Armed with a sharpened omnichannel game plan, global food retailer Ahold Delhaize forecasts accelerated growth rates starting in 2023 that will generate another €10 billion ($11.44 billion) in sales by 2025.

In the Ahold Delhaize Investor Day 2021 webcast on Monday, President and CEO Frans Muller said the Zaandam, Netherlands-based company also projects its net consumer online sales to double by 2025, at which time the retailer expects to achieve “fully allocated” e-commerce profitability.

“We have four big priorities we are doubling down on for the next four years: Serve our customers through deeper digital relationships, accelerate our omnichannel transformation and continue to be the best local operator, lead the transformation into a healthy and sustainable food system, and create the one-stop shop for smarter customer journeys,” Muller said in the video call. “These priorities tie straight into our vision to create the leading local food shopping experience. Leading, at the very least, means being the No. 1 grocery brand in all the markets we serve.”

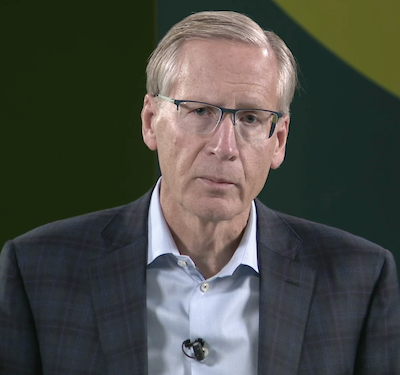

“With our proven model from Europe, we have the unique opportunity to win in these urban markets.” — Frans Muller, President & CEO, Ahold Delhaize (executive photos courtesy of Ahold Delhaize)

“With our proven model from Europe, we have the unique opportunity to win in these urban markets.” — Frans Muller, President & CEO, Ahold Delhaize (executive photos courtesy of Ahold Delhaize)

Reflecting Ahold Delhaize’s “connected customer” vision are key initiatives in the United States and Europe aimed at creating “omnichannel ecosystems” that capitalize on densely populated markets with strong affinities for the company’s local brands.

For example, Ahold Delhaize USA’s The Giant Company has continued to expand its presence in Philadelphia with more stores and, most recently, via the launch of an automated online fulfillment center that also will extend the Carlisle, Pa.-based chain’s reach into southern New Jersey. And in metropolitan New York, Ahold Delhaize USA is coordinating efforts between its Quincy, Mass.-based Stop & Shop chain and New York City-based online grocery subsidiary FreshDirect, acquired in January, to develop a deeper omnichannel offering that will bring more convenience, personalization and value to area customers.

Both Giant and Stop & Shop — as well as Scarborough, Maine-based Hannaford — recently introduced 30-minute online grocery delivery services, including for fresh and prepared foods and staple items. Landover, Md.-based Giant Food also is slated to launch an “endless aisle” service called Ship2me in the second half of this year, initially offering another 40,000 general merchandise and food items.

“Let me describe to you what we mean by a connected customer,” Ahold Delhaize USA CEO Kevin Holt said during the event. “Our customers’ lives are constantly in motion. They’re looking for convenient and personalized solutions to save time in their day so that they can enjoy the moments that matter. Our strategy is built on providing relevant omnichannel solutions so our customers can enjoy the moments that matter in their lives.

“We’ve seen our digitally engaged customers grow by 56% in the last two years.” — Kevin Holt, CEO, Ahold Delhaize USA

“We’ve seen our digitally engaged customers grow by 56% in the last two years.” — Kevin Holt, CEO, Ahold Delhaize USA

“And our strategy is resonating,” Holt noted. “Over the last two years, we’ve seen significant digital growth across all segments of our customer base. In fact, we’ve seen our digitally engaged customers grow by 56% in the last two years.”

Muller pointed to Ahold Delhaize’s efforts in Philadelphia and metro New York to illustrate the company’s post-pandemic thinking and expectations on the way consumers are evolving.

“As we look throughout our portfolio, the new urban centers are critical points of influence for customers. They drive cultural influence for the surrounding area to drive commerce, and they are the focal points for busy customers’ lives,” explained Muller. “With our proven model from Europe, we have the unique opportunity to win in these urban markets. The plan we have just executed to win in Philadelphia is a first export of this to the U.S. Those learnings will now be taken to drive a clear win in New York’s strategy, creating an ecosystem encompassing Stop & Shop, FreshDirect and their partners to offer a unique proposition.”

In Europe’s Benelux region, Ahold Delhaize on Monday announced plans to explore a subsidiary initial public offering (sub-IPO) for its bol.com e-commerce marketplace. The company expects the sub-IPO to kick off in the second half of 2022, and the offering would involve a listing of a limited interest on Euronext Amsterdam. Ahold Delhaize said it would retain significant control over bol.com in the long term.

