Beware mainstream news when watching commodities

If you read mainstream news headlines and follow social media chatter for your sense of where commodities are going, you probably assume coal is a dead commodity.

After all, fossil fuels are dying, right? “Green” technologies are taking over. Lots of prognosticators in the media and your Aunt Sally on Facebook say so.

I heard that some bank or pension plan said they wouldn’t invest in fossil fuel producers any longer, by gum.

And Elon Musk, eh? Electric cars and stuff. Billionaires in space and the like. That’s the future. Few understand this.

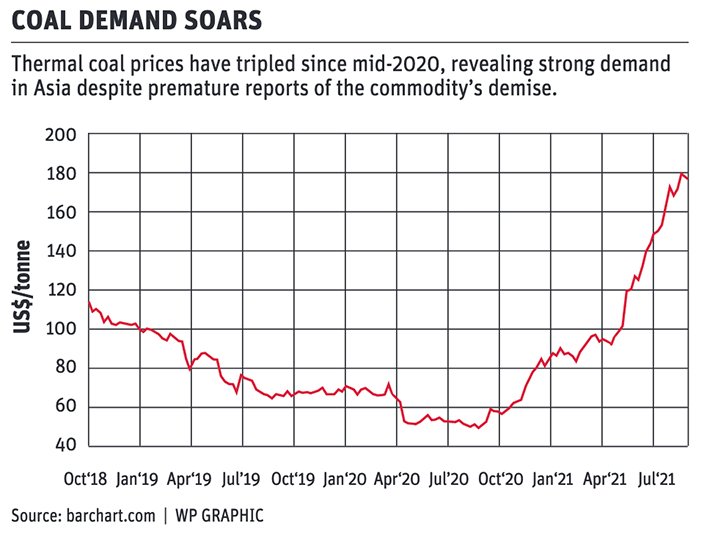

But if you follow market charts, you’ve seen thermal coal — the filthy, carbon-packed stuff used to create energy — soar in price this year. Prices have tripled since mid-2020 and are hitting records.

“Soaring demand for the world’s least-liked commodity sees thermal coal prices jump 106 percent this year,” said a recent headline on CNBC.

Why’s that?

“China and India send coal prices soaring amid green-energy push,” noted the Nikkei news agency in another recent headline. What that headline means is that coal prices are soaring despite the green energy push.

(I don’t include wire services or business sections of other media when sneering at sources of news headlines since they tend to notice what’s really going on.)

If you’d been betting on coal prices shrivelling and dying, perhaps by going short coal futures, you’d have lost a few shirts by now.

Coal demand ain’t going anywhere dramatic any time soon, and that makes it typical of many fundamental commodities that the world relies upon. That’s why people who invest in commodities and commodity production, and that includes farmers, need to have a pretty thick skin when it comes to predictions about the demise of their products.

For coal, the most outrageously negative of all the carbon-based energy sources, the reality is that the Chinese intend to keep using more of the stuff at least until the mid-2020s, and only slowly wean themselves off it in coming decades.

The Indians and Vietnamese are similar, except they aren’t really showing any real signs of leaving coal behind. All three countries are still building coal-fired plants.

It’s easy to get distracted by headlines about North American and European decisions to dump coal, but since that only makes up about 10 percent of world consumption, who cares?

Asia uses about 60 percent. That’s what matters. But we don’t pay much attention to that, so we tend to get it wrong.

If you followed the headlines for meat, you’d think those commodities were going to be soon extinct too.

Everybody says it’s terrible that cattle belch methane and yells that the world should get rid of cows. Plant proteins are showing up big-time in bogus-burgers and somebody’s kid likes them fine. I think I saw that on Facebook. Must be true.

Everybody’s got their gitch in a knot about glyphosate and wants it banned. It must be history too. As are neonics, synthetic fertilizer, and lace-up shoes.

That’s what reading mainstream headlines gives us: an utterly false sense of what’s happening in the world. It’s a completely useless indicator of anything for commodity investors, like farmers. It sort of seems like what’s going on out there, but it isn’t really what’s happening.

Where should farmers and other commodity producers look for a better sense of direction?

As I said above, the wire services (especially Reuters and Bloomberg) tend to notice what’s actually happening in the real world. They are, oddly, often more reflective of what’s going on in the average family’s life than the mainstream media.

This spring, when lumber prices soared, masses of ordinary people got sticker shock and put off renovations. The only people really covering that until the peak was almost past were reporters in the wire services and business press. Mainstream coverage tends to mean that a trend is about to end. You can sometimes trade on that.

Industry or commodity-specific newsletters are also a good source of relatively sensible information. The company that owns this newspaper also owns a news service (MarketsFarm) that publishes a well-respected newsletter. That’s a sensible place to look for an idea of where things might be going.

I tend to look at long-term charts to see where I think things are going to go. I believe charts tell the Truth, if you can speak the language, just like with reading the Hebrew Old Testament and the New Testament in ancient Greek.

Really, like the rest of you, I’m just guessing what’s really written there and how to interpret it.

But as dodgy as that level analysis might seem, it’s a lot better than the kind of “analysis” you get from reading mainstream headlines and paying attention to what appears in the popular press.

I remember a couple of years ago fending off suggestions, from somebody close to me, to invest in cannabis stocks. That’s what the headlines were making look good at the time.

I’m glad I resisted that.

I wish I’d gone with my gut and gone long thermal coal futures about a year ago. The charts were making coal look like an epic rebound contender. Smart people in the business press and wire services were saying it was oversold.

But of course, I dithered, rattled by all those mainstream headlines saying fossil fuels were dead and we were going to have a “green recovery” from the pandemic.

Thermal coal is a terrible commodity. It’s the worst offender on the planet when it comes to climate change. But it’s an honest one, at least on the charts.

Source: producer.com