Soybean oil now drives crop price

Soybean values have always been driven by the meal side of the crush, but that relationship is changing, say analysts.

“We’re going to be crushing for oil,” said Arlan Suderman, chief commodities economist with StoneX.

“It seems strange to say that, but these are the changing dynamics.”

Mac Marshall, vice-president of market intelligence with the United States Soybean Export Council, said oil used to account for 30 to 35 percent of the value of soybeans.

These days it is closer to 40 to 45 percent and that is likely to remain the case for years to come, he said during a recent webinar organized by USSEC.

“It’s really just a sea change to think about that value share being completely different,” said Marshall.

Soybean oil prices crossed over the 70 cents per pound threshold last week. The last time that happened was 2008 when crude oil was $140 per barrel.

This time there is a different driver. The renewable diesel sector is taking off in the U.S.

Biodiesel magazine reports that two expansions and six new renewable diesel plants under construction will add 7.57 billion litres of capacity to the existing 2.09 billion litres.

Five massive proposed plants will tack on another 12.49 billion litres of capacity.

Add it all up and it amounts to a renewable diesel sector that will be more than double the size of the existing U.S. biodiesel industry.

That will create a huge new market for renewable diesel feedstock and soybean oil is the leading candidate to meet those needs.

Canola is another crop that should benefit greatly once the U.S. Environmental Protection Agency approves canola for its Renewable Identification Number (RIN) program for renewable diesel.

This new source of demand is one of the driving forces behind the recent spate of oilseed crush announcements.

Three new canola crush plants are planned for Saskatchewan and ADM is building a soybean processing facility in North Dakota.

Suderman said it isn’t just a North American phenomenon. Green initiatives are sparking demand for biodiesel/renewable diesel in the European Union.

“They’re willing to pay virtually any price for that fuel,” he said.

The same goes for the feedstock to make it, which is why he agrees with Marshall that vegetable oil prices are likely to remain at an elevated level for years to come.

Vegetable oil supplies are extremely tight. He knows of new biofuel projects that are having difficulty locking in feedstock supplies because they’re all used up.

“They’re going to have to pull it away from somewhere else in order to get it,” said Suderman.

Vegetable oil stocks-to-use ratios are the tightest they have been in the modern era.

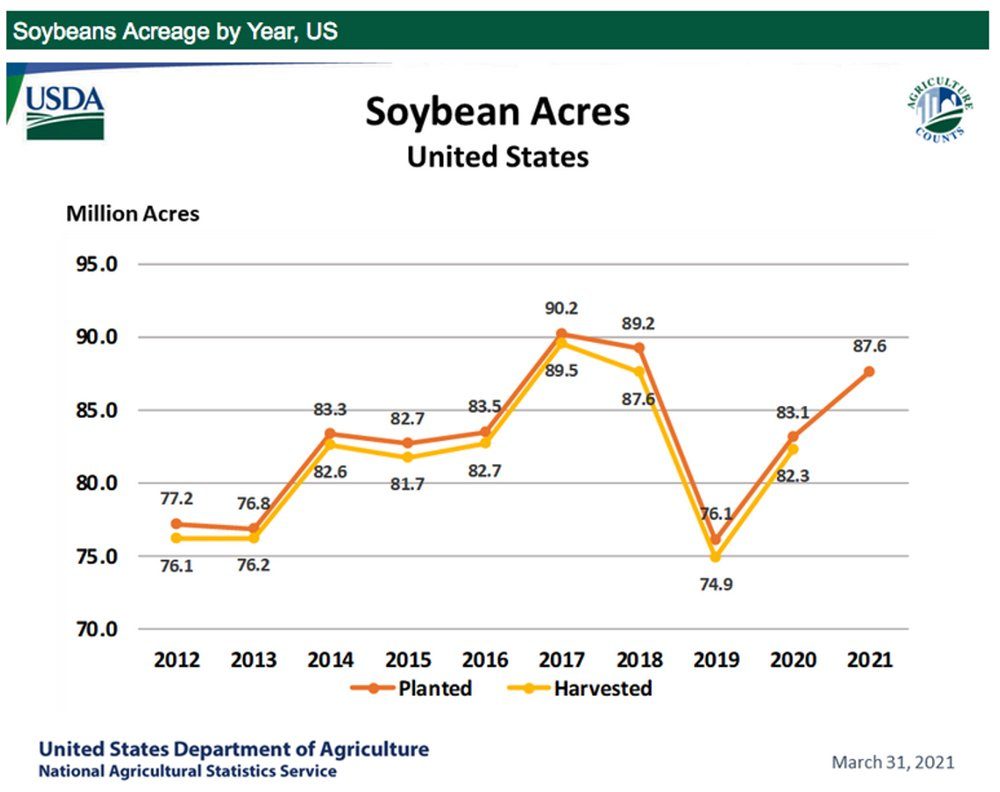

U.S farmers told the U.S. Department of Agriculture that they intend to plant 87.6 million acres of soybeans and 91.1 million acres of corn this spring.

Suderman said that isn’t going to be enough soybeans.

“If we don’t get to 90-plus million acres of soybeans we will have to ration next year unless we have above-trend yields for the crop,” he said in a different webinar put on by StoneX.

Yet through March, April and the first half of May, new crop contracts were convincing farmers to plant more corn instead of soybeans.

IHS Markit surprised traders late last week with a forecast calling for 96.85 million acres of U.S. corn and 88.49 million acres of soybeans.

Suderman said he is sticking with his forecast of 92.85 million acres of corn and 90.5 million acres of soybeans.

If farmers adhere to their intentions and plant 87.6 million acres of soybeans he expects U.S. crush will be rationed as crushers lose out to the strong export pull out of China.

That will result in even tighter North American vegetable oil supplies and upwards pressure on soybean and canola prices.

Contact sean.pratt@producer.com