Bud Light Seltzer, Truly Lemonade and Mtn Dew Zero Sugar were the top product launches of 2020, IRI says

Dive Brief:

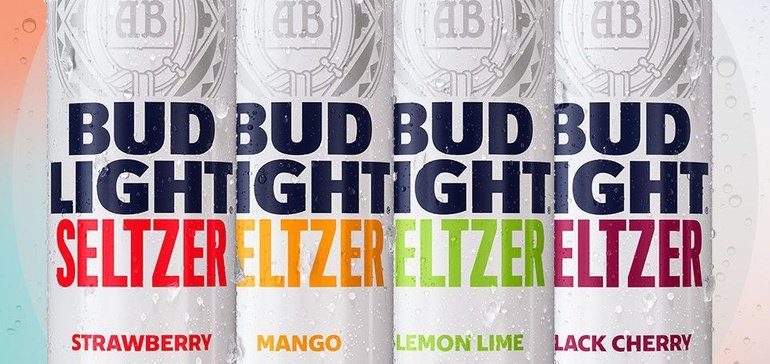

- New drinks did well during 2020 according to IRI’s latest New Product Pacesetters report, which tracks top product launches in the food and beverage industry. Ten of the top 25 food and beverage launches were drinks, with Bud Light Seltzer claiming first place. Truly Lemonade and Mtn Dew Zero Sugar came in second and third. Starbucks Creamers came in fourth. Monster Beverage’s Reign energy drink landed sixth on the list.

- Keto-friendly and sugar-free ice cream maker Rebel placed fourth. Other sweet and savory snacks made the list, including Cheetos Popcorn, Kinder Bueno and Reese’s Thins. Beyond Sausage earned the tenth spot as more consumers tried products in the plant-based meat segment during the pandemic.

- This year, less than one-quarter of product launches came from large companies, yet they represented half of the dollars spent on new product launches in 2020. Median sales for new products totaled $21.5 million, surpassing the $19 million median in IRI’s 2019 Pacesetters report.

Dive Insight:

The 2020 Pacesetters list reflects a number of pandemic-related shifts in consumer purchasing habits.

As many bars and restaurant dining rooms were shut down, COVID-19 led many consumers to increase their alcohol intake at home. Eight of the 27 beverage Pacesetters are alcohol products. Combined, they generated $547 million, marking a major increase compared to last year’s report. In 2019, the six top-performing alcohol beverages earned $198 million in sales. Additionally, alcoholic beverages in this year’s report represented 44% of the dollar sales in new beverages, compared to only 17% in 2019.

Anheuser-Busch has been making an aggressive play for the hard seltzer space, investing an additional $100 million into the category in 2019. Earning the top 2020 Pacesetter spot is a notable accomplishment for Bud Light Seltzer, and bodes well for its success against long-time major contenders in the crowded hard seltzer segment, including White Claw and Boston Beer’s Truly.

With more time to think about their health and wellness during the pandemic, many shoppers looked for ways to merge their eating habits with self-care during 2020. According to a study from the International Food Information Council, nearly one in five consumers indulged more during 2020. Another study done by IFIC showed that two-thirds of consumers are interested in learning more about the role of nutrients and food in immune health. Many consumers have looked for a balance between indulging and healthy eating.

One way many consumers think they can improve their diets is by cutting sugar. This trend, combined with sluggish traditional soft drink sales, have led a number of beverage makers to focus on innovation and reformulation to recapture consumer interest. PepsiCo’s Mtn Dew Zero Sugar also has high levels of caffeine, making it an appealing option for the energy-focused consumer. And although Reign is an energy drink, Monster markets the beverage as “total body fuel” with pre- or post-workout benefits, including amino acids and coenzyme Q10.

Hershey also made a play for the better-for-you segment with its low- and no-sugar versions of some of its classic confections, including 2020 Pacesetter product Reese’s Thins. Healthier versions of comforting sweets allowed consumers to indulge without suffering a caloric overload.

Snacking in general saw an increase thanks to COVID-19, with 37% of consumers saying they stocked up on salty snacks and frozen sweets in April 2020 to prepare for sheltering-in-place, according to a study from the NPD Group. Cheetos’ new popcorn products capture a rising tide in the popcorn segment, which many view as a healthier and lighter alternative to fried or extruded salty snacks. Popcorn sales have grown 32% at the retail level between 2012 and 2017, according to Mintel, with ready-to-eat popcorn growing 118% during the same time frame.

At convenience stores, natural health beverage ZYN dominated, followed by energy drink Reign and Bud Light Seltzer. Energy drinks and coffees rounded out the top 10 Pacesetters for 2020, including two varieties of Red Bull and two Starbucks coffee beverages. More than a quarter of consumers increased their caffeine intake during the pandemic, according to the International Food Information Council, as they juggled working from home, child care, and other quarantine stresses.

Heading into 2021, IRI anticipates consumers will continue to look for ways to balance indulgence with healthy eating and self-care. A number of brands are working to blend self-care, indulgence and convenience into new products, as many consumers will soon be returning to work in offices or spending more time outside the home.

Source: fooddive.com