaining cash-out refinances.

The payment they owe on that recently obtained mortgage is higher than it would have been had lower rates been maintained, and their consumption may be correspondingly lower. The cumulative effect of a higher interest rate on aggregate mortgage payments grows over time as more new loans are originated at the higher rate. The staff’s research documents that, historically, borrowers like these who are not deterred by higher rates are responsible for a little over half of the pass-through of interest rates to mortgage payments.

Conclusion

In closing, let me reiterate why we care about housing. The housing sector is where many households have made, or will make, their largest investment. Therefore, the prices that families pay for that housing can affect their overall well-being. The work you do to make housing accessible is an important part of the economy.

The housing sector is also a key part of the transmission mechanism of monetary policy. That is one reason why policymakers will continue to pay close attention to this vital sector. Of course, no one sector dictates monetary policy. We look at the totality of the data to set policy and achieve the objectives given to the Fed by Congress: maximum employment and price stability. Considering the lagged effects of monetary policy, I am encouraged that over the past two years, we have made good progress toward our dual-mandate objectives.

Source: caribbeannewsglobal.com