Ahold Delhaize’s rationale is that the sub-IPO would leverage the strengths of bol.com, supermarket brands Albert Heijn and Delhaize, food and drug chain Etos, and wine and liquor chain Gall & Gall to form a “first-of-a-kind customer ecosystem” in which the Benelux brands would connect shopping experiences across food and nonfood.

“Retailers who can simplify the customer journey will be most relevant in the long term, and powered by bol.com we believe we can be one of them,” according to Wouter Kolk, CEO of Ahold Delhaize Europe & Indonesia. “With the combined strengths of all the brands in the Benelux, we have a one-of-a-kind opportunity to create a truly comprehensive customer ecosystem.”

“With more tech-savvy customers and diverse competitors than ever before, leading digi-tech, omnichannel and sustainability are the key differentiators for successful food retailers going forward.” — Natalie Knight, CFO, Ahold Delhaize

“With more tech-savvy customers and diverse competitors than ever before, leading digi-tech, omnichannel and sustainability are the key differentiators for successful food retailers going forward.” — Natalie Knight, CFO, Ahold Delhaize

Back in the U.S., an ongoing shift to a self-distributed, integrated supply chain serving stores and e-commerce remains a critical component of Ahold Delhaize’s growth, executives said. Last month, ADUSA Supply Chain, the retailer’s distribution and logistics arm, reported that it hit its 2021 target for the transformation by raising self-managed center-store volume to 65%. Under a three-year supply chain strategy unveiled in December 2019, Ahold Delhaize aims to have over 85% of its U.S. distribution network self-managed by the end of 2022.

“With these changes, we will not only have full control of our supply chain, but an optimized network at scale, which will enable the local brands to better serve their omnichannel customers and create one of the largest supply chain networks on the East Coast,” Holt explained. “The transformation will continue to create value that will allow us to continue to invest in automation and digital capabilities and to lower our cost-to-serve and enable our direct-to-consumer relationships as we build this omnichannel network out.”

Holt said the migration to the integrated, self-distribution network is expected to be completed in April 2024 and encompass 26 distribution centers. In the Investor Day presentation, ADUSA Supply Chain President Chris Lewis reported that the network will include 25 traditional DCs and food processing facilities, 28 e-commerce fulfillment centers, and more than 1,500 click-and-collect sites by the close of 2022.

“As we expand, we’re deploying key technology capabilities to optimize the supply chain,” Lewis said. “At scale, we’ll have a fully deployed transportation management system, which is driving efficiency across the network, reducing overall miles on the road and getting product to stores and e-commerce centers faster.”

“We’re deploying key technology capabilities to optimize the supply chain.” — Chris Lewis, president, ADUSA Supply Chain

“We’re deploying key technology capabilities to optimize the supply chain.” — Chris Lewis, president, ADUSA Supply Chain

To support its strategic goals, Ahold Delhaize plans to raise capital expenditures from about 3% to 3.5% annually. Chief Financial Officer Natalie Knight said investments will focus on building scalable and repeatable operational capabilities — namely in digital, online, data and automation — to provide shoppers relevant products and services, promotions, personalized experiences and premium subscription memberships. The company also expects to deliver annual underlying earnings-per-share growth in the high single digits from 2023 to 2025 and its cumulative “Save for Our Customers” cost-efficiency initiatives to yield €4 billion ($4.58 billion) from 2022 to 2025.

“We start as always with customer lens. We plan to further strengthen our position as a technological and an AI [artificial intelligence] leader in the food industry. We will clearly over-index to omnichannel and digi-tech projects, real-time data capabilities and automation,” Knight explained. “Our growth agenda at bol.com and sustainability will also require significant funds to realize their full potential on this journey. We will not leave our stores behind. We will continue to deliver vibrant, new, modern store formats and experiences powered by and featuring tangible sustainability improvements as such.

“We are lifting our medium-term guidance on capex from 3% per annum to around 3.5%,” she said. “We know this is a level above most of our peers, but with more tech-savvy customers and diverse competitors than ever before, leading digi-tech, omnichannel and sustainability are the key differentiators for successful food retailers going forward. And that’s where we plan to be. These are key growth drivers. They require significant upfront investments to reach scale.”

On Friday, Ahold Delhaize announced that the company and its brands now aim to reach net-zero carbon emissions across operations by no later than 2040 (Scope 1 and 2 emissions) and become net-zero businesses across their entire supply chain, products and services (Scope 3 emissions) by no later than 2050. Previously, the company targeted net-zero emissions by 2050. The new timetable follows an update of the company’s health and sustainability goals in February.

“We realize that these are ambitious targets, which require a lot of work over the coming years, and we feel encouraged by our double AA rating upgrade by MSCI and recently confirmed DJSI leadership position,” Muller stated about the accelerated net-zero targets. “But most importantly, we are confident that these and the other targets included in today’s strategy update are achievable because of our highly engaged and committed associates.”