Spring wheat prospects begin to fade

The first official estimate of United States spring wheat yields could be a harbinger of what’s to come in Canada, say analysts.

The U.S. Department of Agriculture forecasts an average yield of 30.7 bushels per acre, a 37 percent drop from last year.

Is a similar 37 percent decline in store for Western Canada’s crop?

“Maybe not right now but by the time we hit Aug. 1 maybe,” said MarketsFarm analyst Bruce Burnett.

“It’s entirely within the realm of possibility. I don’t for a minute think we’re an exception this year.”

Only one-quarter of Saskatchewan’s spring wheat crop was rated good to excellent as of July 12, compared to the 10-year average of three-quarters.

There has been more moisture in Western Canada than the northern Plains of the U.S. this growing season, giving Canadian spring wheat a bit of an early advantage.

“But that is rapidly diminishing as we get parked under these hot and dry conditions,” said Burnett.

Neil Townsend, chief market analyst with FarmLink Marketing Solutions, believes Manitoba’s yield potential was 25 percent below average,

Saskatchewan’s 15 percent lower than normal and Alberta’s 10 to 15 percent below par as of July 16.

But those numbers will drop the longer it stays abnormally hot and dry and that’s what was in the forecast as of July 16.

He said the Canadian Prairies is in better shape than the U.S. northern Plains with about one-quarter of the region still capable of delivering an average yield.

But the other three-quarters is looking bad to terrible.

“The question is, how much of the bad is going to fall into the terrible category based on the current forecast?” said Townsend.

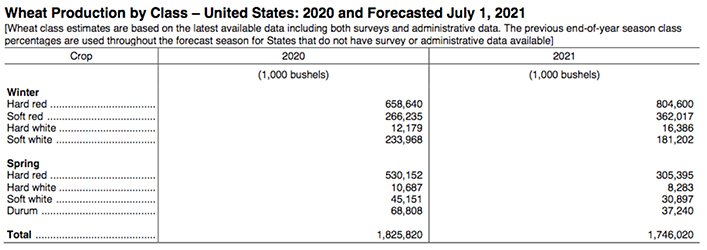

The USDA is forecasting 305 million bu. of U.S. hard red spring wheat production, down from 530 million bu. last year due to lower seeded area and the drastic cut in yields.

That would be the smallest U.S. hard red spring wheat crop since 1988.

The USDA’s total spring wheat estimate (including hard red spring wheat) is 345 million bu., which was well below the trade’s pre-report guess of 459 million bu.

Burnett was surprised that the first official estimate was that low but he thinks it reflects reality given the dismal weekly crop ratings south of the border.

Arlan Suderman, chief commodities economist with StoneX, thinks the USDA estimate may drop even further in future reports.

The USDA is assuming a 3.5 percent abandonment rate. He noted that abandonment in 1988 was 22 percent.

“We’re at 15 percent and we think it may go higher than that,” Suderman said in a recent webinar.

“We could see even tighter wheat production estimates here yet.”

That means millers in the U.S. are going to need to import more spring wheat than usual.

“If the Canadian crop is small that makes that more difficult,” said Suderman.

“Quality milling wheat this year with the good protein levels may be a real concern going forward.”

The market seems to agree. The premium for the Minneapolis September futures contract over the Kansas September futures contract was about US$2.50 per bu. on July 15.

That is well above the normal range of 45 to 65 cents and harkens back to 2017 levels.

“We’re in the process of building that premium,” said Burnett.

The market is already rationing spring wheat demand and may have to ration it further depending on weather conditions over the next month.

But he noted that there was a similar premium around the same time in 2017 that eroded quickly when the crop in Western Canada suddenly received ample rainfall.

Burnett said spring wheat demand remains very strong, so the market will be keenly focused on supply.

Townsend said excessive rainfall in Germany could result in extensive quality damage for that country’s wheat crop as well.

Heat is threatening Russia’s spring wheat crop. The crop is grown in the Volga, Urals and Siberian districts bordering Kazakhstan.

The USDA reduced Russia’s spring wheat yield compared to last month’s report and is now forecasting 21 million tonnes of production, down from 22.67 million tonnes last year.

Contact sean.pratt@producer.com

Source: producer.com