Coca-Cola to discontinue sales of Coca-Cola Energy

Dive Brief:

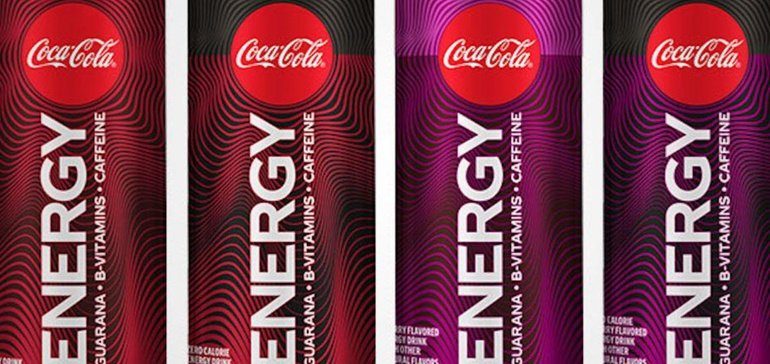

- Coca-Cola is discontinuing sales of Coca-Cola Energy in North America, the company said in an emailed statement. Beverage Digest was first to report the news.

- The beverage giant said the decision to end production comes as it streamlines its portfolio to focus on brands that are performing well. “As we scale our best innovations quickly and effectively like Aha and Coca-Cola with Coffee, we need to be disciplined with those that don’t get the traction required for further investment,” Coca-Cola said.

- Coca-Cola has ended production of many brands in its beverage portfolio to focus on drinks that are growing and have the potential to achieve a large scale. The company has been pruning brands for some time but the pace has picked up during the ongoing pandemic.

Dive Insight:

The past year has been a busy one for the beverage giant, which has ended production of a number of big-named brands. The Atlanta company announced it would discontinue production of Tab soda and Odwalla juice as part of a wider plan to eliminate an estimated 200 brands globally. And in January, Coca-Cola announced it was selling Zico, the distant No. 2 brand in the coconut water space behind Vita Coco, back to its founder.

The decision to end production of Coke Energy ends what is a short-lived time on the U.S. market for the beverage. Coca-Cola first introduced the drink here in January 2020 after debuting the beverage in Europe the prior year.

The debut was not without controversy. Coca-Cola was mired in a legal dispute with Monster Energy over whether the release of its own energy drink would violate a deal struck between the two companies in 2015. At the time, Coca-Cola purchased a 16.7% stake in Monster and agreed to distribute its energy drinks in the U.S. and Canada. Coca-Cola later won an arbitration claim allowing for Coca-Cola Energy.

Now, just over a year later Coca-Cola is ceding the market to category leaders Monster and Red Bull as well as fast-growing startups like Celsius. It also opens the door for further growth by archrival PepsiCo, which spent 2020 building up its presence in the space through a distribution deal with Bang and the purchase of Rockstar Energy for $3.85 billion.

Instead, Coca-Cola will participate in the space through its partnership and investment with Monster. The removal of Coca-Cola Energy also could make Monster a more attractive acquisition target for Coke — fulfilling a long-speculated tie up between the two companies.

Even though it is ending distribution of energy in the U.S., Coca-Cola has several other promising beverages.

Coca-Cola launched Coca-Cola with Coffee in the U.S. in January and has been investing in its sparkling water brand Topo Chico, highlighted by a deal with Molson Coors Beverage, which will manufacture, market and distribute a hard seltzer version of the drink. Aha, its sparkling water released in March 2020, also has shown promise. In addition, Coca-Cola is innovating many of its brands like Diet Coke with new flavors, and Coke Zero Sugar remains a bright spot.

Coca-Cola Energy isn’t going away, however. While it will no longer have a presence in North America, the Atlanta company said in an email it will continue to be sold in select markets around the world, including Europe.

It’s possible Coca-Cola learns from its missteps and decides to introduce an energy drink in the U.S. again, but for now, it’s wise using its resources to invest in brands that show more promise with consumers coming out of the pandemic. If it wants to be positioned well coming out of COVID-19, it makes sense to focus on offerings that are the best performing rather than brands that slow down the business and siphon off valuable time and money.