Biodiesel use to decline in EU

There is a good news/bad news scenario emerging for canola oil in the European Union’s biodiesel sector, according to a Rabobank report.

The bad news is that diesel demand is expected to fall with the increased adoption of electric and hydrogen vehicles.

The electric share of new car registrations in the EU is expected to surge to 65 percent by 2030, up from 1.6 percent in 2019. Hydrogen vehicles would account for another 13 percent.

That is a lot of new cars that won’t be burning biodiesel and renewable diesel. However, the vast majority of older vehicles still rely on gasoline and diesel fuel.

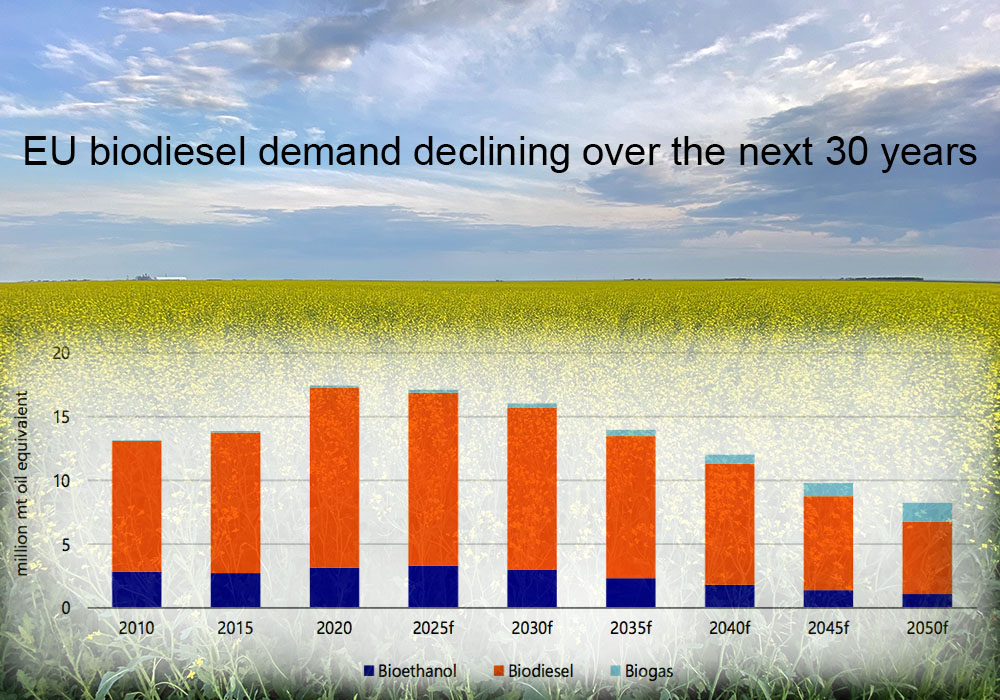

Rabobank is forecasting a four percent reduction in EU biodiesel demand by 2025. It will shrink a lot further by 2030 and beyond to the point where some production plants will be forced to shut down in the 2040 through 2045 period.

An estimated 59 percent of EU biodiesel feedstock is imported, such as soybean oil from South America and the United States and palm oil from Indonesia and Malaysia.

“The rest (41 percent) is produced domestically in the EU, with the biggest share going to rapeseed oil,” stated the report authored by Maria Alfonso, senior grains and oilseeds analyst with Rabobank.

Some of that EU rapeseed oil is made from imported Canadian canola, so an overall reduction in biodiesel demand would hurt sales.

The good news for Canadian canola growers is that palm oil is being completely phased out of the EU’s biodiesel sector between 2023 and 2030.

That is why Rabobank is forecasting a six percent increase in rapeseed/canola oil use in 2025 over 2020 levels despite the overall reduction in biodiesel demand.

It expects rapeseed oil to receive an even bigger boost in demand after 2025 as palm oil’s retreat becomes even more pronounced.

Brian Voth, president of IntelliFARM, said the EU might not want to rely too much on increased canola imports to replace the lost palm oil supplies due to the looming wave of additional canola crush capacity in Canada.

“When you factor in all the new crush demand that’s like an extra five million tonnes of demand, 50 percent more crush demand when all these new plants are up and running,” he said.

“That limits our ability to export unless they’re buying finished oil.”

And for logistical reasons he doubts that would be the case.

So, the EU might have to focus on other feedstocks. Rabobank said used cooking oil will be the other main beneficiary of palm oil’s misfortunes, with an anticipated 18 percent increase in demand between 2020 and 2025.

The long-term outlook for all biodiesel feedstocks is grim in the EU. By 2045 most of the EU vehicle fleet will have been replaced by electric and hydrogen vehicles, according to Rabobank.

Voth is skeptical of these types of outlooks because a lot can change between now and then.

In addition, he doesn’t think the EU has the infrastructure to support that drastic a shift in the vehicle fleet.

“Maybe Europe’s infrastructure is better than North America but there’s a whole lot of changes that need to go on to be able to even have electrical vehicle fleets in that capacity,” he said.

“If all of New York City were to go to electric vehicles it would use the entire power consumption of the whole U.S.”

Source: producer.com