Supply shortfall looms for red lentils

Canada will face less competition in the red lentil export market this year, according to a panel of experts.

Stat Publishing is forecasting 609,600 tonnes of production in Australia, but that is extremely optimistic, according to a trader from that country.

Mostyn Gregg, with Agrocorp International, told delegates attending the Global Pulse Confederation’s Pulses 2.1 virtual conference that rainfall in the January through May period has been “horrific.”

He said Stat is using average yields but it hasn’t been an average start. Rainfall is well behind and there would need to be an extraordinary amount in spring to get back on track. But that isn’t in the forecast.

Gregg believes the crop will be sub-400,000 tonnes, or less than half of last year’s bumper 900,000 tonne crop.

“Canada is going to be in the driver’s seat,” said Gregg.

“If the Canadian grower doesn’t sell, the Australian grower is not going to be there to compete.”

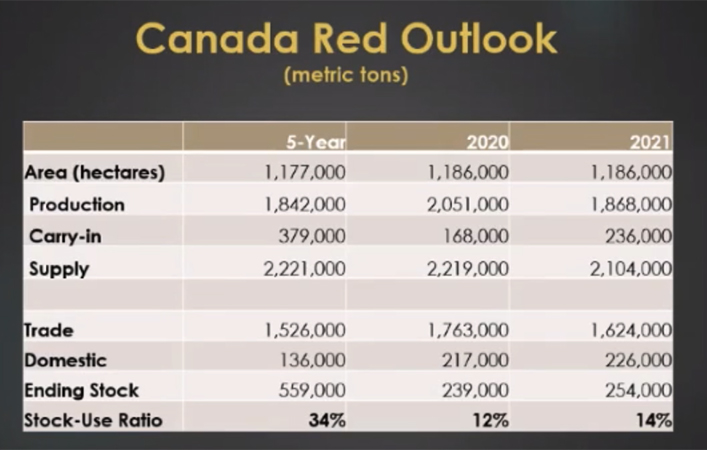

Canada’s crop is off to a shaky start as well, said Stat Publishing editor Brian Clancey. That is significant because Canada is the biggest producer and exporter of the crop.

Stat expects production to fall to 1.87 million tonnes from last year’s 2.05 million tonnes. But that is using average yields.

Clancey acknowledged that yields might be well below average due to early-season drought and cool temperatures.

“It could be a disaster here,” he said.

Clancey said the world is essentially sold out of red lentils and there is no big replenishment in the cards.

He is forecasting 5.77 million tonnes of production from the primary producers in 2021-22, which would be below the five-year average of 5.85 million tonnes.

And that is using optimistic production figures for a number of countries, based on comments made by other panelists.

Stat is using the official government estimate of 1.26 million tonnes for India. Abhishek Agrawal, a trader with Viterra, said the trade thinks the crop is much smaller at around 900,000 tonnes.

India’s annual red lentil demand is 1.8 to two million tonnes, so there will be a significant shortfall.

He estimated India will import 500,000 tonnes of the crop between July and December 2021.

Every panelist said the burning question for the red lentil market is — will India reduce or eliminate its import tariff on red lentils?

Agrawal said it happened last year around this time when the market price for the crop was 15 percent above the government’s minimum support price. This year it is 20 percent higher.

Stat is forecasting 531,000 tonnes of production in Turkey.

Yusuf Memis, a trader with Bashan in Turkey, said that is too high.

Growers planted 50 percent more than last year but there will be significant losses in dryland areas due to drought.

He is forecasting a crop of 240,000 to 280,000 tonnes, down from last year’s 320,000 tonnes.

Memis expects Turkey to import 500,000 tonnes in 2021-22, with half of that volume coming from Canada.

Pakistan is another big buyer of red lentils, importing 150,000 tonnes a year for domestic needs and another 50,000 tonnes for re-export to Iran and Afghanistan when border trade is active with those countries, said Mahesh Raja Manglani, a trader with Mast Qalander Group.

Stocks are extremely low in Pakistan as they are in every major importing country of the world.

Manglani said trade at today’s values of $800 to $850 per tonne is not workable. The last trades were made in the $750 to $775 range.

He said importers will switch to alternative pulse crops like chickpeas, black matpe and green mung beans.

“They won’t buy high-priced pulses,” he said.

But they may have to get accustomed to prices in the $800-plus range, said moderator Farhan Adam, a trader with Marina Commodities in Canada.

He doubts farmers in Canada and Australia will accept anything in the sub-$800 range, especially considering crops in both countries are in trouble and growers have the ability to store lentils and wait for prices to climb further.

If India drops its import duties that will further strengthen the resolve of farmers in key exporting nations and put even more upward pressure on prices, said Adam.

Contact sean.pratt@producer.com

Source: www.producer.com