This week the PMA has run sessions in the Global Retail Week, yesterday’s session focussed in Retail in Europe, disruption and uncertainty.

In January McKinsey and Eurocommerce compiled a report on the European retail sector after surveying 50 CEOs of European grocers, 10,000 consumers and investigating industry market data on the biggest retail trends.

Jean-Albert Nyssens, Clause Gerckens, Eugen Zgraggen

Jean-Albert Nyssens from Eurocommerce opened the session by outlining the results of the report.

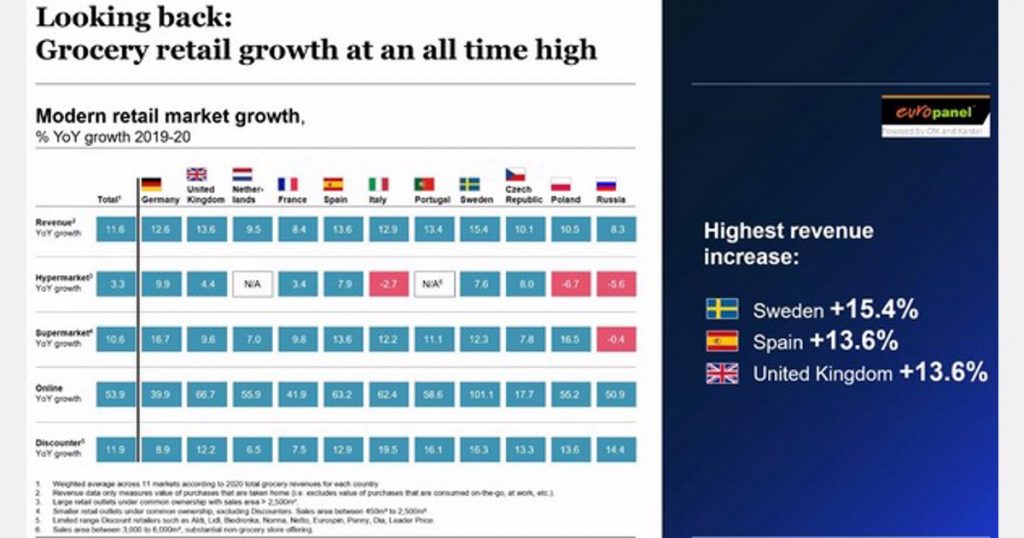

Grocery retail growth was at an all time high, “For some retailers it was their best year ever, with an average growth rate of 11.6%, the UK saw almost 14% growth in revenue YoY year from 2019 to 2020. The main reason for the growth in retail sales was that the hospitality industry was closed as were many offices and schools. The was a huge shift in in the channels of where consumers bought groceries.”

Ecommerce saw a massive increase of 53.9% as people turned to online shopping, discounters didn’t do quite as well as other retailers due the lack of online delivery services.

CEOs were asked what they saw as the top trend to shape the industry in 2021.

Downtrading and increased price sensitivity came out top, followed by scaling of online grocery business and a slow but steady return to normal were the top three answers. A higher focus on sustainability came in 4th place.

“From a consumer point of view ‘Value is king’,” explained Clause Gerckens from McKinsey. “Consumers are looking to save money and will look for the best promotions and are willing to switch to less expensive products. On the other hand they also want more healthy, sustainable products, locally sourced.”

The key points which will shape the industry are:

- Online growth

- Value is King

- Lifestyle agendas drive food demand

- Restaurants return

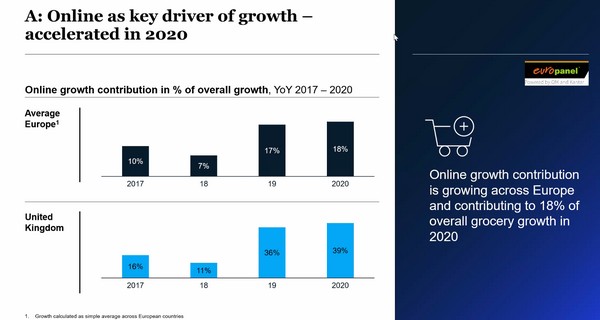

“Ecommerce saw a 39% market growth in Europe and 37% of consumers intend to look for cheaper options,“ according to Eugen Zgraggen from McKinsey. “Also 50% of consumers plan to buy more healthy, local or environmentally friendly products in 2021. These trends mean retail will become more challenging.”

Ecommerce has been a key driver of growth which has been accelerated in 2020. UK online growth was 16% in 2017, but increased to 39% in 2020. This trend is expected to continue.

“People tend to spend more online and it is people who were already regularly shopping online who bought more, it is thought that infrequent users will not continue to shop online. 37% intend to spend less on food, this is not just low income households, but one out of three people surveyed.”

More people are lifestyle driven, which means buying healthy, locally produced and environmentally friendly food. They also want to spend less which will put pressure on retailers as consumers become more complex and demanding.

“There is a very challenging time coming up as retailers try to stay profitable.”