Wheat shows signs of price liftoff

The current rally is supported by strong demand and low supplies and could be sustained by existing production problems

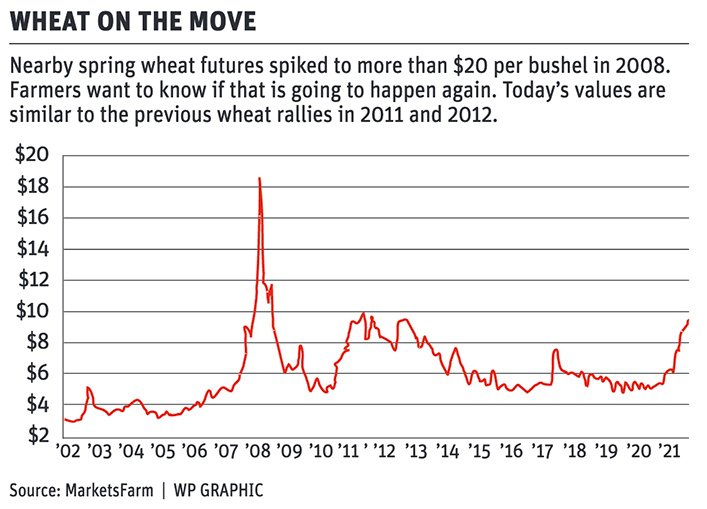

MarketsFarm analyst Bruce Burnett put up a slide showing how nearby spring wheat futures prices spiked above $20 per bushel in 2008.

“The question I get the most from farmers is, are we going to see that again?” he said during his Farm Forum Event 2021 virtual presentation.

His answer is that he doubts it.

However, nearby futures prices could shoot up to the $13 to $15 range if there is a major threat to winter wheat crops in the European Union, the Black Sea or the United States.

He noted that it is very dry in some of the main U.S. hard red winter wheat growing states, such as Texas, Oklahoma, Colorado and portions of western Kansas.

Australia is having huge quality problems with its wheat crop with a lot of the key growing areas receiving three to four times the normal rainfall during harvest time in November.

“Those rains have been devastating. White wheats sprout very easily and that’s the primary wheat that Australia grows,” said Burnett.

The March Minneapolis spring wheat contract closed at $10.22 on Dec. 9, which is already slightly higher than the previous wheat market rallies in 2011-12 and 2012-13.

The primary reason for today’s strong prices is the U.S. Department of Agriculture’s November estimate of 48 million tonnes of ending stocks for the world’s major wheat exporters.

Any time that number gets to the 50 million tonne range, it tends to spark a rally. In 2007-08 it dropped as low as 43 million tonnes.

Burnett said the current rally is supported by strong international demand in addition to the shortage of supplies.

That demand is coming from some unusual places this year. Nigeria, Ecuador and Peru were the top three buyers of Canadian wheat in October.

They are usually good customers but seldom leading the way.

Demand from all across Latin America has been unusually robust due to high ocean freight rates leading to shifting buying patterns.

African countries have also been active in this environment of high prices and low export volumes.

Burnett estimated Canada will ship out 12.25 million tonnes of its total supply of 24 million tonnes of wheat. It already exported 4.2 million tonnes through week 17 of the crop year.

He forecasts a “very, very tight” 3.9 million tonnes of carryout.

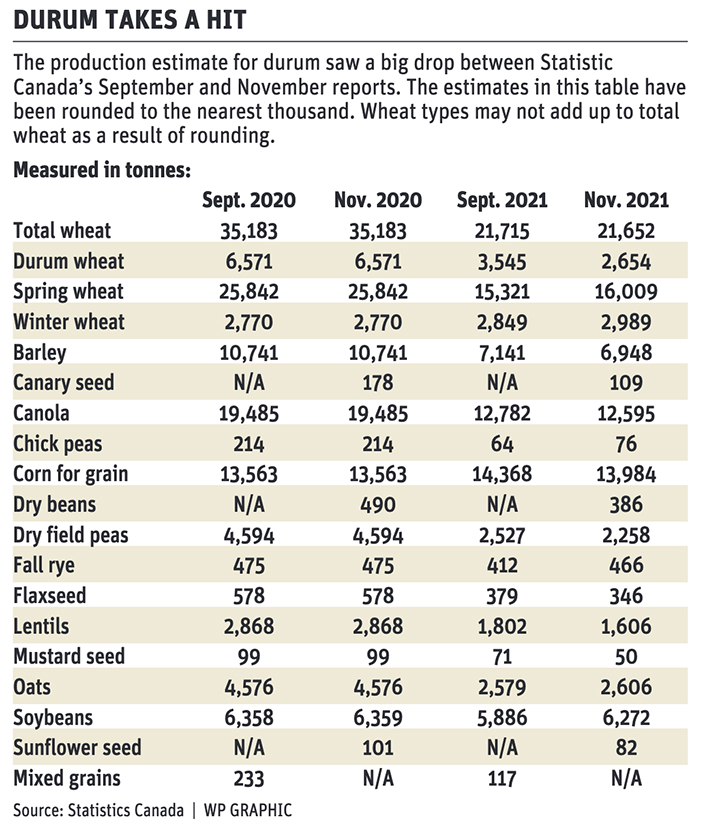

It is going to be even tighter for durum. Statistics Canada is estimating 2.65 million tonnes of production, the smallest Canadian crop since 1988.

Bid prices are $20 per bu. in southwestern Saskatchewan and it would probably take another $1 or $2 to trigger any transactions.

The spread over spring wheat bids is about $8 per bu., which is extremely wide.

Burnett estimates total Canadian supply at 3.4 million tonnes, which is less than half of last year. Exports are forecast at 2.3 million tonnes, down 3.5 million tonnes.

Nigeria was Canada’s top durum customer in October, which is highly unusual. The main buyers are usually Italy, North Africa and the Middle East.

“Certainly Nigeria is not on that bingo card,” he said.

Burnett forecasts a paltry 372,000 tonnes of carryout, which will barely be enough to service the North American milling market for the first couple of months of the 2022-23 crop year until new supplies arrive.

He said Canadian farmers will plant an extra 600,000 acres of durum this year, largely at the expense of spring wheat plantings, which are forecast to fall 900,000 acres.

That should result in four to 4.5 million tonnes of durum production, which won’t be enough to ease the global supply crunch in 2022.

Australia’s recently harvested durum crop is in trouble because it is mainly grown in Queensland and northern New South Wales, two regions that were deluged by November rains.

“Quality on the durum side from Australia is not going to be good. This year we’re going to see a lot of durum that doesn’t make grade in terms of export quality,” said Burnett.

Source: producer.com